Watch Out If Silver Breaks Through This Threshold Next Week

The huge Silver Rally this week took a lot of precious metals investors by surprise.The silver price surged 15% since the Brexit vote results last Friday. Silver began trading at $17.25 last Friday and closed at $19.76 today. Gold also performed very well by increasing 7%.

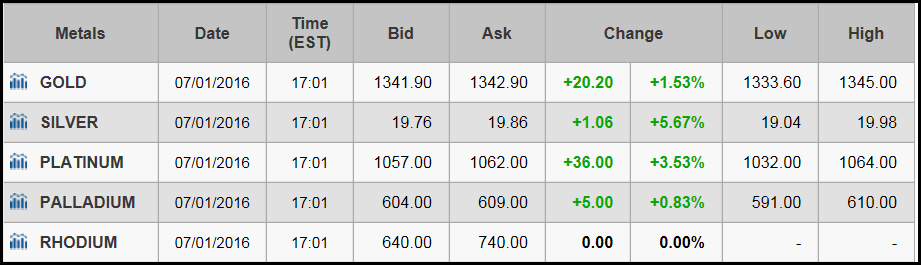

As we can see from the Kitco table above, silver had its best day in several years by jumping $1.06 as of the close this Friday.

Watch Out If Silver Breaks This Threshold Line

What is interesting about this present silver rally is shown the the chart below:

From 1996 to 2004, the price of silver traded below its 200 MA (RED LINE). Once it jumped above it in 2004, it never fell below it except for the brief time it bounced off it at the end of 2015. While I don’t pay a lot of attention to Technical Analysis, a lot of traders do.

What is important to notice in the chart is the 50 MA (BLUE LINE). Once the silver price fell below the 50 MA at the beginning of 2013, it continued to decline over the next three years. However, as the price of gold and silver started to rise in the beginning of 2016 and surge even higher after the Brexit vote last week, silver is only $0.75 away from breaking through the 50 MA (BLUE LINE).

Once silver breaks above this 50 MA Threshold, I believe we are going to see a great deal more hedge fund and traders move into the silver market. We may see the banks try and hold silver from crossing this trend-line, but if silver does close above $20.50 next week and continue higher… this could spell real trouble for the bullion banks who hold a great deal of silver short contracts.

Precious metal investors who were hoping for lower gold and silver prices to purchase more metal were caught by surprise as the silver jumped 15% in a week. Those who have NOT YET BOUGHT METAL, you may be paying a lot more of the price if silver really starts to take off over the next several weeks. I heard that several precious metals dealers said they had never seen anything like the kind of sales they were experiencing today.

Disclosure: None.

LOL if silver and gold spike astronomically banks will start dumping assets to cover and then if that doesn't work they will want bailouts. Afterwards they will then engage in the same thing again. The only lesson learned is screwing the public is dependable and pays handsomely most of the time when they are ignorant that you are making money gambling with them at risk for the losses which rapidly become astronomical.