Why The Strong Dollar Will Drive Your May Trades

It’s all about the dollar. In fact, it’s been all about the dollar all year.

When the buck is strong, as it was in early January, stocks, commodities, and energy crater. When the greenback is weak, everything rallies as they have done since mid January.

The good news for those short stocks, commodities, and oil is that the buck seems to have reached a major turning point on Tuesday night and gotten strong again.

I ascribe this to the large numbers of international trade transactions that settle this month, which generate a lot of dollar buying and foreign currency selling.

This is no accident. It turns out the last seven consecutive months of May have seen the dollar appreciate, quite substantially so, by an average of 3%.

Let me explain the mental gymnastics I had to undergo that enabled me to reach these conclusions.

Now that the market has thrown out any chance of a Fed rate hike in June, the capacity for the dollar to disappoint has burned out. Futures markets are only pricing in a 15% probability of such a move.

All we need now is for the Department of Labor to deliver a half way decent April nonfarm payroll report of around 200,000, the average print it has been reporting monthly for the past two years.

That means the economy is speeding up, not slowing down, and that interest rate hikes will happen sooner,not later. The Q1 mini recession is now behind us. The dollar should rise and the currencies should fall.

This is against a backdrop of foreign governments looking to weaken their own currencies at every opportunity.

Look for someone in Japan to say something very negative next week when they return from the Golden Week vacations. For them, the yen at 107.00 is nothing short of the apocalypse for their economy.

Since politicians everywhere are not inclined to commit suicide, keep your ears open.

If you want to see how this works look no further that the Australian Dollar (FXA), which cratered 5% this week in the wake of a surprise 25 basis point interest rate cut by the Reserve Bank of Australia.

It turns out that the economies of commodity dependent countries are still reeling from the after effects of the 2015 commodity crash.

This is why I doubled up my long dollar positions, adding a short Euro position (FXE), (EUO) yesterday in addition to my existing short yen position (FXY), (YCS).

It is also why I doubled up my short position in the S&P 500 (SPY).

Yes, I was three days early on the yen. Part of the problem that comes with seeing major trends and reversals before anyone else is that I sometimes execute the trades a little too soon.

It is a good problem to have.

Foreign currencies are definitely trading against their terrible long-term fundamentals right now. The details of those fundamentals are detailed in all their glory in my previous newsletters.

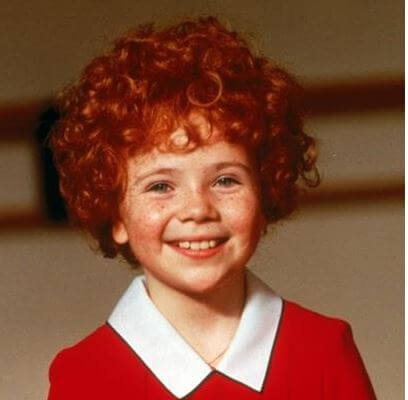

Suffice it to say that I have beaten the subject like a red headed stepchild, ad infinitum, and until the cows come home.

There! I’m done mixing my metaphors for the day.

And apologies in advance to all red headed readers.

See the Similarity?

The Diary of a Mad Hedge Fund Trader, published since 2008, ...

more