Crypto: Hodl

The performance of Bitcoin over the last week was another yawning event. The lack of volume, interest and volatility continues to be the headline event. The US vote gives some hope with the pro-crypto politicians from Colorado and California elected. The bounce back in the global tech sector adds some fundamental relief as well. If you believe owning ETH or BTC is a call option on future technology then you should care about the present technology share price. The grinding bid tone to the week matters but perhaps not enough to spur action. Many look at 2018 as a lost cause for crypto – an annus horribilis – where 2019 can’t get here fast enough. Out of the pain of the January, collapse has come many positive steps towards institutionalization. The global crypto markets are growing up. The latest BitMEX research is the focus of the week for me. There is a lot in the report but here are the things that stand out.

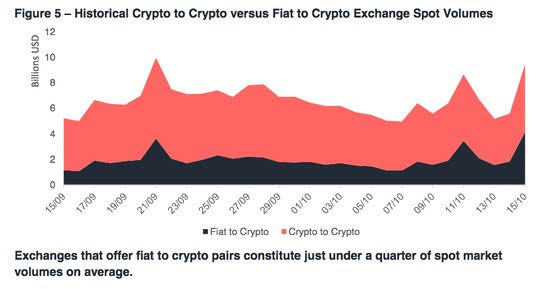

- Total spot volumes make up less than three-quarters of the total market volume.

- Visitors to an exchange and business aren’t the same thing - exchanges like Coinbase, Bittrex, and Cex.io appear to have more visitors per day than other exchanges that have similar volumes.

- Cold wallets are used by only one-third of top exchanges, while 11% of top 100 have fallen victims to hacking attacks.

- Less than half of top exchanges have strict KYC requirements, and over one-quarter of them have no such requirements at all.

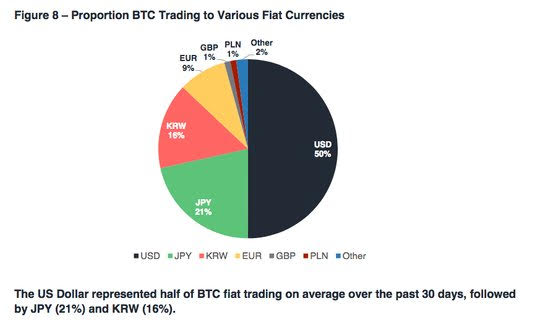

The need for more regulatory clarity seems obvious in the list of findings. The need for better data – from coin lending rates to margins to the bid/ask spread – all seem necessary for building up the trust in the market. The dependence of the market on fiat currency makes clear the risks of USD strength as a negative to the viability of the asset class.

What Happened Last Week?

- Hong Kong plans to regulate crypto with new sandbox. Hong Kong has not been satisfied with the protection for crypto users to date. As a result of this, the Securities and Futures Commission (SFC) announced plans to regulate the space via its “sandbox”, reports the Financial Times. This means that they will adapt existing regulations to newly-uncovered risks in regards to the crypto world. This is important due to the fact that current rules state that crypto trading is not regulated unless they include assets that are considered futures contracts or securities. According to the Ashley Alder, CEO of the SFC, the new measures will regulate the distribution and management of digital assets, so that the investors and their funds are protected.

- PBOC researchers warn of bubbles in blockchain investments. Speculation, market manipulation and other irregularities in blockchain-related investment and financing are common in the country, the central bank said in a working paper written by Xu Zhong and Zou Chuanwei. They argue that cryptocurrencies won’t be able to replace legal tenders as they lack flexibility in supply, intrinsic value support and sovereign credit guarantees. Bottom Line – while the Chinese government remains net positive on blockchain, this paper is targeting reasons to support the PBOC outright ban on ICOs and seems more about token airdrops and other “tokenization” issues.

- Former US NEC Gary Cohn: Crypto is not where we are headed, blockchain is. During a panel at the New Economy Forum in Singapore, Cohn, now an adviser to Springcoin, said the financial industry is likely to move toward adopting blockchain technologies rather than cryptocurrencies. Bottom Line: The crypto bad, blockchain good argument lives on.

- US Office of the Comptroller of the Currency Otting: Fintech lenders could get National Bank Charter by early 2019. Fintech lenders are likely to be the first type of companies to receive a special national bank-like charter and blockchain companies that support securities or asset tracking could follow later as charter applicants, Otting said at the D.C. Fintech Week conference hosted by Georgetown. Bottom Line: the path to clear regulatory status for crypto exchanges and business is getting nearer.

Themes:

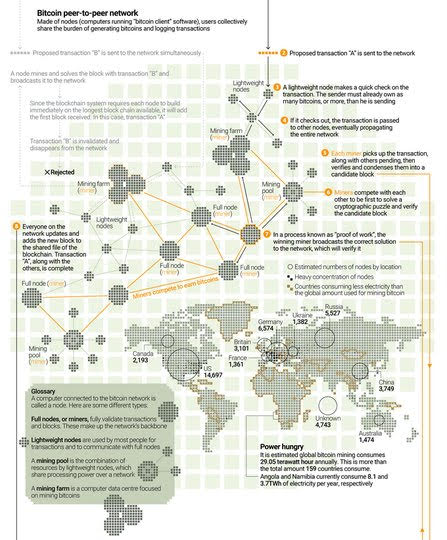

- Decentralization and Blockchain is this BTC or ETH? Where BTC and ETH are mined matters. Chart above comes from a South China Morning Post infographic. Bitcoin nodes have higher bandwith than Ethereum. Bitcoin nodes have increased by a factor of 1.7x, according to a paper from early this year out of Cornell. Bigger bandwith means larger blocksize, allowing for players - more transactions with the same level of decentralization. But Bitcoin nodes tend to be more clustered together than Ethereum. Part of the reason for this is that a much higher percentage of Bitcoin nodes reside in data centers. Specifically, only 28% of Ethereum nodes can be positively identified to be in datacenters, while the same number for Bitcoin is 56%. Nodes that reside in datacenters may indicate an increased level of corporatization. They may also be a symptom of nodes deployed to skew node counts for various different implementations (a.k.a. part of Sybil attacks to influence public opinion), a hypothesis that was floated extensively during the course of the study. In contrast, Ethereum nodes tend to be located on a wider variety of autonomous systems.

- Is the low BTC price good for the long-term sustainability of blockchain? Marginal Revolution blogger Tyler Cowen argues this week that the drop in BTC and other coins, the end of ICO funding is a good thing as it will force the technology to confront its deficiencies and get back to trying to solve global problems like cross-border settlement. As he concludes: “Think of bitcoin and other crypto-assets as like a company that is finally receiving a cash call. I am modestly optimistic, but it is time to put up or shut up.”

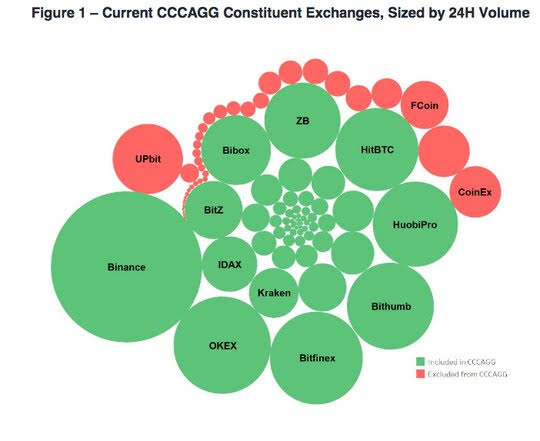

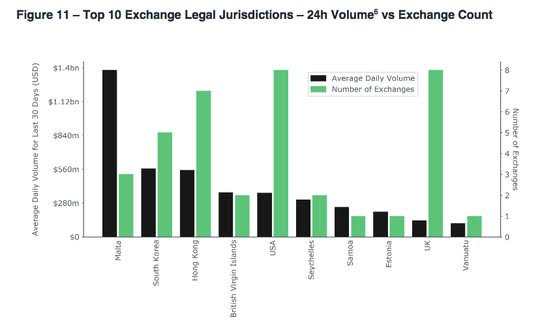

Question for the Week: Is the ecosystem of exchanges about to change? There is plenty of movement in Crypto Exchanges that suggest a change is brewing for the parts of the platforms from compliance to financial backstops to value monetization all leading to decentralization and more fragmentation. The drop in overall volumes in BTC has been notable but according to bitmex it hasn’t changed the order of exchanges, nor has it led to consolidation.

Bitstamp was sold at the end of October to a Belgium investment firm NXMH for $400mn according to news reports. Gemini gets Aon to fully insure its crypto assets as they compete with Fidelity for custody solutions. Chain analysis is being used by Binance for their AML compliance. These moves highlight the push for separation of business tasks into specialist companies.

The other force at play in the exchange world is the fiat currency to crypto demand function. USD hegemony remains but the ongoing Asia role makes it clear that stable coins are not a simple USD token. Markets in crypto are not immune from emerging market crisis flows and demand. The role of central banks in potentially monitoring and halting this flow is a risk to consider. It’s no surprise that the winner last month in market share for flows was Bithumb – up 187% while Binance and OKEX saw 8 and 35% drops.

Finally, the role of legal clarity in crypto is taking shape and that race for being the center right now is going to Malta. The UK and US are laggards in comparison. How the regulatory environment plays out in Hong Kong, US and UK will matter but the first mover advantage gets the pipes and maybe able to move some of the US exchanges over the next few months.

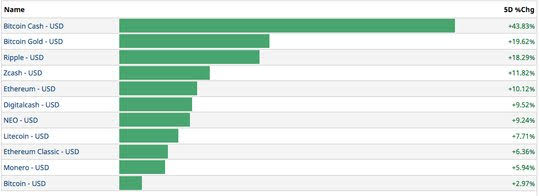

Market Recap: The rally back from the recent lows to the recent highs isn’t terribly exciting and yet the $5800 to $6800 trading range for Bitcoin continues to make the next break that much more powerful when it happens. The last week was a steady set of gains but the cooling of this today (Thursday) tracks the FOMC meeting and the pullback in equities. Perhaps that is just a coincidence – correlation isn’t causality – or perhaps the market is beginning to act a bit more in line with the logic of alternative money. Rates and the USD are key drivers for gold and for safe-havens so perhaps, BTC and ETH start responding accordingly.

The technical focus for the week is on the potential break out of cash coins – Zcash being the lucky winner. The trading over the 55-day moving average looks important for the hope of testing $158 again and the long-shot of retesting the 200-day near $218.

The same picture for BTC isn’t so obvious and so it goes with the tight ranges continuing to curse technical traders with $6200-$6600 the next key range for the week ahead.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

What is a "Hodl?"

It is an acronym for "Hold On For Dear Life." Meaning you should hold onto the cryptocurrency rather than selling it.

Actually it is a "BACKRONYM." Funny story - it originated with some drunk guy's post on a bitcoin forum back in 2013, where he simply mispelled "hold" as hodl. The term has stuck ever since.

No way, that has to be an urban legend. Too funny if true though.

Oh it is true alright. Google it. Or just check out this link:

https://www.investopedia.com/terms/h/hodl.asp