Weekend Report- Electric Metals…Reduce Your Time To Lambo

I would rather own a copper mine than a gold mine- Robert Friedland

“Time to Lambo” is the urban expression of how long one must hold an investment until its gain reaches enough to cash it in and buy a Lamborghini. This report makes the point that if you want to reduce your time to lambo you should get into the “electric metals” because a revolution is coming your way.

The electric metals are Lithium, Cobalt, Copper and Nickel. These metals are going to lead and power the next commodities super cycle. Today we stand at the cusp of the next electrical revolution. One equal to when Edison flipped on the light switch and changed the world. The internal combustion engine is on its way out and alternative electric energy is on its way in and green energy requires 5-6X the copper to produce and distribute it as conventional energy. As an investor, I just know that when a super cycle begins you don’t want to miss it.

This report is very timely as it is coincident with the copper breakout that Rambus has been highlighting this past week. I am going to show some ways to position oneself for this trend. I am not making any specific recommendations just showing what’s going on beneath our very noses. There is a specific story that goes with each chart, however I am going to limit my comments and not develop each story as some members have expressed they just want the charts and not the narrative. Give us your feedback for your preference for future reports. After the electric metals review I offer my thoughts on Novo Resources and whether or not its too late to get in on the discovery. Also this edition is Robert Friedland centric as his companies are centered around the electric metals.

“All of the largest copper mines in the world are like old woman laying in bed waiting to die”… Robert Friedland

By the year 2035 the world’s entire fleet of automobiles will be replaced with electric or hybrid vehicles. This single change will double the amount of copper consumed in the world today. The only way to economically produce this amount of copper is with a vastly higher price and this does not even consider the growth in green energy which is many times more copper intensive than conventional energy.

The following charts are of companies which are positioned well in the space and are well aligned with this electric metals trend. There are many other copper choices, however these specifically offer upside for this upcoming revolution.

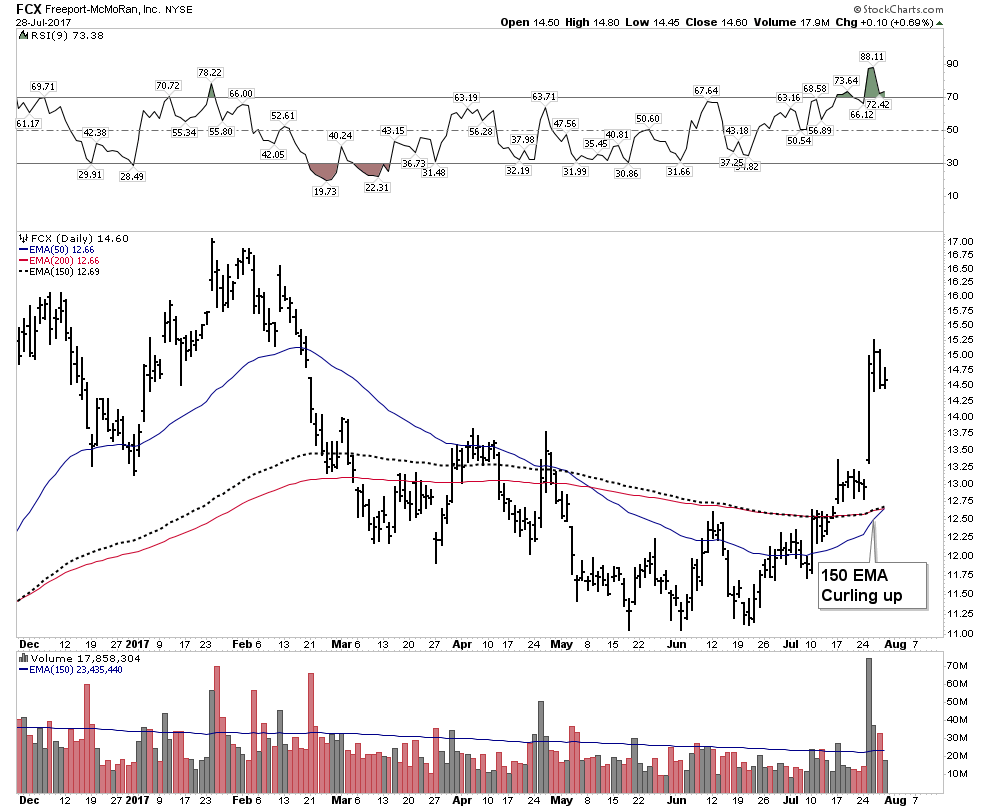

Freeport McMoRan – The largest publicly traded copper producer, with the 2nd largest producing copper mine-the Grasberg mine.

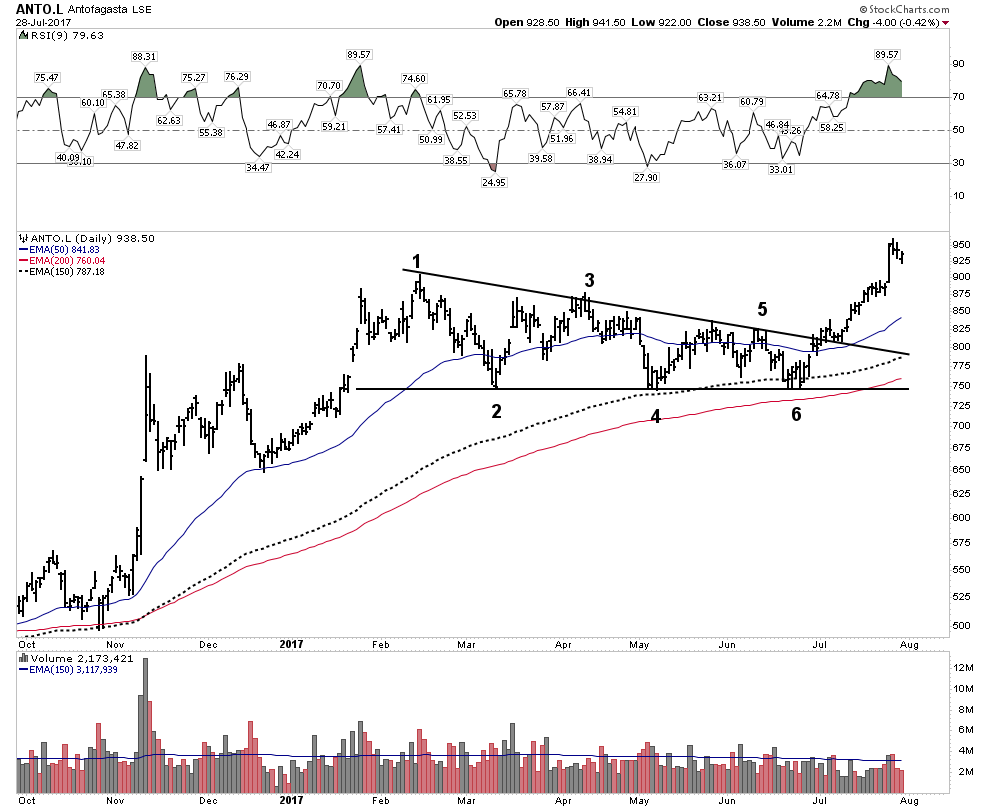

Antofagasta– Chilean Copper Mining group on LSE

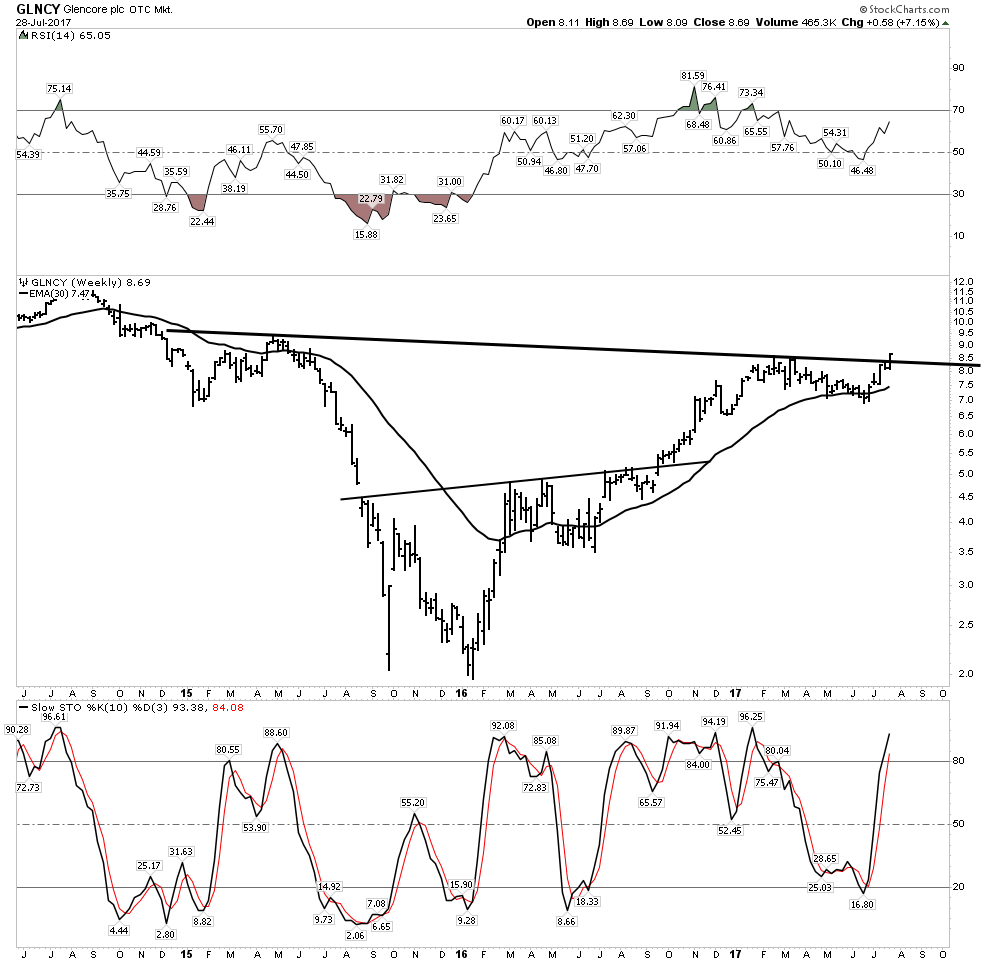

Glencore PLC- Smartest guys in the room (Mark Rich’s old firm)

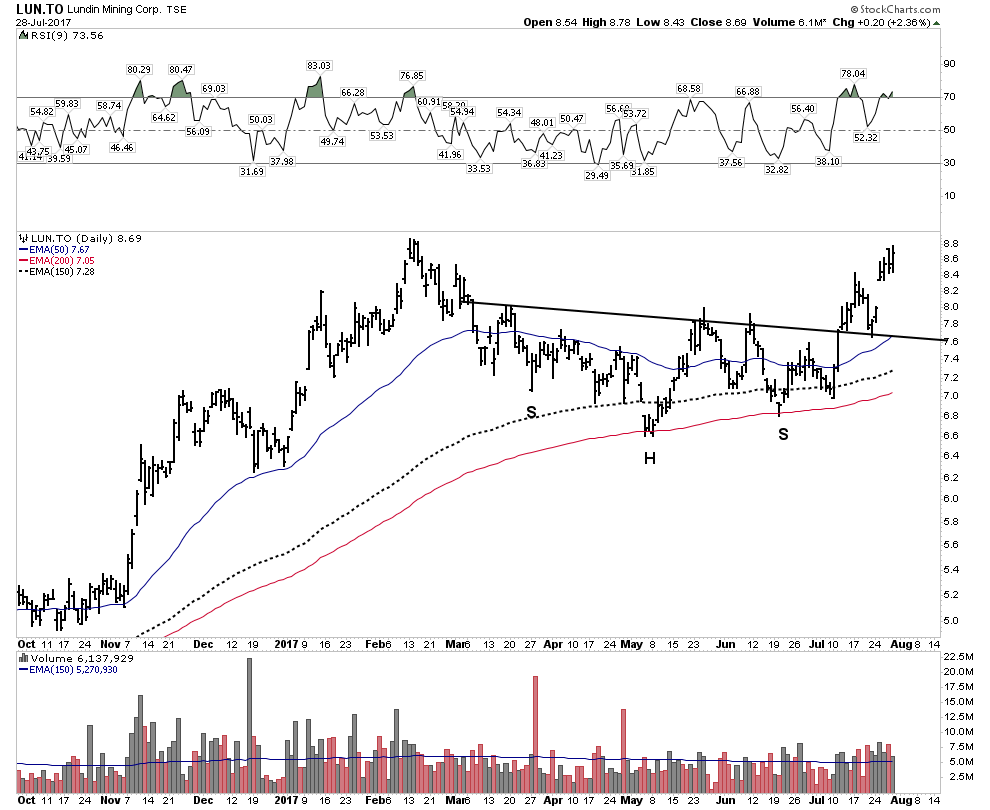

Lundin Mining- Copper, Zinc, Nickel. Legendary management.

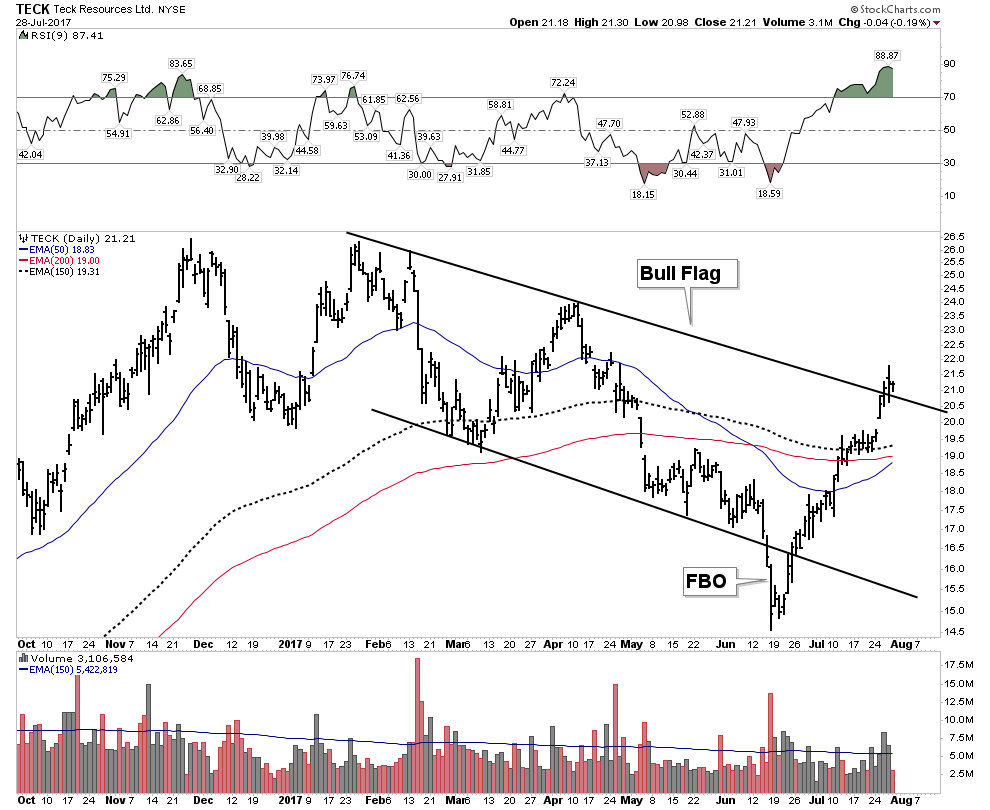

TECK– Canadian Giant

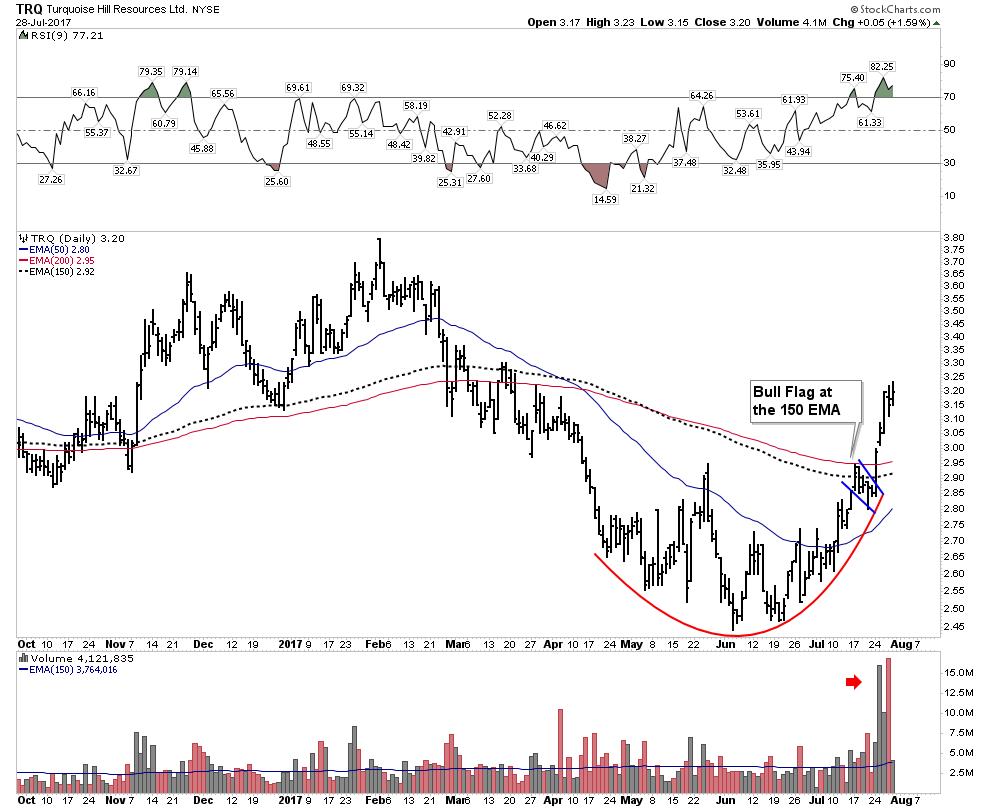

Turquoise Hill Resources - Oyu Tolgoi Mine (formally Ivanhoe Mines) Friedland’s second Tier-1 discovery. This is a potential take over target by a major such as RIO, BHP or Vale. Bought shares this week. Huge upside.

Nevsun- (NSU)

I have a decent sized position in NSU. There is a risk of a significant drop when next quarters earnings are released due to continuing metallurgical issues with the Bisha mine in Eritrea related with their zinc extraction. However, this is an amazing company endowed with a balance sheet which enabled them to buy the Timok discovery from Reservoir Resources in Serbia. A super-high grade copper discovery at 13% copper in the top level of the deposit. It has been beat up and I love the chart. Nice inverted H&S off the bottom:

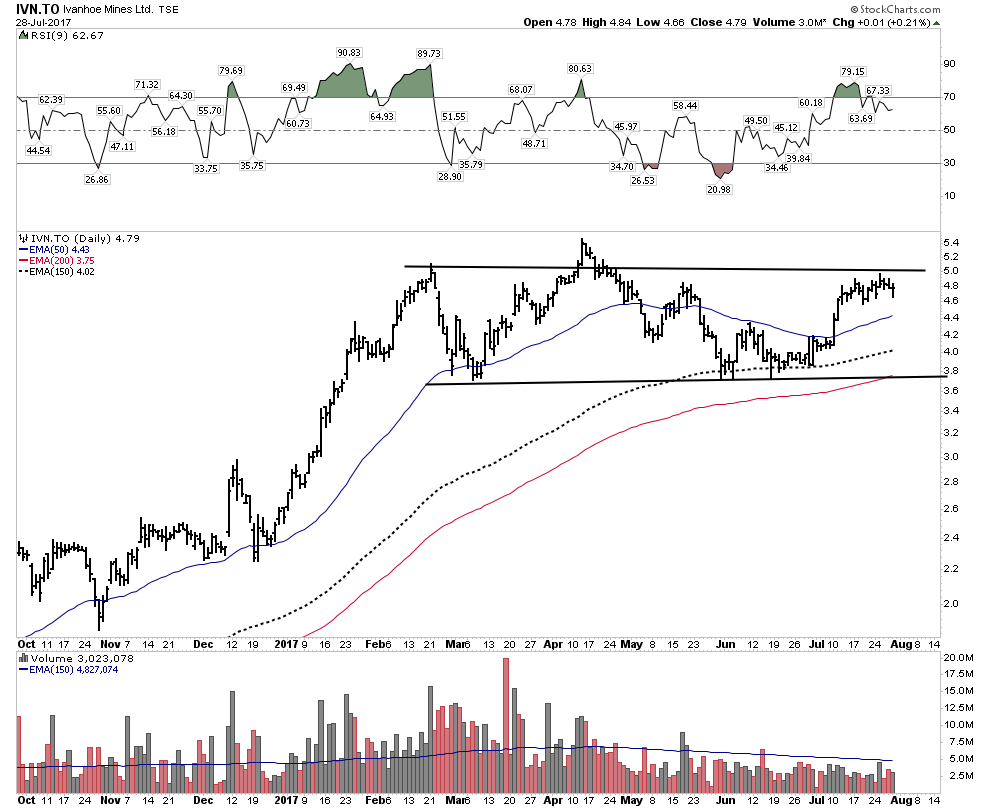

Ivanhoe Mines- (IVN.to)

This of course is Frieland’s crowning career achievement. Massive world changing deposit which will bring the world into the next electrical revolution. Top Tier-1 deposit in the world. Located in the DRC, considered a risky place to operate. He has mitigated that risk by making the Chinese, Japanese and DRC as partial owners. The Chinese have built the supply railroad to the seacoast already. Does one really want to mess with the Chinese in Africa?

As a resource investor, one simply should own this stock. But it is a question of the entry point:

So here is the fly in the ointment. The stock has had a heck of a run off the bottom. This was one of those lifetime opportunities to buy this stock during all of 2015. (I did chronicle it back then) so where does one enter now? Well, I think there may be a chance that it may be somewhat exhausted. Maybe, maybe not. Therefore the chart below gives me pause. Maybe we will get a pullback corrective move.

Cordoba Minerals (CDB.v)

This is my copper exploration discovery play. My trusted broker at Sprott (I have learned to trust him) called me 2 months ago and said you have to participate in Cordoba’s secondary offering with warrants. He told me the story and he said I can’t tell you all of it, but you will like it. I took the offering and after it closed it was announced that it was partnered by none other than… you guessed it…Robert Freidland. So this project has some real potential. Plus the young CEO is an up and coming hard charger. I’m in!

Copperbank Resources Corp CPPKF

This is a swing for the fences super leveraged optionality play for you riverboat gamblers out there. It is a collection of uneconomic, at todays prices, copper projects. No guarantees here but interesting.

There are numerous other copper plays, especially the major base metal producers, however I have focused in on copper centric special situations above. Also I am not attracted to any lithium plays at the moment and will visit this sector at a later time.

Question- What was the best performing metal on the LME over the past year?

Ans: Cobalt.

Cobalt is a much thinner supplied metal than copper and it is all virtually a product of secondary recovery from major copper and nickel mines. Due to its tight supply it has rapidly responded to the coming revolution in electrical power storage as has Lithium. There are few pure play cobalt companies, however one that is recommended by Sprott is Ardea Resources Ltd . It trades on the Sydney exchange. I own it, plus warrants.

Discovery!!! Novo Resources- is it too late to get in?

I would like to discuss with you the recent possible discovery with Novo.

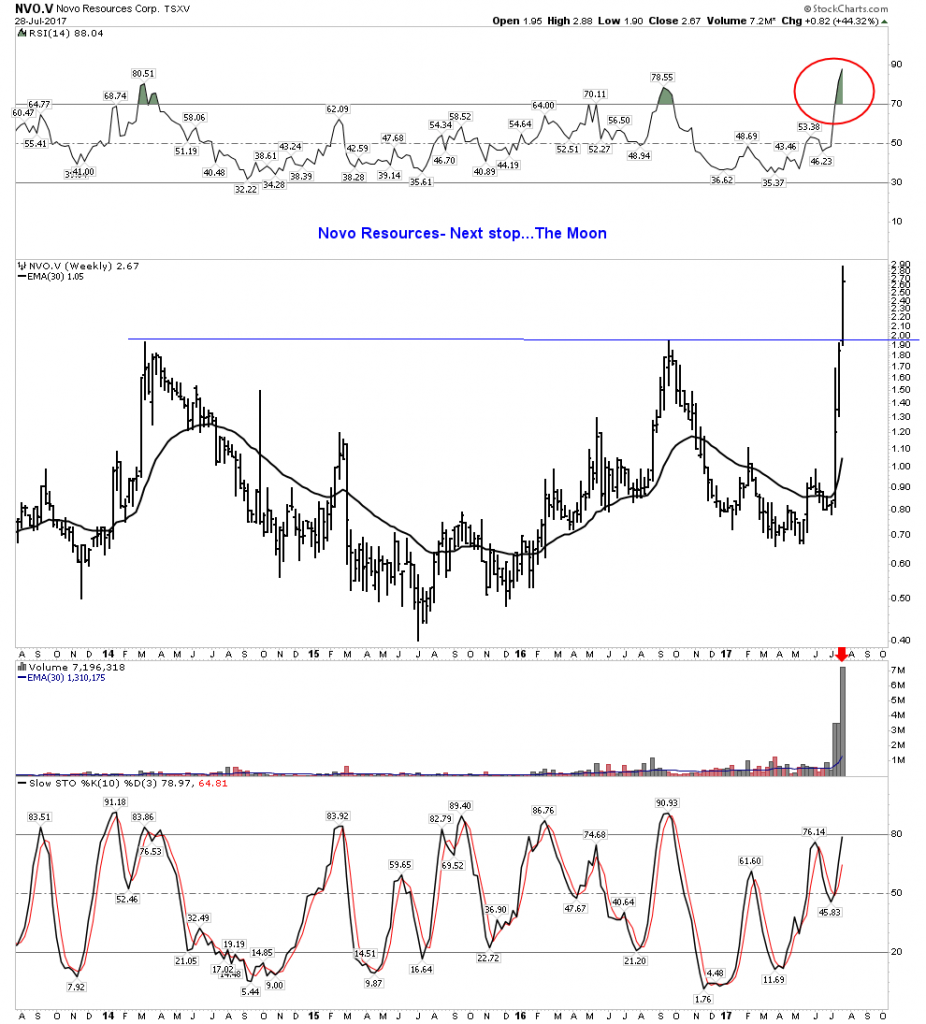

About 2 years ago I took a small position in this stock. When I saw that Quinton Henning was dropping everything and devoting all of his time to this project I figured it was worth a look. I took a small position and had intended to follow-up and buy more. It was on my shopping list to bulk up on, but I never got to it, but at least I got my foot in the door with a starter position. Early on Quinton explained this could be a gigantic play. Analogous to Witwatersrand in South Africa!. The geological theory is that basin broke in half and drifted all the way to Australia 3+ billion years ago. Pretty far out concept so not many cared to get their head around it. Well, looks like he might have discovered something and initially it seems to validate his theory. It is going to take some time for the drill deposits to further confirm his geological model, but if he is right this stock could go to the moon. This could be a game changing discovery. This stock is now trading purely on concept so how can one justify buying it after such a run-up? I would say the only way is due to the people involved. In geo school they teach only 1 in 1000 anomalies end up as an economic producing deposit. So the only way to mitigate those risks is by employing the right people and that’s what Quinton brings to the table. So is it too late to take a position? I say no it’s not, as it’s actually early days. I bought some more Thursday and Friday at the highs.

When I say game changer, what do I mean?

Have you ever watched a new discovery take off? Well this is what they look like. They never give you a chance to buy in. Pull backs are short and only intra-day, one just has to buy and hang on. May I suggest instead of using your faith to buy Tesla, you use your faith to buy Novo. If you ever want a good read, try reading “The Big Score” by Jacquie McNish. It’s about Robert Freidland and his Voisey’s Bay discovery. I recommend reading this book because it will give you a real understanding of the man Friedland and what can happen in a discovery market. It goes beyond anything you could have initially imagined.

The Voisey’s Bay discovery took Diamonds Fields stock from less than $1 up to around $160 in less than a year. It also ignited the entire sector where junky stocks rocketed higher as well. John Kaiser is saying this current move in Novo could go all the way to $10-15 before much more information is known. Then later if drill results confirm the theories it could be a $50-$100 stock.

Furthermore, these are the kinds of discoveries that ignite bull markets. It brings money into the market and builds its own momentum. None of us can possibly have any idea if this discovery plays out, but I do know Quinton is a brilliant honorable geo. In early days one just has to bet on the people.

I watched from the sidelines when Keith Barron got his hit in the Fruito Del Norte and his stock went from 42 cents to $46 in about 8 months. If you waited for a pull back you waited with me… on the sidelines. Same when Andre Guamond discovered Eleonore and Virginia Mines, a 40 million market cap stock, got bought out for north of $500 million.

But here is the thing, the geological theory for the Novo discovery encompasses a much larger district scale discovery than any of these discoveries, if it is actually validated. So far the existing Witwatersrand in SA has produced over 1.6 billion ounces of gold, what if Quinton is right?

I was thinking yesterday of the possible implications if he is correct and I began to realize the stunning impact of all of this. You must know of the vast number of citizens who are hungry for such a discovery. I am sure just about everyone whom you know is vaguely aware there is something wrong with our economic system. There is a deep seated fear of how the debt bubble will play out and they realize they need some sort of protection, but they don’t really know what to do. There is a huge amount of money sitting on the sidelines waiting to do “something”. All it will take is a spark to ignite an inferno. Historically there is a world for this. Its called a GOLD RUSH.

That is what we are set up for. Gold rushes come from the depths of post bubble contractions. Historically there is a reason for this, men start looking for gold when times are tough and it seizes the imagination of the public. That’s what happened in 1849 and 1896… Sutter’s Mill and the Klondike, both placer discoveries during a PBC. This is why we have a gold discovery TV series playing today, its the same thing in the modern era. But maybe the big discovery comes in with Quintin’s geo theory. So I am postulating that this could seize the publics imagination and cause a new awakening in this sector. If it did it could deliver a runaway bid to just about every discovery play that you know. The good stuff as well as the crappy stuff. We have not had a true major gold find since 1981 when Hemlo was discovered. This sparked a staking rush not seen in Canada since the Klondike gold rush of the late 19th century. We are only 3 weeks into this, but I think one should sit up and consider the possibilities.

I am clearing the decks and finding cash to buy more of Novo, be brave knights… Oh, and I am not waiting for a pull back.

Above- big bases = big moves

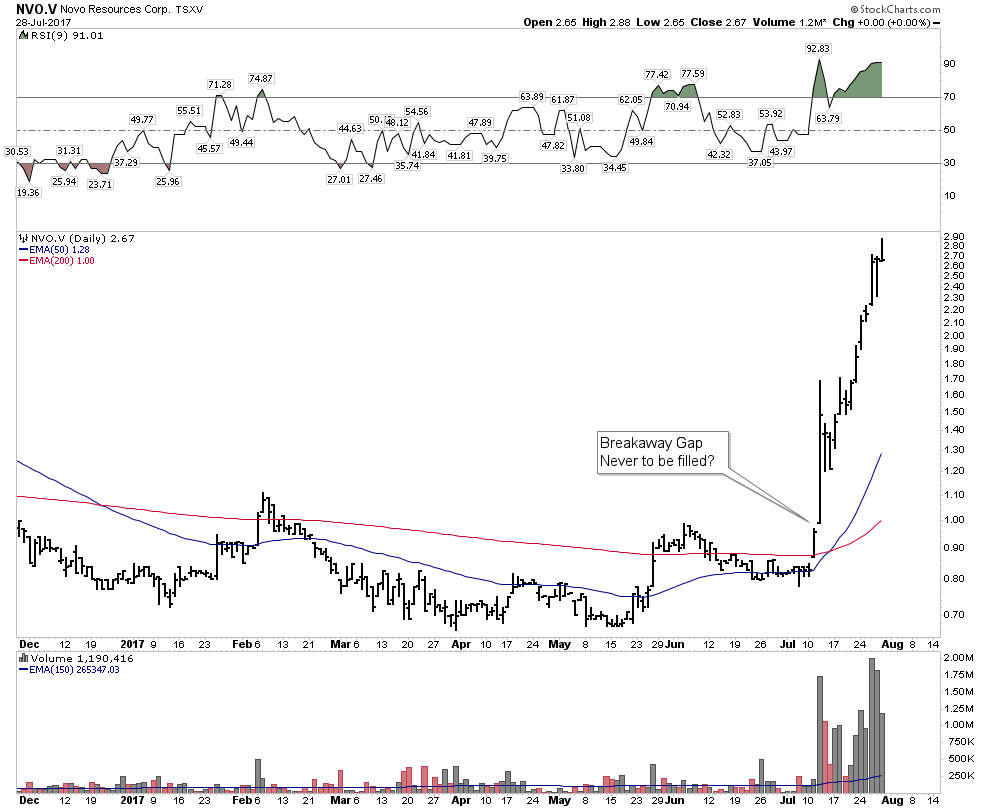

Below- Breakaway gap never to be filled?

So what would be a reasonable strategy for fresh money here? I would suggest buying one third at the market, another third at 2.10-2.20 and another third if it breaks to a new high. This is high level speculation knights, only use money you won’t miss if you lose it all. But once you buy, one has to hold on with all your might. Don’t trade it, don’t “register” your profits, Be brave and just hold on.

Tesla TSLA – Sport Shorting- Is it ready yet?

This idea fits into our electric metals idea. You’ll see why further below.

I have never shorted Tesla….until Friday. I initiated a small short side probe. I have amusingly watched multiple hedge fund managers break their axe on this short sale. It just seemed stupid to me that they would even try. You can’t short a faith based concept stock… that is until the faith cracks. Somehow I am getting a sense that the flock may be wavering. Well, just maybe. We have seen how the longer term TSLA charts are still in bullish configurations. It is still above its rising 30 EMA and could certainly be considered just in a correction or consolidation. So it’s not a classic Weinstein set-up.

However my shorter term chart shows how the decline may have begun. Note we had the breakdown out of the H&S top with two urgency running gaps. (pretty classic- see IBM below) Now it is bound by a rising wedge. The jury is still out, but it has obvious bearish implications. With the upcoming release of its new model this week maybe we get an upward pop, but it is relatively low risk for me as I will cover it if it closes above the NL for 3 consecutive days.

Here is an entertaining story I heard this week. It is about a conversation between Robert Freidland and Elon Musk. Elon approached Freidland about a longterm supply arrangement for cobalt:

Musk: I have the world’s largest battery factory so I am offering to secure a contract to buy all of your nickel and cobalt at current metals prices over the next 10 years.

Freidland: You know Elon that’s interesting, we will think about that and get back to you.

Two Months Later

Freidland: Elon you are totally screwed, the Germans are building a gigi factory twice as big as yours, The Chinese are building four of them as big as yours, the Japanese are building two, the Koreans building one. So unless you are willing to pay to buy our cobalt and nickel at whatever the prevailing price may be in the future you are not going to be able to build any batteries at all.

Then your company is going out of business and we are going to make a fortune shorting your stock!

Reportedly this conversation really did occur.

I understand Tesla is a faith based stock, but consider these numbers as of June 28 2017:

Market Cap; Ford- $44 Billion Tesla- $62 Billion

Cars Sold 2016 Ford-6,651,000 Tesla-76,000

Stock Valuation per car sold: Ford-$6,616 Tesla-$815,789

Traders Update- IBM Short

Here is an update on the IBM short I am still holding. It’s a great example of using chartology to identify trades. I have read some very good analysis of why IBM is a short sale candidate. So when I combined the story with the charts it made perfect sense. The trade was entered in mid-June once it became apparent that it was building out an anemic bear flag consolidation. It had already triggered a death cross as can be seen on the chart. I began chronicling it on the forum in mid-June as well. Frankly, this short simply appeared to be presenting itself on a silver plater. It almost seemed too obvious, but I trusted my instincts on this. Now, if it seems to you it’s just a little move down so what’s the big deal, you need to consider the tactics and sizing. I used in-the-money August and October put options. I sized it to where the options actually controlled up to 8,000 shares at the break of the bear flag. You may recall I mentioned twice on the forum that I was increasing my short position 2 days before it broke down out of its bear flag. This is an example of doubling UP into the trend as opposed to doubling down which is a losers tactic. Sure it takes faith in ones convictions and in this case it paid off. I mention the sizing only to relay that even though it’s a somewhat small percentage move it can pack a big wallop.

But here is the thing knights. The chart tells me there is much further to go. My trade objective is another 10 points to the downside. That’s what the measured move projects to. Be right-sit tight.

Plungers Trade of the Year Update -Oil Short

As I reported in early July I am going to sit on the sidelines a bit on this short and look for a reentry. So here is what I see. First off let’s review semantics. When I introduced the term Bear Market Rally (BMR) a few years back I defined it as a rally within a bear market typically lasting 4-12 weeks. Rambus has done a good job depicting these rallies in the gold sector over the last 5 years. I have seen references on the forum depicting BMR’s as 1 year and longer affairs. Those should be termed cyclical bull markets NOT BMR’s. Just getting the definitions right.

I interpret the current rally as a BMR. We are 5 weeks into it. Typically the duration lasts 6-10 weeks, so we should have further to go. Originally I figured $47 would be the extent of the rally, but the market has other plans. My best guess projection would be to the upper BB (50,2), currently $51. Once we reach that objective I will be watching for a reversal to the downside. At that time I will reenter the short expecting the downtrend to resume. This has been a managed short since the beginning and we watch for further defining signs day by day.

I have plenty of other short ideas, but it’s tricky stuff so I will save them for another time. Keep an eye on SOXL however.

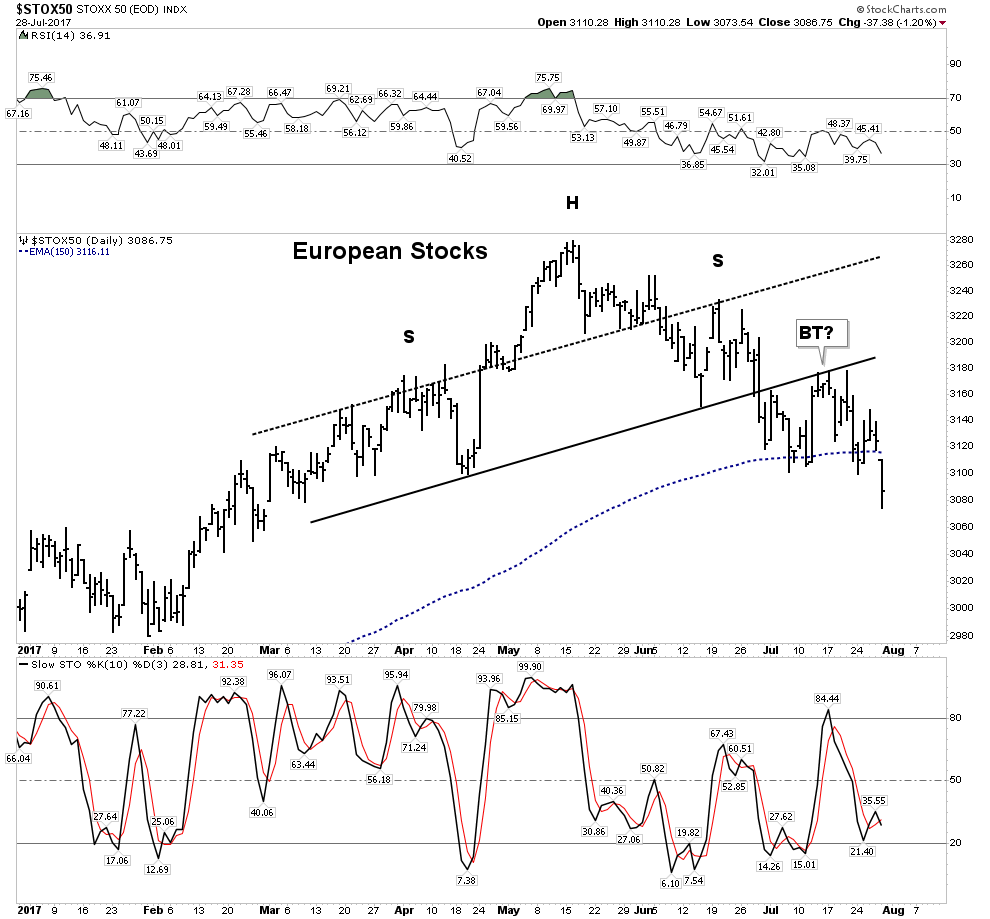

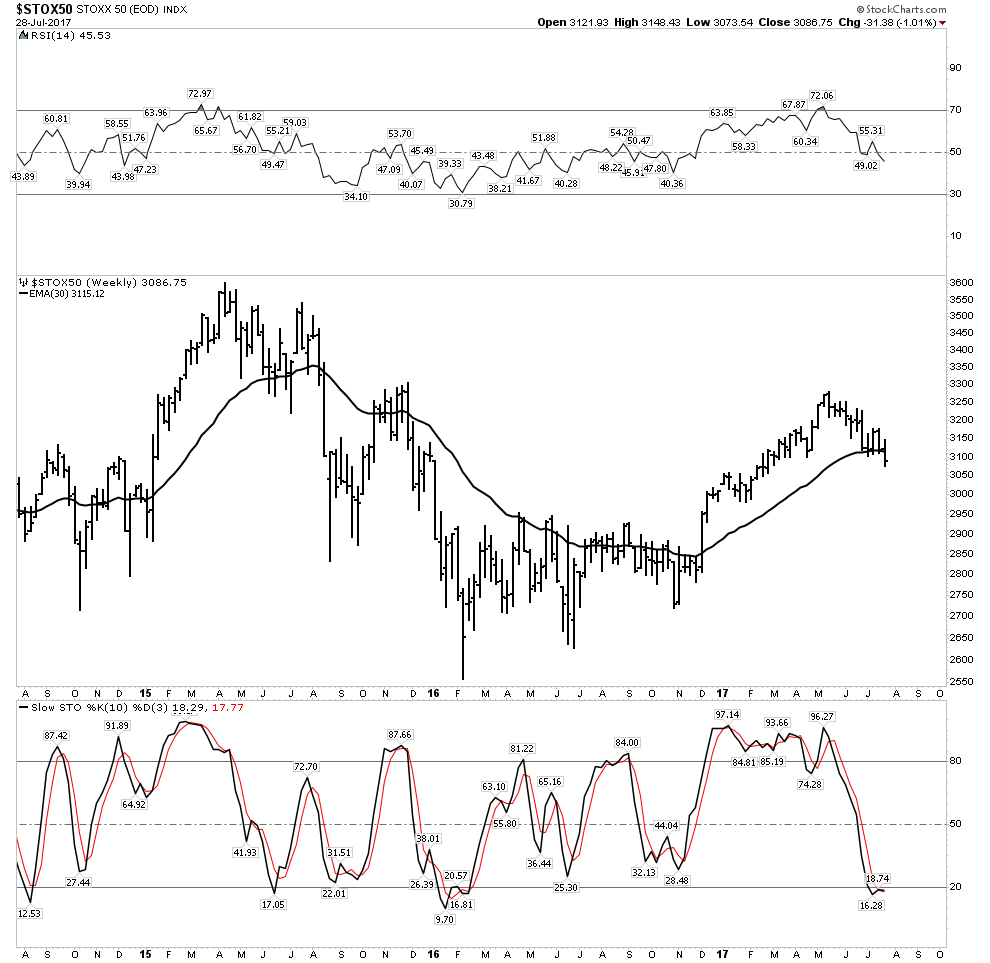

Post Bubble contraction update

My model continues to progress. Recall it entails Europe topping in May-June while the US markets remain firm throughout the summer after a little correction. We got the correction and now US markets continue to rise. The model calls for them to peak in September. Commodities should stay firm into August. I want to make sure I have an ample war chest going into the fall. Hard to do with gold stocks perking up this week.

Below we see European stocks continuing to follow the model. This seems pretty blatant to me with Friday’s gap break below its 150 EMA (30 W EMA Proxy)

A three year weekly shows stochastics pinned to the bottom and a peek below the 30 EMA.

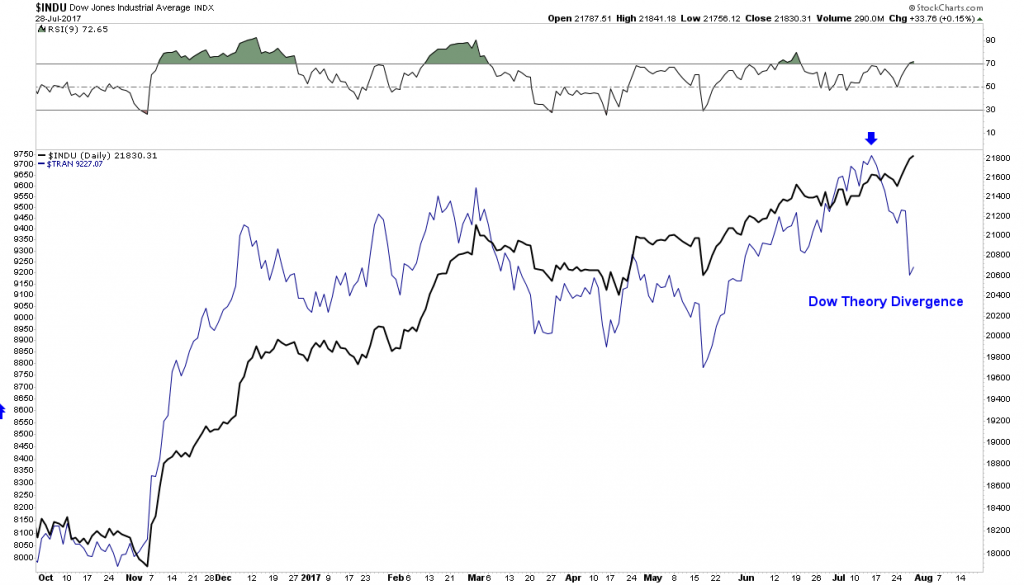

As mentioned the NYSE continues to motor higher, however the trannies have got a problem with it. We will keep an eye on this one:

Commodities could get weak in the fall season, especially if the USD ever finds a bottom. Don’t forget about the electric metals and the coming second electrical revolution. It’s where you will want to be.

Disclosure: None.