Tesla’s Cobalt Blues; Spin, Fake News Or Deception?

- “Spin” is a form of propaganda that relies on a biased interpretation of fact to influence opinion.

- “Fake News” is a more dishonest form of propaganda that relies on a combination of fact and falsehood to influence opinion.

- “Deception” is an even more dishonest form of propaganda that principally relies on falsehood to influence opinion.

- Depending on the reader’s sophistication, the cobalt discussions in Tesla’s Q1-18 earnings letter could be fairly characterized as spin or fake news, or even deception.

- None of the possible characterizations speak well of public company that has a legal duty to provide full and fair disclosure of all material facts.

In its 2018 First Quarter Update, Tesla (TSLA) said:

“Cells used in Model 3 are the highest energy density cells used in any electric vehicle. We have achieved this by significantly reducing cobalt content per battery pack while increasing nickel content and still maintaining superior thermal stability. The cobalt content of our Nickel-Cobalt-Aluminum cathode chemistry is already lower than next-generation cathodes that will be made by other cell producers with a Nickel-Manganese-Cobalt ratio of 8:1:1.”

While I initially viewed the claims as a creative revision of Tesla’s battery chemistry history, I had major surgery the next day and didn’t feel up to preparing a written analysis until recently. So, while this article not as timely as I’d like, I think it offers a fascinating glimpse into the mind of the world’s greatest stock promoter.

Tesla Does Not Make Lithium-ion Cells

Tesla does not make lithium-ion cells or own significant cell manufacturing technology. Instead, it buys finished cells from Panasonic (PCRFF), which developed its high-energy lithium-nickel-cobalt-aluminum, or NCA, chemistry in partnership with Sumitomo Metal Mining (SMMYY). When Panasonic delivers finished cells to Tesla, the finished cells are assembled into battery packs by Tesla employees.

Whenever Tesla makes claims relating to the energy density of cells, the materials used in cells and the performance characteristics of cells, it is taking unmerited credit for development work that Panasonic and Sumitomo finished while Tesla was building Roadster prototypes.

Tesla’s Battery Technology History

Prototypes of Tesla’s Roadster EV were revealed to the public in July 2006, four years prior to its IPO in July 2010. The first 109 Roadsters were delivered to customers in 2008.The two-seater weighed 1,305 kg, was powered by a 53-kWh lithium-ion battery pack and had an EPA estimated range of 244-miles. According to Tesla’s Emergency Responder Guide, the battery pack was built using Lithium Cobalt Oxide, or “LCO,” cells.

LCO cells have a specific energy of ~200 wh/kg, so one kilowatt hour, or kWh, of cells weighs about 5 kg. The LiCoO2 cathode powder used to manufacture LCO cells is roughly 60% cobalt by weight. Since cathode powder weight typically represents 40% of cell weight, the Roadster used roughly 2.0 kg of cathode powder and 1.2 kg of cobalt per kWh of battery capacity.

When Tesla was designing the Model S, it upgraded the cell specifications to Panasonic’s NCA chemistry which offered higher energy density and greater thermal stability than Panasonic’s LCO cells. That change also gave Tesla the ability to pack 85-kWh into the Model S floorboard and offer the world’s first 300-mile range EV.

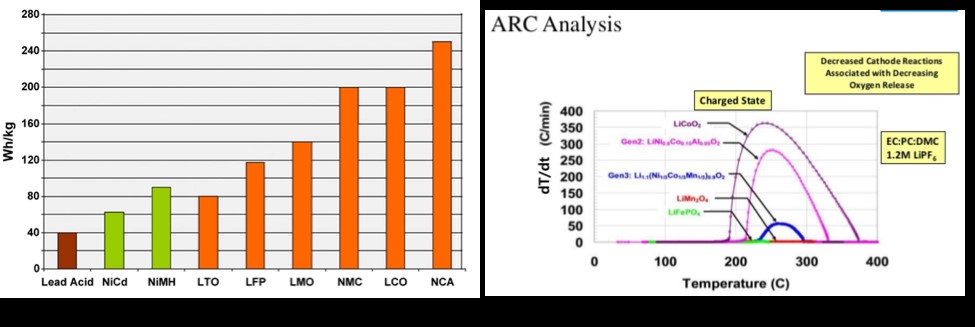

(Click on image to enlarge)

NCA cells have a specific energy of ~250 wh/kg, which is ~25% higher than LCO. So, one kWh of NCA cells weighs about 4 kg. Panasonic’s original Ni0.85Co0.15Al0.05 cathode powder formulation is about 9.2% cobalt by weight. Since cathode powder weight typically represents 40% of cell weight, the Model S used roughly 1.6 kg of cathode powder, 782 grams of nickel and 147 grams of cobalt per kWh of battery capacity.

Based on average LME prices of $21.84 kg for Nickel and $45.50 kg for cobalt in 2010, the metal cost savings from choosing NCA over LCO were roughly $31 per kWh of cell capacity. Two-thirds of the savings, or roughly $20 per kWh came from substituting nickel for cobalt and the balance came from the higher energy density of NCA chemistry.

To the best of my knowledge, Panasonic still uses its original NCA-80,15,5 cathode powder to make 18650 cells for Tesla’s Model S and Model X battery packs in Japan. According to Total Battery Consulting, Panasonic uses a second generation NCA-84,12,4 cathode powder to make 2170 cells for Model 3 battery packs in Nevada. At current prices, Panasonic’s Gen2 NCA cathode powder enjoys a metal cost advantage of $2 per kWh over its Gen1 powder.

Parsing Tesla’s Written Representations

I initially viewed the cobalt discussion in Tesla’s Q1-18 earnings letter as a creative revision of technological history. Since I think the quoted paragraph bears only a passing resemblance to demonstrable truth, the following sections will parse the paragraph one sentence at a time and highlight the factual claims that trouble me.

Tesla quote: “Cells used in Model 3 are the highest energy density cells used in any electric vehicle.”

My notes: Tesla selected Panasonic’s NCA chemistry for the Model S because it had the highest available energy density and that technical characteristic (a) directly translates into a lower cost per kWh, and (b) is essential if your goal is to maximize travel range. While Model 2 is the only car that uses Panasonic’s 2170 NCA cells, the Workhorse Group (WKHS) uses Panasonic’s 18650 NCA cells in its medium-duty electric trucks.

While it makes sense to assume that 2170 cells from the Gigafactory might have a slightly higher energy density than 18650 cells from Japan because their larger volume reduces the can to contents ratio, I haven't been able to find any documentation that supports or refutes an assumption that the NCA-84,12,4 cathode powder used in the Gigafactory has the same performance characteristics as the NCA-80,15,5 cathode powder used in Japan.

I do, however, think it’s worth noting that the Model 3 has a pack level energy density of 150 wh/kg while the Model S has a pack level energy density of 170 wh/kg.

Tesla quote: We have achieved this by significantly reducing cobalt content per battery pack while increasing nickel content and still maintaining superior thermal stability.

My notes: Panasonic and Sumitomo achieved a substantial reduction in the cobalt content of lithium-ion cells in 2006 when they offered their first NCA cells to the electronics industry. Tesla capitalized on the accomplishment in 2010 or 2011 when it chose NCA chemistry for the Model S over the LCO chemistry it used for the Roadster. Since 2006, the only advance in NCA chemistry has been a second generation NCA-84,12,4 cathode powder that reduces the cobalt content of the cathode powder by about 2% and reduces metal costs by about $2 per kWh.

While NCA has better thermal stability than LCO, the chemistry Tesla used for its Roadster, NCA has far less thermal stability than the NCM, LMO and LFP cathode powder formulations used by established automakers.

Tesla quote: The cobalt content of our Nickel-Cobalt-Aluminum cathode chemistry is already lower than next-generation cathodes that will be made by other cell producers with a Nickel-Manganese-Cobalt ratio of 8:1:1.”

My notes: The statement is simply not true. Panasonic’s NCA-84,12,4 cathode powder is 7.3% cobalt by weight while NCM 811 formulations will be 6.1% cobalt by weight if the technology is commercialized. It also creates a misleading implication that Tesla is a cell producer rather than a cell purchaser.

Parsing Management’s Color Commentary

Since earnings releases are usually prelude to a conference call with analysts and shareholders, I think earnings release disclosures are most fairly analyzed in light of color commentary from management during the conference call. Once again, I view management’s color commentary as a creative revision of Tesla’s technological history that bears only a passing resemblance to truth. The following sections parse management’s conference call discussions and highlight the factual assertions that trouble me.

JB Straubel in Tesla’s Q1-18 Conference Call: “Being on a path to reduce cobalt usage, for instance, has been something we've been working on for literally several years now, and this has been extremely helpful in the overall cost per kilowatt hour, especially with recent commodity price movements.”

My notes: Tesla does not make NCA cells or own significant cell manufacturing technology. When it makes claims relating to the the materials used in cells, it is taking unmerited credit for development work that Panasonic and Sumitomo completed while Tesla was building Roadster prototypes.

Panasonic and Sumitomo achieved a substantial reduction in the cobalt content of lithium-ion cells in 2006 when they offered their first NCA cells to the electronics industry. Tesla capitalized on the accomplishment in 2010 or 2011 when it chose NCA chemistry for the Model S over the LCO chemistry it used for the Roadster. Since 2006, the only advance in NCA chemistry has been a second generation NCA-84,12,4 cathode powder that reduces the cobalt content of the cathode powder by about 2% and reduces metal costs by about $2 per kWh.

Elon Musk in Tesla’s Q1-18 Conference Call: “Yeah, we think we can get the cobalt to almost nothing

My notes: Since a similar sentiment was expressed in a recent Tweet from Mr. Musk, “We use less than 3% cobalt in our batteries & will use none in next gen,” I’ll include the tweet as part and parcel of this section.

The cobalt content in Panasonic’s NCA 80,15,5 cells has been roughly 3.68% of cell weight for over a decade. Panasonic’s recent introduction of an NCA 84,12,4 cathode powder reduced cobalt content to 2.93%. While Panasonic is working on an R&D stage cathode powder that could reduce cobalt content by 50%, it expects to use 8,000 tonnes of cobalt this year and up to 25,000 tonnes per year by the early 2020s.

My Overall Impression

They say beauty is in the eye of the beholder. I think the same dynamic prevails when one tries to classify representations in an earnings report as spin, fake news or deception. I don’t see anything that remotely resembles unvarnished truth when I parse Tesla’s representations. To the contrary, the lily gilding strikes me as extreme and wholly unjustified.

The Verge recently observed, “Musk’s “next-gen” claim is a vague phrase that doesn’t set out a definite timeline, so it’s impossible to know when he’ll deliver — but don’t expect it to be in the next couple of years.” I’d include “almost nothing” in the same class of meaningless fluff.

Conclusion

I believe Tesla is very concerned that cobalt will become an insurmountable barrier to growth. More importantly, I think institutional investors are becoming increasingly unwilling to feed Tesla’s insatiable appetite for capital because the risks in the cobalt market can’t be quantified with any meaningful degree of confidence. Without rock-solid supply chains, Tesla’s gigafactory is a $5 billion boondoggle and its exponential step-change growth story an illusion.

Later this week I’ll publish a second installment of this series that analyzes the rapidly evolving geopolitical risks in the cobalt market that could easily explain Tesla’s newfound fondness for the term force majeure.

I continue to believe Tesla’s stock is worthless and bankruptcy is inevitable.

<< Read More: Tesla’s Cobalt Blues; Growth Fallacies And Supply Chain Risque Majeure

Disclosure: I am short TSLA through long-dated PUT options.

So John, the stock was halted today. Musk has his own rules, apparently. His tweets, like POTUS, is getting him into big trouble.

It's a fascinating circus to watch. I have no idea how Mr. Musk thinks he can fund a going private transaction when most institutions can't own shares in companies with limited liquidity, but I've been surprised several times over the course of my career.

It should also be a ton of fun for individual stockholders who hold Tesla shares in margin accounts and won't be able to use private fund shares as collateral.

I bet!

What? I totally missed that! When did that happen and why?

Musk tweeted and it busted the balls of shorts. But it is not settled information so the stock was halted. It may be a securities violation

That's crazy, why did he do that and why? What do you think his plan is here?

#Musk tweeted that he was thinking of taking #Tesla private.

Spin is one thing, truth is what matters. I thank Mr. Peterson for shedding some truth on the topic of battery technology. Invariably battery technology is advancing and I suspect when electric vehicles become dominant in the auto industry new cars will not be using the current technology. Hopefully, Tesla will be able to migrate with the others. It is not a innovator in this market but is trying to scale existing technology which has serious problems ramping. This, however, seems to be the least of its worries given its real production is still so low.

There were no credible emerging battery technologies when I started blogging 10 years ago and there are no credible emerging battery technologies today. In the battery industry it takes a decade for an innovation to go from Eureka! to first commercial product, another decade for an innovation to go from first commercial product to performance optimized product and yet another decade to go from performance optimized product to cost optimized product.

I've been reading holy grail stories on a regular basis for the past decade. None of them have delivered on the bold promises.

Perhaps that is why Musk is considering taking Tesla private. He may understand mass production of electric cars could hit a brick wall of Cobalt supply. It would be interesting to gain your take on that.

My next article is tentatively titled "Tesla’s Cobalt Blues; Growth Fallacies and Supply Chain Risque Majeure." I hope to habit it ready for publication tomorrow morning.

Indeed he battery market moves very slow and is why he had to make do with what is rather than what may be. That said, hopefully a credible mass producible battery technology will come about soon. It is really the main stopping point for clean energy growth including electric cars. I am a big fan of hydrogen cars, however, generating and distributing the hydrogen has its own problems.

How can #ElonMusk claim they will use NO cobalt in their next gen batteries? How is that even possible? Is there any basis for this claim at all? Bearish on $TSLA

@Alexa, every expert I've spoken with thinks it will be extremely difficult to take the cobalt content to zero because the cobalt stabilizes NCO chemistry and reduces oxygen outgassing, which is extremely hazardous.

This blog from Benchmark provides more detail.

www.benchmarkminerals.com/panasonic-reduces-teslas-cobalt-consumption-by-60-in-6-years/

You've made a good case here. You must be brave to take this stance. Watch out! I wouldn't be surprised if Elon Musk came after you.

Mike, I’ll never forget the phrase in that Paul Newman prison farm movie, “sometimes nothing is a real cool hand.” Compared to Mr. Musk I have nothing other than the truth.

Thanks, an interesting read. Doesn't sound very promising for Tesla.

Every company has spin. That's the job of a good CEO/PR company. Personally I think #Musk and #Tesla are going to achieve great things. The man is a visionary. Sure, the company has it's share of challenges... what company wouldn't when trying to achieve greatness. But when they succeed, no one will remember these early problems or occasional spin. Bullish on $TSLA

Danny, would you classify it as spin if one of your co-workers took credit for your projects as well as his own?

Good point.

There is a difference between "spin" and outright lies. The question is which is the case here.

I agree. At the end of the day let's remember they make great cars and their customers love them. As long as they can demand that kind of loyalty, I think the company can work out the kinks.

Yes, customer loyalty is a consideration to be factored in. But the criteria for consideration when deciding if a company is worthy of your business, is different than the criteria of determining whether it's a sound investment. Cautious on $TSLA.

The man is somewhat unhinged. Have you read some of his recent earnings statements or Twitter rants? Like calling one of the cave rescuers of those missing Thai boys a pedophile simply because he said Musk's mini-sub could not help in the rescue? Clearly #Musk has a loose connection with the truth. I'd stay away.

@[Juan Carlos Zuleta](user:9576), what's your take on this $TSLA article? You seem to know a lot about lithium and cobalt.

A well written, eye-opening article. Highly recommended.

Many thanks for the kind words Bill.

Yes, Bill. Seems like the Carnival Barker who runs Tesla is almost in the Trump category in handling the truth carelessly.