Dividend Capture Strategy: Trade Execution Matters

One area in investing that is often overlooked by investors is trade execution, which relates primarily to commissions, bid-ask spreads, and price impact. Yet sometimes it is trade-execution alone that can make the difference between and profitable trade and an unprofitable one.

In a new paper, “Ex-Dividend Profitability and Institutional Trading Skill,” by Henry and Koski, the authors examine whether institutions with superior trade execution skills can earn profits from a “dividend capture” strategy, which involves trading stocks around the ex-dividend date. (Note, we’ve covered some other dividend strategies in the past here and here and here).

Before getting into the paper, let’s review some mechanics of dividend announcement and payment.

The Ex-Dividend Date

The Theory

The ex-dividend date represents a temporal line in the sand. In order to be eligible to receive a dividend, an investor must own the stock before the ex-dividend date. If you buy a stock on the ex-dividend date you don’t get the dividend. This creates a dislocation point for the stock price that relates to the dividend that is to be paid.

The Modigliani-Miller model states that the payment of dividends is irrelevant to the market value of a company. Under the MM model, on the ex-dividend date any dividend payment is immediately offset by a decline in the stock price by the amount of the dividend.

The Reality

While academic theory offers neat solutions, the real world is always messier. As it turns out, dividend payments are not precisely offset by a decline in the stock price. In general, as a lot of empirical research has demonstrated, ex-day stock prices decline by an amount less than the dividend.(1)

Dividend Capture and Trading Skill

A dividend capture strategy, therefore, aims to profit from this discrepancy, by buying the stock before the ex-dividend date, selling on or after the ex-dividend date, capturing the dividend and this small premium, and thereby earning abnormal returns.

Because abnormal returns associated with dividend capture are small, the strategy is dependent on trade execution for profitability. The authors wondered whether institutions 1) earn abnormal returns after trade execution costs, 2) what impact these execution costs had on profitability, and thus 3) how profits were affected by trade execution skill.

Digging into the Study

The authors use institutional transaction data from Abel Noser Solutions, which includes trade data from pension plan sponsors and investment managers. Additionally, the authors use CRSP data to calculate returns, volume and dividend information. The sample is from January 1999 through March 2008, covering ~25,000 ex-dividend events for ~1,500 firms.

Measuring Abnormal Ex-day Returns

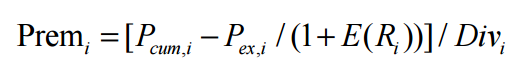

In order to assess the size of the dividend capture premium, the authors compute price movements around the ex-day (adjusted for daily expected market returns, R), and compare to the dividend as follows:

Source: Ex-Dividend Profitability and Institutional Trading Skill

The premium is simply the ratio of the difference between the closing cum-day price and ex-day price to the dividend. Not that in the Modigliani-Miller theoretical setting, the interday price change should exactly equal the dividend; the ex-day premium would equal one, and there would be no abnormal returns.

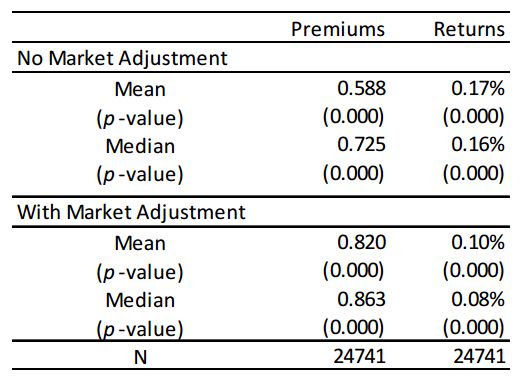

The table below reports the ex-day premiums and returns, with and without the market adjustment:

(Click on image to enlarge)

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Consistent with prior research, the authors find the premium is significantly less than one (i.e., the stock price change is less than the dividend), and abnormal returns are positive. They also find that institutional volume during the event window is almost double than in other periods, which suggests institutions do indeed actively trade during the ex-dividend period.

The Effect of Transaction Costs

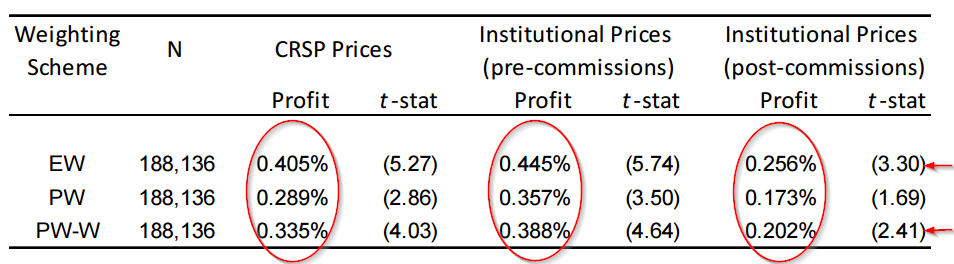

The authors examine profitability of specific managers across the ten day [-5,+5] window around the ex-date, consistent with the literature relating to dividend capture. “Pre-commission” positions account for bid-ask spreads and price impact, and “post-commissions” use actual transaction prices after commissions and trading costs. They examine equal weights (EW), principal weights (PW)(2), and principal weights winsorized at 2.5% and 97.5% (PW-W).

Below are the results:

(Click on image to enlarge)

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

First, pre-commission profits for institutions are more profitable than for “dumb-dumb” CRSP (e.g., for EW, 0.445%>0.405%), which suggests certain institutions have trading skill. Second, even after accounting for commissions, while profits are lower, they are still statistically significant for EW and PW-W, with t-stats of 3.3 and 2.4, respectively. It would seem that certain institutions, pursuing optimal strategies, can profitably pursue a dividend capture strategy. Moreover, they find that while dividend capture trades account for less that 6% of trades in the sample, they account for 15% of abnormal returns.

The authors go on to measure differences in profitability across institutions of varying trade execution skill (low-skill versus high-skill), and find a difference of 40 basis points. Thus, for a low-skill manager, this renders the trade unprofitable. It appears that only institutions with trade execution skills are able to earn abnormal profits using a dividend capture strategy.

Summary

While dividend capture is not a strategy with a lot of alpha, some dividend capture strategies, pursued with a high degree of trade execution skill, may provide an opportunity for investors.

Join thousands of other readers and subscribe to our blog.

Disclaimer: Please remember that past performance is not an indicator of ...

more