EUR/JPY Elliott Wave Forecast: Bullish Zig Zag Pattern

*** EUR/JPY – SHORT TERM ELLIOTT WAVE ANALYSIS ***

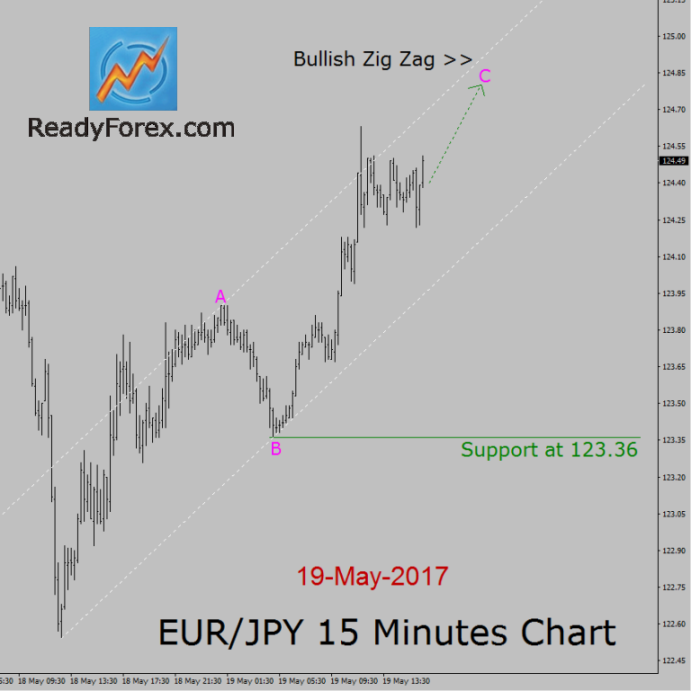

Trend is bullish in EUR/JPY currency pair, 15 minutes time frame. As I have suggested few hours ago during my daily Live trading room session, the market is rising up on a short term basis to print a corrective Elliott wave C bullish leg and traders should look for a buy trade. Strong key support level is present at 123.36 price level.

In my judgment, price action in EUR/JPY currency pair is now going to move sideways and then up to print a complete bullish Elliott wave C wave leg. Wave C is going to complete the corrective Bullish Zig Zag pattern. The current market action offers us a possible long trading chance to join an uptrend in the next coming trading hours.

Currently; price action of EUR/JPY currency pair is in the progress to complete the bullish wave C leg which is going to complete the bullish Zig Zag Elliott wave pattern. So, a good idea is to look for a possible buy trading chance at the market to join an uptrend as the bullish Zig Zag looks in-complete. However; if the price of EUR/JPY currency pair breaks below 123.36 critical support level then I might like to stay out of the market and re-examine the fifteen minutes chart of EUR/JPY currency pair.

Forex trading involves significant risk of loss. The high degree of leverage can work against you as well as for you. The possibility exists that you could sustain a loss of some or all of your ...

more