Why Gold Has Bottomed & Is About To Go North - Way North

...I believe gold has started a brand new bull market, and that this most recent correction was just a normal profit-taking event that reset sentiment for the next wave up. [Here's why I have come to that conclusion.]

correction was just a normal profit-taking event that reset sentiment for the next wave up. [Here's why I have come to that conclusion.]

...In my opinion, gold has found a firm intermediate bottom, which means the underlying direction over the next 3 months or so should definitely be north. You see, if gold were to trend lower, it would have to do it rather quickly based on the timing of this intermediate cycle. This is the advantage cycle counts give you. In fact, if the lows printed on the 7th of October indeed turns out to be an intermediate cycle low (which I believe they will), then we should have at least 20 weeks of rising prices ahead of us. There will be obviously rallies and dips, but the general direction will be north.

There are a few reasons why I feel the bears are wrong about lower gold prices ahead this year. First is the weekly swing that gold printed last week and the miners (so far) have printed this week. A weekly swing is a much more accurate tool for determining trend changes in a specific asset class, especially this far into an intermediate cycle. In fact, we are now 20+ weeks (if we haven't bottomed) into May's intermediate cycle. That is on average how long these cycles last. Therefore, if we are to have lower prices in the near term, they will have to take place hard and fast before bottoming for the next cycle to take place.

In the miners, barring a collapse for the rest of week, a weekly swing looks like it is in place.

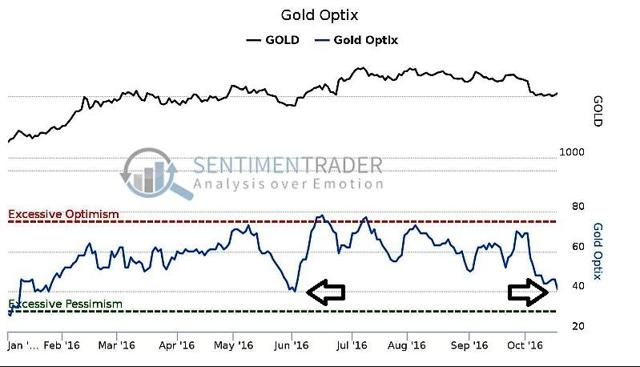

Now in any complex making higher highs (which gold has been doing since last September), I use sentiment readings as a contrarian tool to spot when there may be too many bears in the market. Price extremes at intermediate bottoms is when to pull the trigger and buy. As the chart shows below, we are now at similar levels to what we had in sentiment back in late May (last Intermediate low). Consequently, from the May bottom, we rallied $150+ an ounce to top out at $1366 in July. Will lightning strike twice?

Source: Sentimentrader.com

To sum up, I believe gold has started a brand new bull market, and that this most recent correction was just a normal profit-taking event that reset sentiment for the next wave up.

This article may have been edited ([ ]), abridged (...) and/or reformatted (structure, title/subtitles, font) by the editorial team of munKNEE.com (Your Key to Making Money!) to provide a faster ...

more