When Will Gold Rebound?

For many traders and investors, momentum is everything. After all, why tie up money in an asset that’s not likely to produce a positive return and produce it pronto?

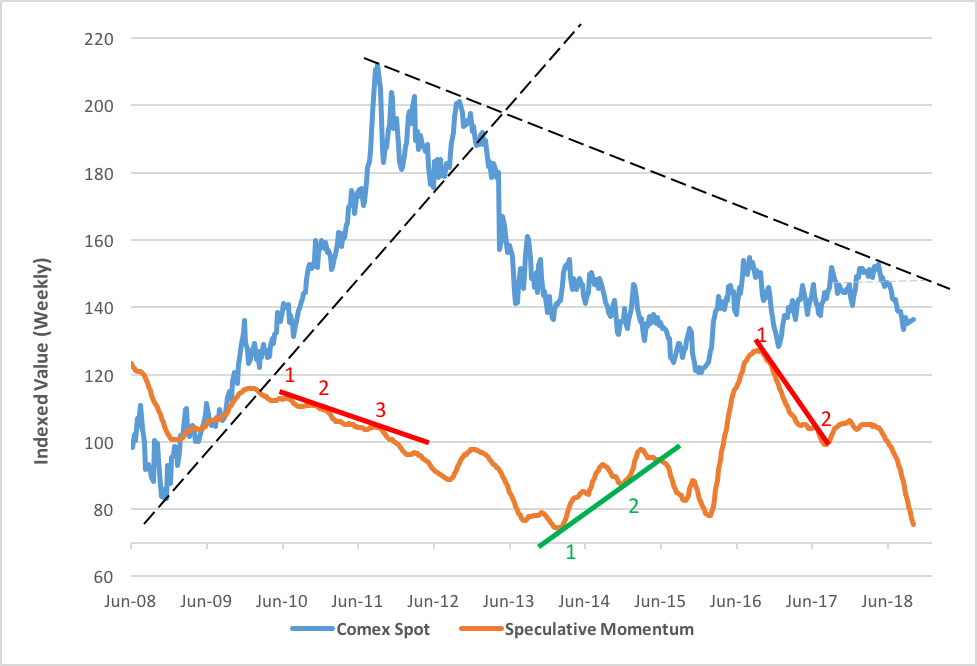

Normally, investors consider an asset’s price velocity as a measure of momentum. And they’re right to do so, though that’s not the only type of momentum worth considering. Take gold as an example. Bullion had great upside mojo—measured by its price—until 2011. But even as gold’s price raced to its zenith, there were signs that speculative enthusiasm—momentum, in other words—was actually waning.

Speculative length—the degree to which long positions held by speculators exceeds or lags open shorts—is a favorite tool of analysts to gauge traders’ and investors’ conviction in an asset’s future price strength. A single reading of speculative length reveals little information, though; you need to see trends to get a real sense of investor fervor. Plotting a trend line of the metric’s exponential moving average, giving greater weight to more recent readings, lends more immediacy to the indicator. And, by indexing the spread between the 12-month and 24-month exponential averages, we arrive at the trend line depicted in gold below.

You may well wonder about the value of going through all this math. It’s simple. We’re looking for divergence in gold’s price trend and that of the momentum index. These deviations can be predictive. Let’s go back to gold’s run-up to its 2011 high. Notice how the momentum index declined as Comex prices raced upward. That falloff foretold the break in gold’s upward trajectory. A trend line, of course, needs at least two points—either highs or lows—to be established. Resistance in the momentum index was established in December 2010, with a high reading ten months before gold’s ultimate peak. The third time the index slumped coincided with the Comex price summit. This divergence could have informed the astute investor of deterioration in speculative ardor for the metal.

Another downturn in the momentum index coincided with gold’s more recent test of its upside strength. After failing earlier this year, gold is now moving sympathetically southward with the index. Should the index turn upward, analysts and momentum traders would then start looking for a trend line to be established, along with other technical and sentiment indicators, before considering re-entry on the long side. That’s when the yellow metal will be ripe for a rebound.

Disclosure: None.