U.S. Dollar; Triple Support Test After Rare 30-Week Decline

From 2011 to the start of this year, the US Dollar has been pretty strong, as it rallied nearly 30% in 6-years. Over the past 30-weeks, King Dollar has been rather weak.

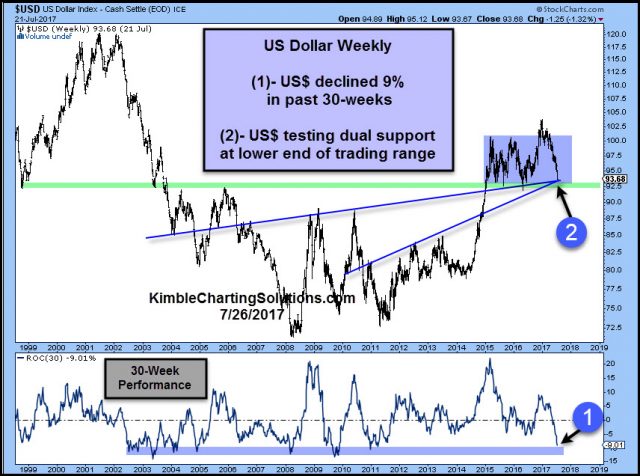

Below is a chart for the US Dollar over the past 18-years, with 30-week performance applied.

CLICK ON CHART TO ENLARGE

King Dollar has declined over 9% in the last 30-weeks at (1). As one can see, this sharp of a decline in 30-weeks hasn’t taken place a ton of times since the late 1990’s. The decline has the US Dollar testing the bottom of a 24-month trading range and two rising support lines at the same time at (2).

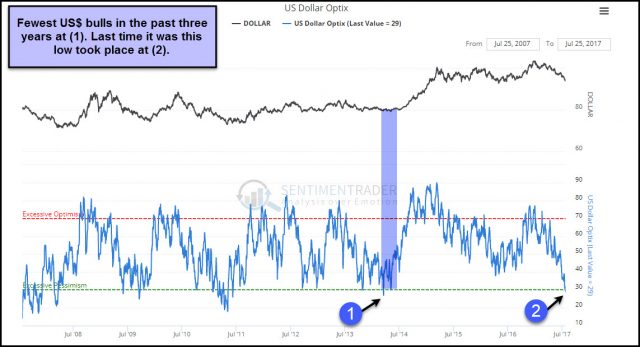

This decline has bullish sentiment towards the US Dollar at the lowest levels in the past three years, according to Sentimentrader.com, reflected in the chart below.

CLICK ON CHART TO ENLARGE

With few investors bullish King Dollar at this time and a triple support test in play after a rare 9% decline in 30-weeks, what the US Dollar does at (2) in the top chart, could become very important for the Dollar and many commodities.

Gold & Silver have not pushed much higher while the US Dollar has been very weak. This makes the price point in the US Dollar , all the more important to the metals sector, if this triple support test would hold.