Could Trump Talk Down The USD Successfully – Morgan Stanley

Donald Trump is now the US President. So far, the US dollar has gained from his election. Can he talk it down?

Here is their view, courtesy of eFXnews:

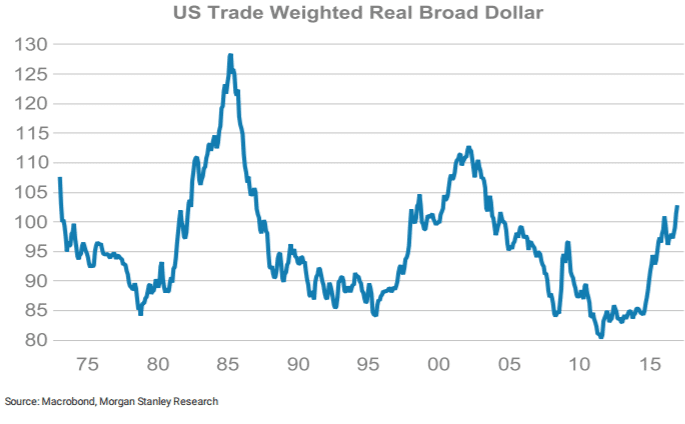

President Donald Trump has broken with the usual practice of leaving comments on the valuation of the USD to the US Treasury by contradicting the current Treasury’s strong-dollar policy.

Calling the USD “too high” raises the question of what policy tools could be used to weaken the USD and, even more important, whether these devices could turn FX rates lastingly around. There have been occasions before when markets have speculated about the implementation of a ‘USD weakening policy,’ where many concluded that a higher USD would be in the interest of a few but bear disadvantages for many. Just go back to February last year when there was talk the G20 had agreed to ‘currency coordination.

What could Trump do? The first policy option is to talk down the USD. Trump could only continue to say that USD is too strong, as he did earlier this week. However, talk without action is unlikely to impact USD except in the very short term. Decreasing the demand for USD by keeping interest rates low is another option. Given Trump’s comment this week, it is not unreasonable to imagine a scenario in which Trump tries to influence the Fed not to raise interest rates in the current environment as it would cause USD to rise too much. In fact, Trump made comments along these lines during the campaign in a CNBC interview saying,”I am a low-interest rate person. If we raise interest rates and if the dollar starts getting too strong, we’ve going to have some very major problems.”

Delaying hikes would cause steeper curve. With the Fed being politically independent, it does not need to pay attention to such commentary. However, even if the Fed did back away from rate hikes, if Trump follows through on his fiscal policy plans, then any reduction expectations of near-term hikes should just cause a steeper US curve,a s markets would see the Fed as being behind the curve

Protectionist policies counterproductive. If Trump sought to gain competitiveness (quasi USD weakening policy) through import tariffs or border adjustability, we think this would be largely ineffective. Either of these policies would likely cause USD strength (possibly significant strength)even with retaliation from trading partners,given the US is a relatively closed economy. Similarly, labeling other countries currency manipulators may have a counter productive effect.

Bottom line: We explore his options and conclude that talking down the currency or putting pressure on the Fed are unlikely to be successful. However, any failure to deliver on his promises on fiscal policy or tax reform would, in our view, be the most likely route to a weaker USD.