This Gold Rally Is Suspicious

Since middle December 2016 gold prices have been going up nicely:

source: www.stockcharts.com

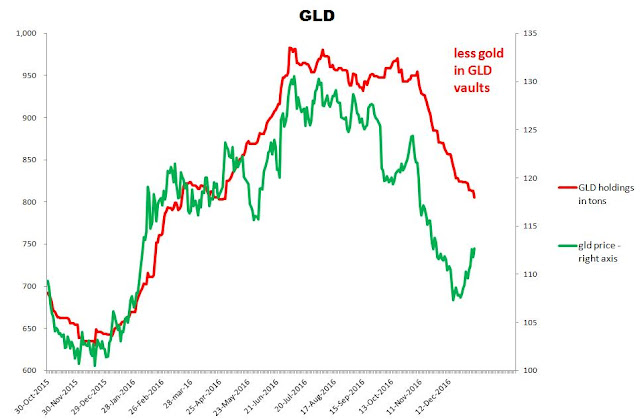

However, this picture is still not supported by gold flows reported by GLD:

source: Simple Digressions and GLD data

For example, yesterday as many as 276 thousand ounces of gold left GLD vaults. Simply put, the American investors are not buying this rally (more - they are selling) and since December 15, 2016 (when the current rally had started) they decreased their holdings by 1.4M ounces. In my opinion, it is quite a large figure.

That is why I have serious doubts about this rally...

This article is not an investment advice. I am not a registered investment advisor. ...

more

"However, this picture is still not supported by gold flows reported by GLD"

Simple Digressions, are there any reasons why you keep trying to mislead investors with this questionable indicator even after it is proven to be deeply flawed? In your previous articles from other sites, you have also tried this tactic and have been called out for it. Please explain the period after November 2012 when GLD's holdings were increasing or flat while the gold price plummeted. GLD's holdings plummeted later on as a result. Which data leads which data again?

You also ignore the fact that GLD's movements are more or less insignificant when you look at the rest of the gold market. How accurate of a picture can you get from such a small indicator when compared to the size of the gold market? The activity in the gold exchanges alone dwarfs the activity in GLD. I'm also in agreement with the many SA readers that state GLD's holdings itself is questionable at best. How reliable are GLD's holding reports? GLD does not give retail investors the right to redeem for any of its mystery physical gold holdings. This fact alone ensures the GLD shares to be nothing more than paper at the end of the day. GLD also has a glaring audit loophole in their prospectus that states they have no right to audit subcustodial gold holdings. To this day, I have not heard of a single good reason for the existence of this backdoor to the fund.

I remember there was a highly publicized visit by CNBC's Bob Pisani to GLD's gold vault. This visit was organized by GLD's management to prove the existence of GLD's gold but the gold bar held up by Mr. Pisani had the serial number ZJ6752 which did not appear on the most recent bar list at that time. It was later discovered that this "GLD" bar was actually owned by ETF Securities.

There is also credibility to the following red flags that I've read around TalkMarkets and welcome everyone else to verify for themselves:

"Did anyone try calling the GLD hotline at 866▪320▪4053 in search of numerical details on GLD's insurance? The prospectus vaguely states "The Custodian maintains insurance with regard to its business on such terms and conditions as it considers appropriate which does not cover the full amount of gold held in custody." When I asked about how much of the gold was insured, the representative proceeded to act as if he didn't know and said they were just the "marketing agent" for GLD. What kind of marketing agent would not know such basic information about a product they are marketing? It seems like they are deliberately hiding information from investors."

I have already explained it. Starting from December 2012 $GLD holdings were decreasing. So were gold prices. What is the problem then?

Unless this indicator stops working I will be following it. What is more, I will tell you when it does not work any longer.

Simple Digressions, once again you are not being entirely truthful here. It wasn't until mid February when the holdings truly start plummeting. You can see $GLD's holdings increasing or holding steady throughout January. Either way, this period contracts your claim of this indicator being reliable. There are other times when this indicator failed too if you want to go further.

Thanks SD (not sure what to call you), for an interesting read and follow up explanation.