A Cryptocurrency Crash Likely Wouldn’t Cause Aftershocks

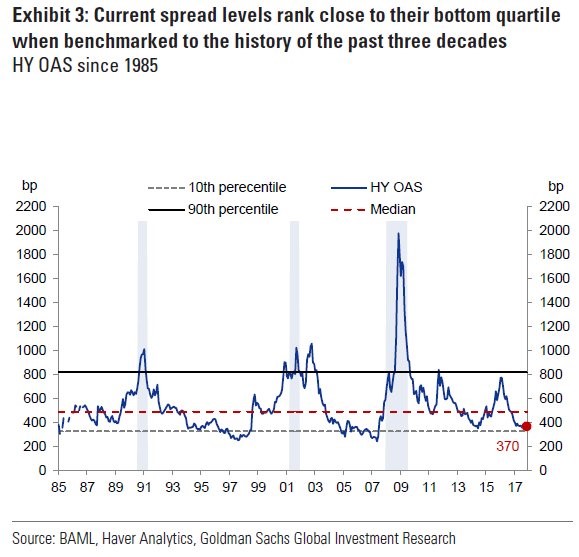

Options Adjusted Bond Spread

We’ve discussed that at this point in the business cycle the yield spread between treasuries and junk bonds usually increases to reflect the increased risk in the market. The chart below is a great depiction of the options adjusted bond spread because it shows the various percentile levels in the past 32 years. As you can see, with a 370 basis point spread, the high yield spread is near the 10th percentile. It got slightly lower in 1997 and 2007. The widening of spreads in 2016 came very close to recessionary levels which is why many thought a recession was coming even though the yield curve was positive. This chart makes it very clear that if you’re buying junk bonds, there’s not much upside and a lot of downside. However, we might see the final bit of upside before the selloff commences.

(Click on image to enlarge)

Cryptocurrencies Remain The Top Story

Even though I think it’s a terrible bet to put money in any of the cryptocurrencies at these current extreme levels, it’s still important to talk about them because the segment has become the top story of December in all of finance. It’s fun to talk about companies and assets which are volatile. It’s boring to make money consistently. The annualized standard deviation of the S&P 500 is 6 while the annualized standard deviation of bitcoin is 101. I’m guessing the alt coins have an even higher annualized standard deviation. Litecoin is up 10,604% in the past year. The chart below shows the various manias throughout history. The tech bubble in the 1990s barely registers on this chart which bitcoin now leads. Bitcoin is now at $17,200. If there was a chart for beanie babies, it would be interesting to compare it to bitcoin.

(Click on image to enlarge)

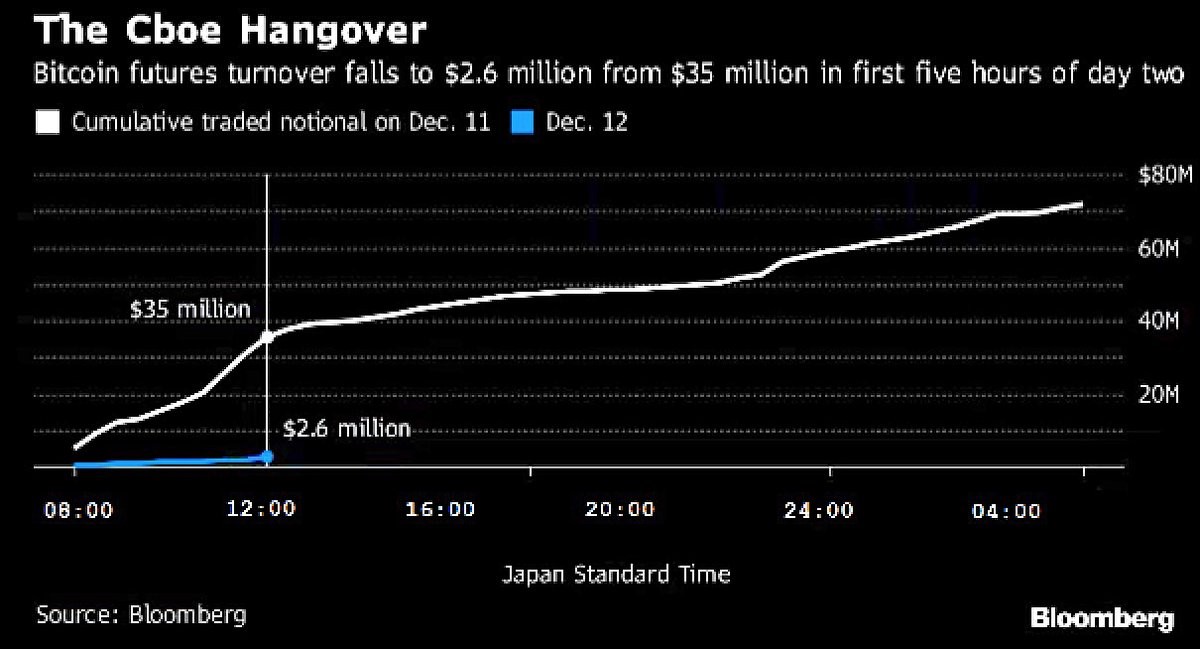

The fact that we are looking at the market cap of all the coins to find a potential limit shows how outlandish the action has gotten. The total market cap of these coins is $500 billion. Coinbase is the top downloaded free app on the App Store. There are 1,345 cryptocurrencies listed on the coinmarketcap website. I still don’t think there would be much of an effect if they all went to zero tomorrow. If Apple, Google, Microsoft, Amazon, and Facebook stock all went down 15%, it would be the same as all the cryptocurrencies going to 0. If those stocks fell that much the Nasdaq might fall in the high single digits or the low double digits. That would be a scary event, but it probably wouldn’t have much of an economic effect. When the cryptocurrencies get above $1 trillion, I will get more worried about the systemic risks of a crash. As you can see from the chart below, the trading in bitcoin futures on the CBOE fell 93% from the first day to the second. Most traders would rather not touch an asset which has little history and a lot of euphoric speculation. The blockchain is a buzzword just like artificial intelligence and gene mapping. Unlike buzzwords of the past like 3D printing, cryptocurrencies have received a $500 billion valuation.

(Click on image to enlarge)

Stocks Experiencing Euphoria Too

The euphoria in the stock market looks like nothing compared to bitcoin. That’s an accurate summary of how both rallies will end because stocks won’t have the same size crash as bitcoin at the end of this euphoria stage. A 10% decline in the S&P 500 would be a bigger deal than a crash in cryptocurrencies. As I mentioned, there is near term euphoria in stocks. That statement is supported by the chart below which shows the 10 week moving average of the Investors Intelligence survey has never had this many bulls, dating back to 1992. There have been 60 record highs this year in the S&P 500 which is the third highest ever. There were 65 records in 1964 and 77 records in 1995. There have been 67 record highs in the Dow this year which is the second most. Only 1995 had more records, with 69.

(Click on image to enlarge)

Volatility Eliminated

The VIX was up 6.21% to 9.92 on Tuesday even though the S&P 500 was up 0.15%. The charts below show how low the VIX has been this year. The left chart shows the number of days the VIX has been below 12 in a year. The total is 100% higher than the peak in 1994. The total is even higher than the peak in 2007. The chart on the right is even more clear as there hasn’t been more than 5 days in a year with the VIX below 10 from 1986 to 2016. This year has had 47 days with it below 10.

(Click on image to enlarge)

Europe Also Seeing Excessive Optimism

The chart below takes an average of the top 4 economic sentiment surveys in Europe. As you can see, the sentiment is the highest since 2000. The chart makes the point that QE created this economy filled with optimism. I disagree with this notion because the sentiment has been high without QE. Summarizing the economy with one policy is easy, but ineffective. If you say QE did everything, when QE ends, it implies a crash will occur in confidence. Confidence might fall from the perch, but there’s little evidence of a crash next year. It’s better to say QE helps sentiment by pushing risky assets up. QE isn’t the only catalyst of low junk bond yields; it’s one of the more prominent factors pushing yields lower.

(Click on image to enlarge)

Conclusion

Bitcoin and the other cryptocurrencies rallying are mostly noise. It’s worth discussing, but not investing in them. The inevitable crash shouldn’t cause much of an impact on stocks and the economy. I think gold will see a rally when cryptocurrencies fall because gold does well in times of panic and because some investors are switching from gold to cryptocurrencies to store their wealth. The lack of volatility in stocks probably won’t continue in 2018. However, this run has been improbable, so take that statement with a grain of salt. There should be a decline in optimism because of central banks pulling back on stimulus, but I don’t expect anything dramatic.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more

The crypto impact will be felt less in the stock market because it isn't a component in the market like the dot com bubble, however, the willingness to take risk will have a dampening effect. Given the slow growth of the market it will cause a bump. Strangely, bitcoin and crypto betting is somewhat due to both greed and fear.

A crash in it will have to be assessed as to why it crashes. If it crashes because growth, stability, and market forces get back into play versus QE and destroying capital value with artificially low rates then it could actually be good for the market. If, however, it crashes due to the fact that optimism is subdued and cash flow diminishes so much everyone needs US currency to cover expenses this will be caused by the market and crypto currencies will just be a giant glaring example of the fallout.