Where Do US Steel Imports Come From?

There's been a lot of talk on steel imports to the U.S. since it was announced that there would be massive tariffs imposed on steel imports. But where do these imports actually come from and how do they impact the local economy?

The U.S. administration has introduced levies on the import of steel and aluminum, allegedly for reasons of national security. The tariffs of 25 percent on steel and 10 percent on aluminum came into recently, but so far, many of the most important trading partners for steel have been granted at least temporary exemptions.

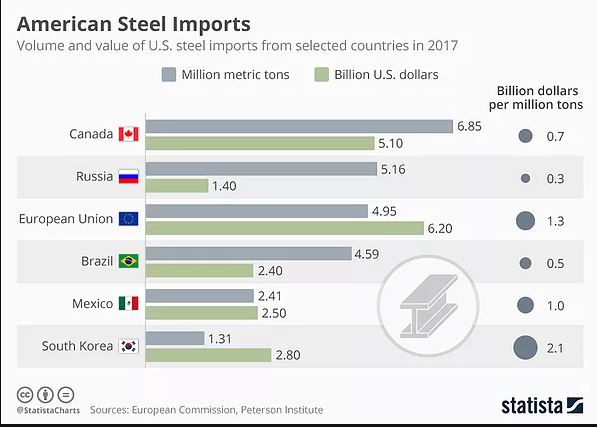

These apply to the selected major steel exporters shown in the below chart fromStatista, like the European Union, Brazil, Canada, Mexico and South Korea. Interestingly enough, not on the list for exemptions is Russia. While Canada is America's most important provider by metric tons, it's the European Union whose steel imports to the U.S. have the highest value. Only steel from South Korea costs more per metric ton.

The end result is that many U.S. steel companies will suffer, and that's become quite apparent in recent days.

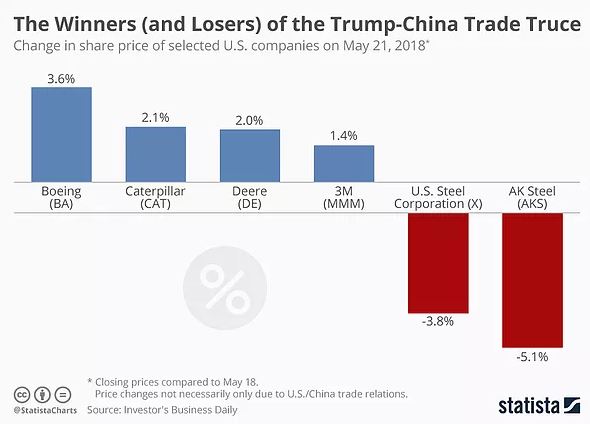

Two weeks ago, the U.S. and China put out a joint statement, announcing that "China will significantly increase purchases of U.S. goods & services" and that "both sides agreed to encourage two-way investment and to strive to create a fair, level playing field for competition". As Investor's Business Daily analysisshows, for some companies this had an immediate positive effect on their share price. For those in the steel industry however, the reception of the news wasn't quite so favorable.

Reacting on Monday, the markets rallied, with U.S. companies such as Boeing, Caterpillar and John Deere laying on 3.6 percent, 2.1 percent and 2.0 percent in value, respectively. All three are significantly reliant on trade with China. Boeing, for example, could benefit from $1.1 trillion worth of jet purchases over the next twenty years, according to Investor's Business Daily. In the world's largest construction equipment market, Caterpillar has also invested heavily in China.

The other side of the story is steel. U.S. Steel Corporation was down by 3.8 percent on the news, while AK Steel also saw a drop of 5.1 percent.

This certainly isn't the end of the story though, with a lot of details still to be ironed out - and stuck to by both sides. Ultimately, the U.S. steel market will see some near-term pain, and will the bulk of the industrials sector. Not much to be done at this point except to sit back and see where the chips fall from here.

Disclosure: None.

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. ...

more