Wakeup Call - The Price Of Gold Is Headed Lower

A wakeup call can seem like quite a jolt when it happens, but, usually, we are grateful for it. And even if we didn't ask for a wakeup call, it can still prove fortuitous. Maybe this will be the case for some of you when you read this.

If you are a long-term holder of physical gold for the right reason, i.e., 'gold is real money', and you understand that gold is not an investment, and you are not currently speculating/trading gold with short-term objectives for higher prices, then this could be a benign event for you.

If, on the other hand, you are an 'investor', trader, or speculator with expectations for higher gold prices; if you are a long-term investor who is overcommitment to gold financially and emotionally; if you are still waiting for the impending 'moonshot' that will bring you wealth untold; if you would like to spare yourself some unnecessary remorse; then you might want to continue reading.

After recently perusing some gold charts for some historical perspective, I was relatively nonplussed; but continued my search. When what to my wondering eyes should appear...

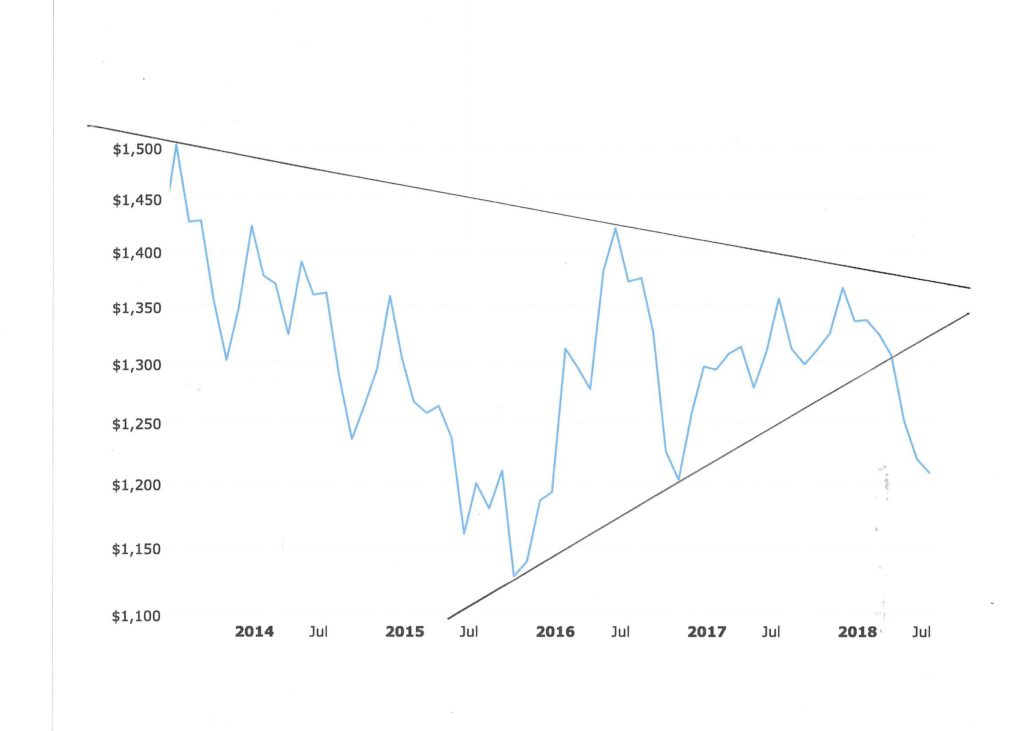

The above chart is a 5-year history of gold prices (inflation-adjusted) from August 2013 to August 2018. As you can see, it is not a pretty picture.

Below is the same chart without the inflation adjustment...

After looking at both charts, there are a couple of differences that are apparent:

1) the overall result of the price action for the entire period is a loss of slightly more than three hundred dollars per ounce on an inflation-adjusted basis; the second chart's nominal amount is less than two hundred dollars per ounce

2) a break below $1200.00 per ounce would be a clear violation of the pattern of successively higher lows since December 2015 when viewing the inflation-adjusted chart; the pattern remains intact on the second chart even if gold were to break below $1200.00 and go a bit lower

What is clear on either chart is that gold has broken below a line of support dating back to its price-point low in December 2015. Maybe just as important, the price of gold has been held below a declining line of overhead resistance going back five full years...

How low can gold go? A lot lower than most want to admit. Under reasonably normal conditions, my guess would be $850.00-900.00 per ounce. The $850.00 point is ideal - it coincides with the January 1980 high point.

There is the possibility that it could go lower, too. Or, it might find a floor at $1000.00 per ounce. There are several scenarios but there is only one thing you need to focus on - the U.S. dollar.

If the dollar heads lower and accelerates its long-term decline, then the price of gold will reflect that by moving higher. If, on the other hand, the dollar continues to stabilize and strengthen, then gold's price will reflect that by moving lower.

It IS that simple. (also see The Case For Gold Is Not About Price)

Disclosure: None.