Sugar Market- A Sweet Opportunity

Sugar is among one of the worst-performing commodities of the year. It declined more than -48% only from the year peak to its low while consumption is growing and production reaches historic records. When price declines it usually creates an opportunity for investors to profit in compliance with the primary rule of investing, buy the value for cheap.

Sugar price

The chart presents sugar prices over the last 10 years. Sugar price declined around 72% from its high on the beginning of 2011. It has done quite well in the recent years but it is still down 65% over a broader time horizon. The price can double or triple but it still would not reach its high. This is how extremely cheap that asset is.

Fundamentals on the sugar market

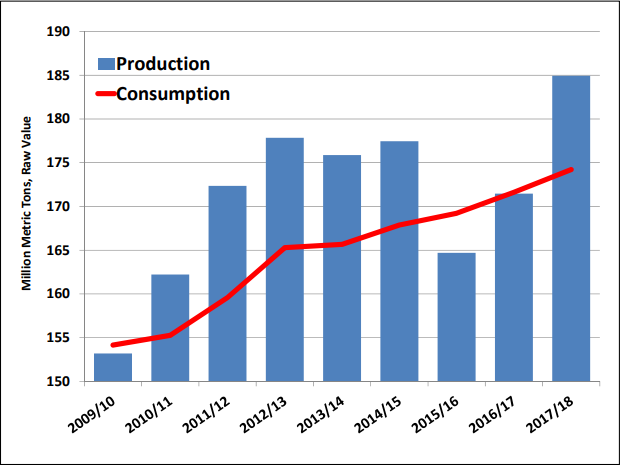

Sugar is produced mostly from sugarcane. Brazil is the world’s largest producer of sugarcane and the biggest supplier responsible for more than 70% of the global sugar demand. According to research of the United States Department of Agriculture the global production and consumption will reach the historical record in the season of 2017/2018.

Source: United States Department of Agriculture

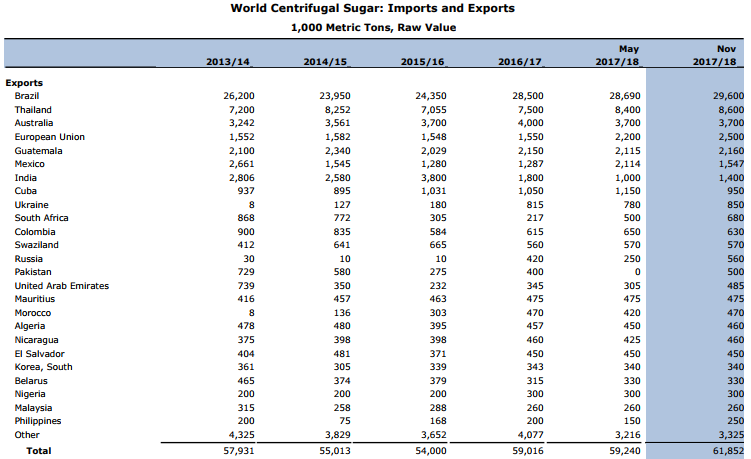

Brazilian sugar production is expected to reach a total of 645 million tonnes in the fiscal year of 2017-18. Brazil is not only the world’s largest sugar producer but also the world’s largest sugar exporter. In 2016, Brazil exported total 29 million tonnes of sugar, worth over $10.4 billion, representing nearly 50% of the world’s total sugar exports that year.

Source: United States Department of Agriculture

Brazilian sugar cane industry continues to expand. Sugarcane is the world’s largest crop and Brazil is its largest producer. Sugarcane alone accounts for over 80% of sugar produced. The Agricultural Trade Office also estimates that 48% of the sugarcane produced in Brazil will be diverted to sugar this coming fiscal year, due to the expected deficit on the world market, while total sugar exports are projected to increase by 5% reaching 29.07 million metric tonnes (MMT). The center-south (CS) region is expected to harvest 600 MMT of sugarcane in the fiscal year of 2017/18, while the North-North-eastern (NNE) sugarcane production for year 2017/18 is projected at 45 MMT.

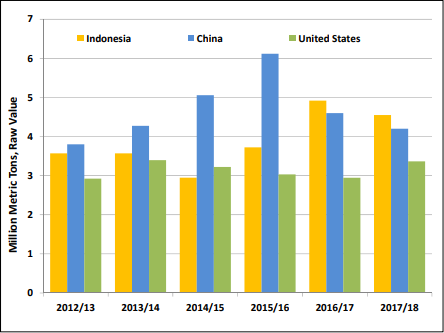

The steady growth of the sugar industry in Brazil is believed to be mainly driven by the continued deficit in the global sugar market. Brazilian sugar exports for this coming fiscal year of 2017/18 are projected at 29.07 MMT, up 1.3 MMT compared to the previous fiscal year 2016/17. Brazil has remained competitive on the global sugar market in part because of the devaluation of the local currency, the Real. Currently, the biggest markets for Brazil’s sugar exports are India, China, Algeria, Bangladesh, Indonesia, and Malaysia.

Source: United States Department of Agriculture

The world consumption is in a persistent upward trend when production fluctuates in the recent years. The reason of the situation are mostly the farmers around the world. Farming is a business like any other. When prices are low farmers plant less because the plantations are less profitable. It affects the production capacity which has a significant influence on commodity prices.

We can observe a new trend in Brazilian output while Brazil’s mills reduced the amount of cane they use to produce sugar. Brazilian producers are converting more sugar into ethanol to meet the rising demand for biofuel, especially after the steep depreciation in the Brazilian real has made U.S. dollar-denominated crude oil costlier for domestic users. Producers argue that they opt for the product that is giving them better returns. That situation could shift more cane to ethanol production at Brazilian mills, reducing the amount of sugar output. When the largest producer in the world will reduce the production of food sugar then there will be less sugar to export.

The other factor which can cause an increase of sugar prices is bull market on oil. The oil market is in the process of making a bottom. The base is between 25$ or 50$. We cannot predict precisely when prices will turn back but we can say that somewhere here, between 25-5$ or maybe 30-60 $ is a bottom. Higher oil prices, the main energy source, means higher cost of production and transportation which translates generally into higher prices of all commodities. But in the case of sugar and oil there is also a direct link. The higher the oil price the bigger the demand for ethanol which will trigger automatically appreciation of sugar prices.

How to trade sugar?

Making my investment decision, I usually choose no-leveraged assets. SGG (iPath Dow Jones-UBS Sugar) is an ETN with exposure to sugar. The underlying asset is The Sugar No. 11 – future contract which is the world benchmark contract for raw sugar trading.

I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving ...

more

I have been looking at #sugar for a while and I appreciate how well researched this article was. Sugar looked like it bottomed out and I was bullish until this week. Brazil announced that it had plans to end the tariffs on U.S imported Ethanol which will dampen demand for Brazilian ethanol. Also sugar production is far outpacing any demand growth with Europe, and Latin America as well as Brazil producing at record. Sugar futures have been supported by increasing Brazilian ethanol production but if that starts to ebb due to American competition we can see another turn down in sugar prices.

I'm surprised #Sugar Consumption is increasing. There is such a push to eat healthier (soda tax, etc) that I would have thought it was on the decrease. Maybe I should be taking a close look at sugar. $SGG