Dead Cat Bounce Definition: Day Trading Terminology

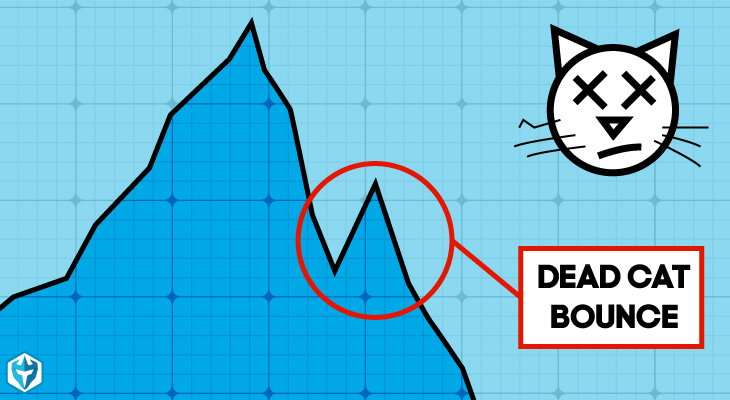

In trading, dead cat bounce refers to a temporary recovery that happens after a long decline which is usually followed by a downtrend. It can be defined as the chart phenomenon that happens during bearish moves. Basically, it is a long awaited correction from a brutal bearish trend. As a market jargon, it is a trap for traders who are always looking to go long.

History

The term was first used in 1985 during a review of the Singaporean and Malaysian stock markets. Both markets bounced back after undergoing a hard fall as a result of the recession that happened during the same year. Financial Times journalists Wong Sulong and Horace Brag were quoted as describing the events as “what we call a dead cat bounce.” It is believed that the term was derived from the idea where a cat will bounce after falling from a great height.

It is common for traders and investors to become fearful and that is why DCB is used to identify price levels for potential breakouts. According to financial experts, the DCB pattern involves a gap that happens during a downtrend. This gap is created by unexpected news that appears after or before normal market hours.

How to spot a dead cat bounce

It can be quite tricky to spot a DCB even for experienced traders and investors. Thankfully, there is a solid approach that can allow both to spot a DCB on the trading charts. As a price pattern used by technical analysts, the first signal is the confirmation of the pattern which does not appear on the price bounce.

At first, it may appear as a reversal followed by a downward price move. This is how it becomes a DCB when the price drops below its prior low and the reason why short term traders profit from it. Investors will also try to use the temporary reversal as a good opportunity. They do this with the goal of initiating a short position.

Here are three brief points to help you spot the DCB

1. Start by identifying a security asset with a strong bearish trend

2. This should be followed by spotting a price increase that breaks the downtrend slope

3. Finally, wait for the price to break the trend set.

Dead cat bounce trading example

Let’s assume we have a company trading as XXY and its share price is $15 a share. At the end of Day 15, the market closes on a particular trading and the company announces via press release that it is restating its earnings. Furthermore, its CEO suddenly quits the company. On Day 16, the company opens trading with its share price at $1.50.

Since this will place the company at duress and the likelihood of shutting down, the share price jumps to $2.50 after the bell strikes. This is what technical analysts refer to as a dead cat bounce. As a result of the news about the demise of the company, the share price jumps from $1.50 to $2.50 after the opening bell. This event is attributed to short sellers covering while existing shareholders are doubling down.

How to trade the dead cat bounce

When trading at DCB, timing is everything. Not sticking to the trading rules will result in you losing.

1. Opening the DCB

In this step, you are required to identify the DCB pattern which can be done by following the steps and example above. To ensure success, your trading entry time should be perfect otherwise; you will miss on a significant price decrease. This is because the price decrease is an impulsive move.

2. Proceed by marking the bearish impulse using a bearish trend line.

Drawing a trend line requires you to identify two points on the price chart. These points will be connected by a straight line. To draw a proper trend line, the line should begin at the point where the actual move starts. The swing points need to have enough price movement to allow the ability of drawing a trend line capable of containing your trend.

3. Short the stock

A short sale involves the sale of a security which is not owned by the seller. This is done with the promise of delivery. The next step involves placing a stop order. It should be done above the top and created during the new drop. To ensure success, a trader needs to stay in the market until prices generate a bearish move. This should be equal to the initial pulse.

Final Thoughts

Dead bounce cat is a pricing pattern used by technical analysts and usually identified in hindsight. It is common for analysts to predict the temporary recovery of the market using technical and fundamental analytical tools. DCBs provide an opportunity to short term traders who benefit and are able to make profits from the short rally.

Disclosure: This is not a recommendation to buy or sell any stock but is merely an informative article on different trading setups.