Soybean Farmer Edition

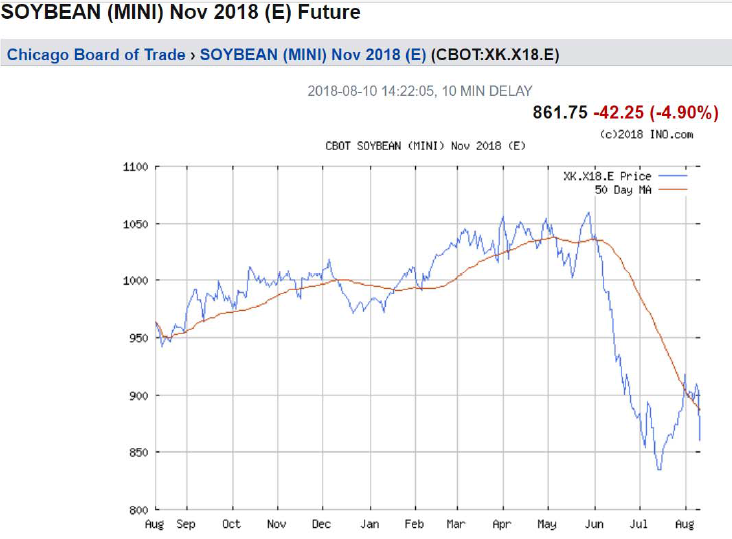

Many observers have noted that the Chinese must eventually come to the US for some of their soybean needs, as the supply of Argentine and Brazilian soybeans are depleted and American soybeans are harvested. Current futures for November 2018 do not indicate a price recovery to pre-Trump tariff war levels, even if they do come. As of today:

Futures prices for November delivery remain far below where they were in March, about an 18% decline. Using historical correlations (Chinn and Coibion, 2014), this suggests that spot prices have taken a similar hit.

The Friday drop in prices is in part attributable to the USDA’s World Agricultural Supply and Demand Estimate (WASDE) release, which indicated better than expected harvests (this is an “event study” interpretation — see here).

The WASDE forecasts contains some interesting nuggets (page 15) which suggest a surprise in yield/acre. The end-of-marketing-year stock is projected to rise from 430 to 785 million bushels going from 2017/18 (ending this month) to 2018/19, instead of the July forecast of 580 million bushels (and 2017/18 itself showed an estimated increase from the previous year’s 302 million bushels. So, 302 to 430 to est. 785.

USDA apparently does not see a recovery trend in prices. Average price is $935 for the nearly ended market year, and is now forecasted to range from $7.65-$10.15 in 2018/19, down from the July range of $8.00-$10.50.

For context, one estimate of breakeven for an Indiana farm on high productivity soil is $10.05/bushel.

Disclosure: None.