Renewed Optimism Or Just A Bounce?

If there were any questions lingering, it's now clear that institutional investors are definitely moving forward with crypto investments.

After all, why not?

The new crypto ETP that was launched last week in Switzerland has quickly become one of the most popular products on the primary Swiss stock exchange. Volumes on the Amun Crypto Basket have surpassed all other ETPs currently traded at SIX.

I must say that this excitement has surpassed all my personal expectations. In a recent interview, I noted that the Swiss were more likely to treat this new product with a healthy dose of caution, especially given the price action of late.

We're seeing a nice bounce across the crypto markets this morning. Let's see how this develops.

Traditional Markets

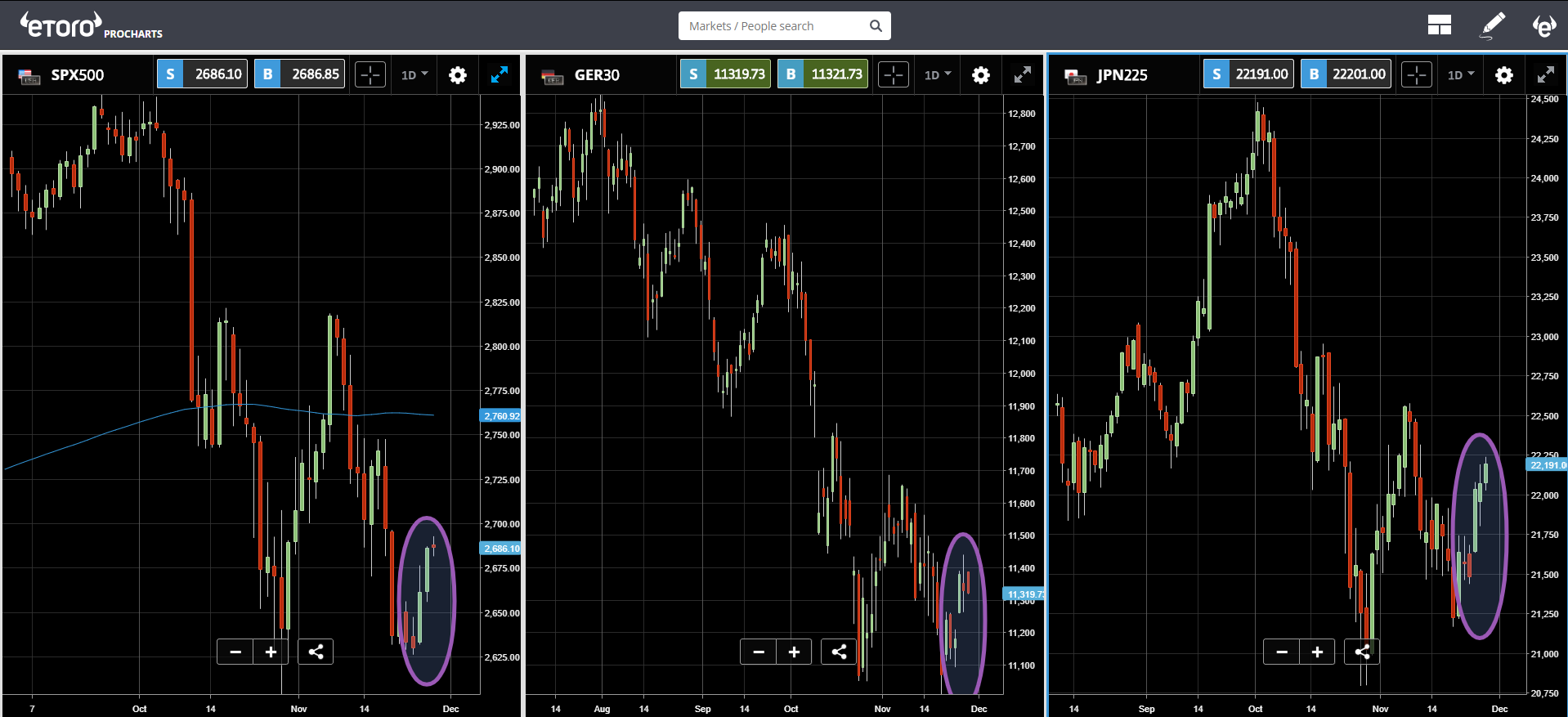

Seems as though weeks of selling action has brought some stocks down enough for value investors to start stepping in again. Major indices in the US gave a big push off the floor since the start of the week (purple circles). A move that has sustained into the Asian session and the European open.

The upward action, however, is more likely a reflection of lower prices than it is of any newfound optimism. Going into the weekend's G20 meetings that will be attended by many key heads of state, there seems to be little cause for exuberance.

Signs of Sentiment

Evidence of the above-mentioned sentiment can be found in the currency market. Had this been a full-on risk rally, we would likely see money flowing away from the US Dollar but in fact, the opposite is happening.

Not only is the US Dollar gaining, it's even threatening to break out to new heights. The US Dollar Index is now half a point away from its highest level in about a year and a half.

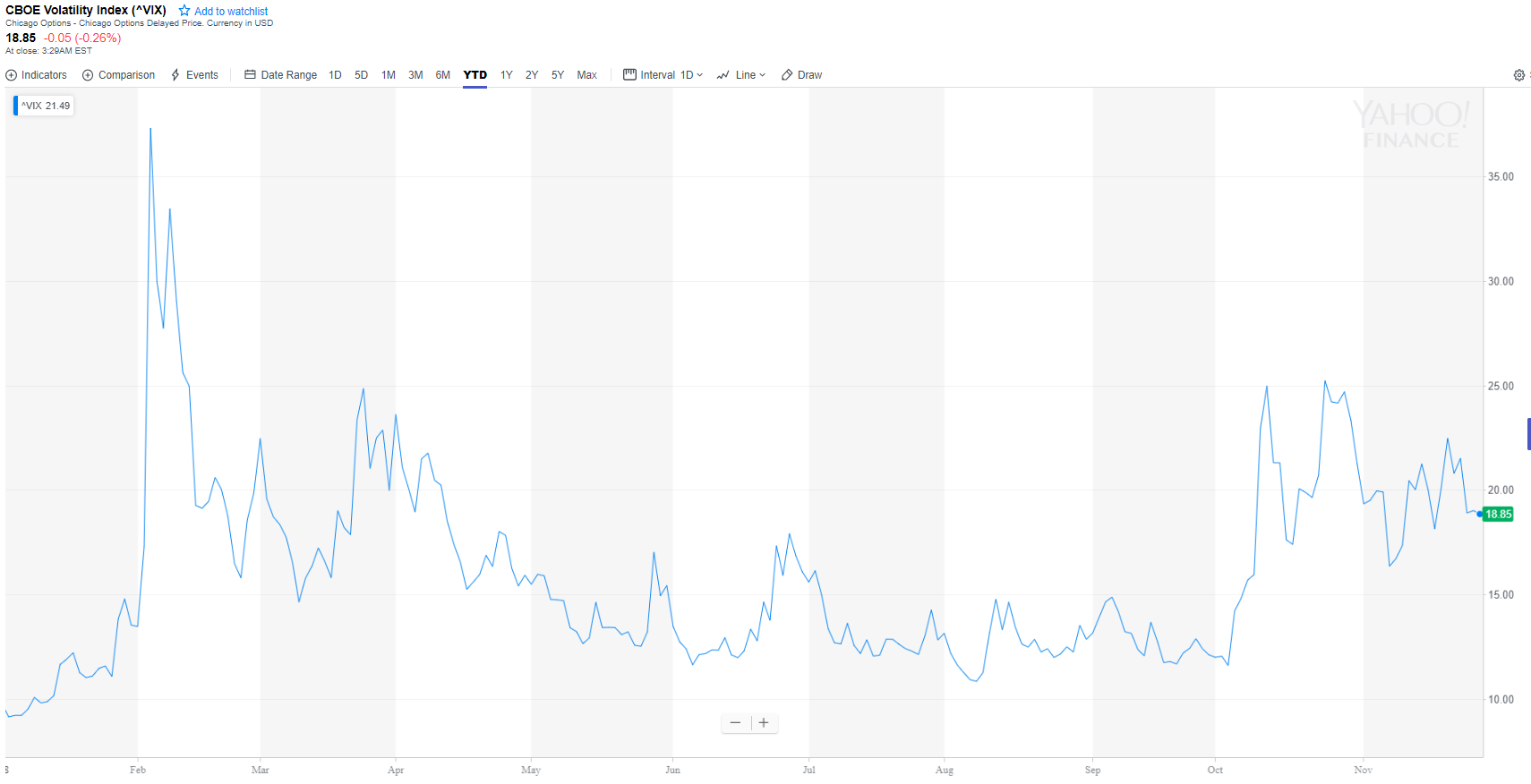

Volatility has also not come down enough to convince us that the action is over. As we can see, the VIX volatility index still lingers at elevated levels.

Later today we'll get speeches from both Bank of England Governor Mark Carney and Chairman of the Federal Reserve Jay Powell who will speak about the Fed's financial stability. Neither of these events are expected to impact the markets but with monetary tightening being one of the key factors influencing stocks lately, many investors and analysts will be tuned in.

In honor of our recent alliance with the popular crypto exchange Binance, we dug a bit deeper into their native token, more