There Is No Way Past $53 For Crude Oil, Time For Shorts To Pounce

The Saudi government ordered a strike on the Houthi Militants early on Thursday triggering a rise in the price of Oil. Crude prices were up by nearly 3% in early morning to about $50.70, as did Brent price which increased by 3.44%.

This came as a reaction to a possible bottleneck in the supply of the commodity with Yemen looking certain to rage war against the Saudi following the attack.

Many oil traders are now bullish on the commodity as they anticipate a slowdown in supply in the coming days following the latest events.

Price action trading

From a technical point of view, the current run is likely to continue in the next few days, but by the look of things, the price of oil does appear to be approaching a major resistance zone. The $51.00 to $53.00 resistance zone has proved effective since the start of this year, and there is no way the current run would push the price of crude oil beyond $53.

This is why shorts may be preparing to pounce with the price now just below the $51.00 per barrel level. From a price action trading perspective, a limit “sell order” at $51.00 with a stop loss at $52.00 level and a profit target at $48.00 would seem logical.

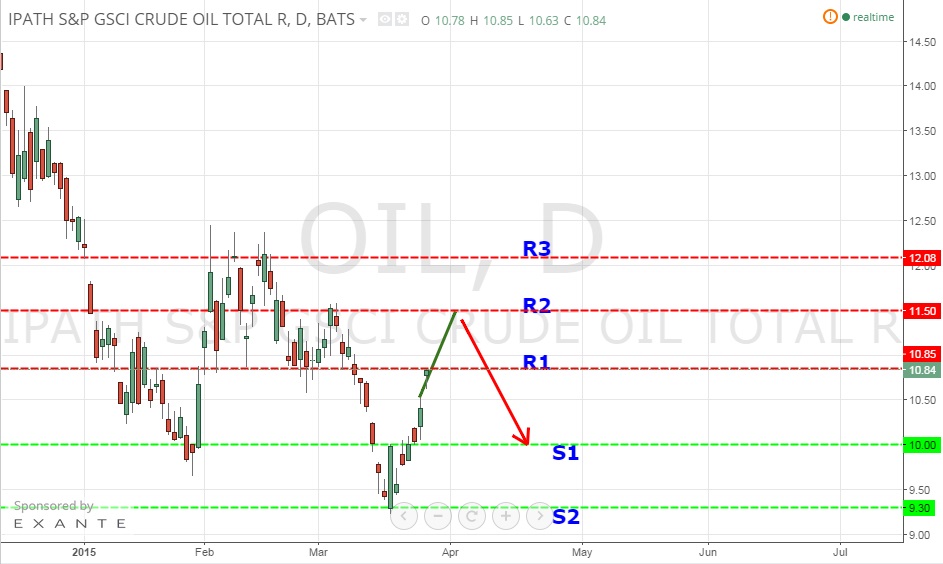

As for bulls, better luck with the IPATH shares

The IPATH S&P GSCI Crude Oil Total shares seem to provide more room going up, which may offer bulls a better alternative at this time. With the price currently pegged at just under $11, there are two major targets going up at $11.50 and $12.00, while the immediate support appears at $10.00 level.

The long-term support level at $9.30 though appears way too far for now and it would take a major decline (at least 15% to take the price per share to the level).

The IPATH shares for crude oil have just tested the resistance R1 at $10.85, which seems well set to be broken. As such bullish buyers would aim for R2 at $11.59, upon which the bears would then pounce with a profit target at $10.00.

Therefore, while there is a possibility of more upside in the IPATH shares, even the shorts could still seize an opportunity once the $11.50 resistance level is tested. However, as far as crude oil is concerned, shorts have a better chance trading the commodity futures.

Conclusion

The price of Oil has undergone one of the biggest declines in history over the last few months declining from about $107 per barrel reached in June last year to about $42 reached last week.

However, the last few days have seen crude oil prices rally to well above $50 per barrel, which means a reversal could be on the cards in the next few days.

As such, shorts will be looking to pounce, but bulls still have some time to rally the IPATH shares associated with crude oil further before the U-turn.

The bottom line is that despite the recent events in Saudi Arabia and the sworn promise to revenge by the Houthi militants, the general bias in the price of oil suggests an inevitable reversal, with a key resistance zone already being tested.

The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does it ...

more