Shale May Disrupt OPEC Strategy In 2018 - IEA

The International Energy Agency (IEA) on Tuesday said the continuous rise of the U.S. shale production could force OPEC to adjust its policy in 2018.

According to the agency, crude oil production from the U.S. could equal global demand in 2018 following the surged in production level to over 10 million barrels a day in January, the highest in 47 years.

“U.S. producers are enjoying a second wave of growth so extraordinary that in 2018 their increase in liquids production could equal global demand growth,” the IEA stated in its report published on Tuesday.

“This is a sobering thought for other producers currently sitting on shut-in production capacity and facing a renewed challenge to their market share,” the Paris-based organization added.

Experts linked this to what happened in November 2014, when OPEC was forced to announce a new strategy geared towards improving its market share after U.S. oil revolution. According to IEA, history could be repeating itself.

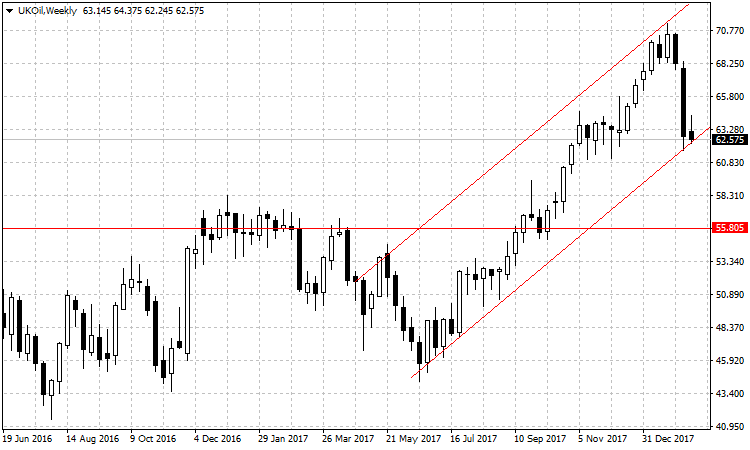

Oil prices have risen more than 50 percent since OPEC and non-OPEC members reached an accord in November 2016 to cut oil productions in order to reduce global oil glut and artificially boost prices. Brent crude oil rose to more than 3-year high of $71 a barrel, before pulling back in February to wipe out its 2018 gains.

Therefore, if OPEC failed to effectively curb global oil glut in 2018, oil prices could drop to as low as $50 a barrel for Brent crude and trade between $50-$60 for the remaining part of the year.