Tech Talk: Bulls, Bears And Hawks

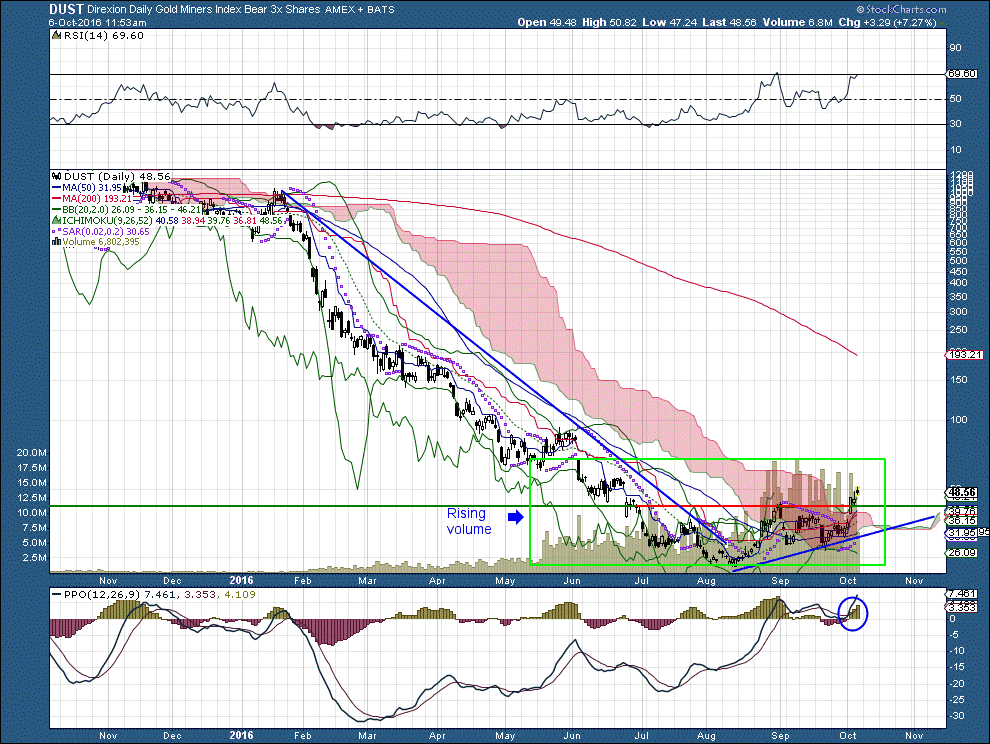

Sometimes it seems to make sense to bet on a bear in a bull market. That’s what I did yesterday, when I bought some DUST, the symbol for an ETF called Direxion Daily Gold Miners Index Bear 3X Shares, which trades on the NASDAQ.

This is a highly leveraged (three times) bet against gold. When you own something like this, you have to watch it like a hawk. In this case, however, seasonality is on my side, I believe.

Over the last five days, shares have gained more than half, but if you look at them over the longer term they represent a loss of more than 90 per cent for those who bought them a year ago. By way of comparison, the S&P 500 has more than doubled during the same time period.

Technically, this ETF has a few features I really like. Most notably, and boxed in green, unit volumes have been on the rise since May. During that high-volume period, losses first tapered off, and in the last six weeks reversed themselves. After a steep drop from March to August, the units have begun to rise.

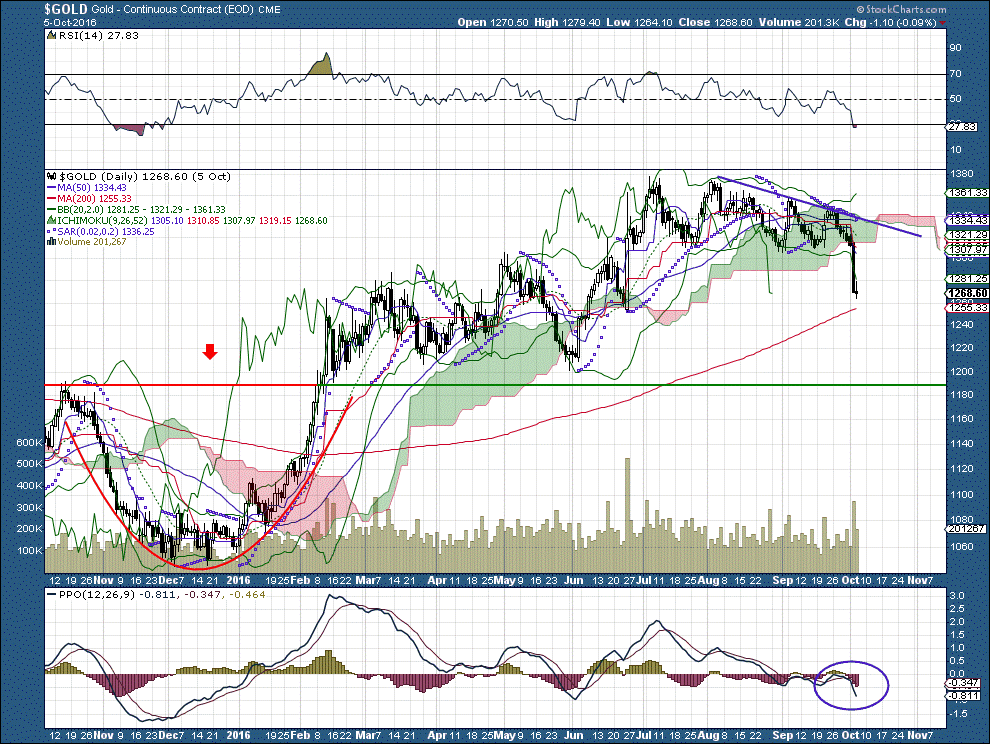

My belief is that the next couple of months will be happy ones for those who own this ETF. The reason is that, four years out of the last five, gold declines in October. During each of the last five years, gold fell in November.

The following chart illustrates gold’s seasonal action during the last twelve months; the red arrow and the red parabola show how severe the price drop was at the end of last year. The blue circle on the far right of the PPO line shows the recent sell signal.

As always, of course, please remember that probabilities are just that: probable. This is not a buy-or-sell recommendation; I don’t do that.

Disclosure: None.

Thanks for sharing