Saudi Power Struggle Strengthens Crude, And The USD

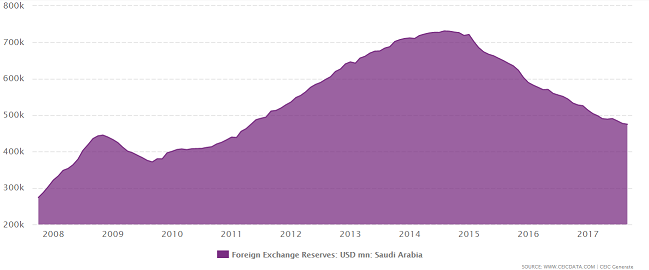

Following three years of low crude oil prices, Saudi Arabian foreign exchange reserves continue to fall. After peaking at $731.2b in August 2014, reserves have fallen almost in a straight line. The latest data from September 2017 ($475.1b), shows that Saudi reserves are now below $500b. Given the Saudi riyal’s peg to the US dollar, the speed and scale of the decline is driving concerns regarding the health of the economy. While current reserves and access to US dollar bond markets means that the economic health of the Kingdom is safe for now, the outlook is concerning. Saudi Arabian FX reserve data for the last 10 years is visually illustrated below:

Back to the future: Saudi FX reserves back to 2011 levels

Despite a variety of measures undertaken by the Kingdom, including reducing the government budget deficit significantly and leading efforts to drive higher crude oil prices via an OPEC agreement, foreign currency reserves continue to fall. This suggests that falling reserves are due to reasons beyond lower crude oil prices and government deficits. A balance of payments deficit, driven by capital flight from within the Kingdom, is a likelier culprit.

Less money = higher political risk

As Saudi Arabia confronts the reality of lower crude oil revenues, political risks are rising thanks to lower wages, higher unemployment and a weaker future outlook. As the fortunes of the Kingdom reverse, capital flight is likely to become a more significant problem going forward. The Saudi Arabian elite can clearly see what is on the horizon, and are responding by repatriating their funds overseas for safety.

Prince Mohammad bin Salman’s political purge this weekend, labeled as a ‘corruption crackdown’, makes sense in this context. As instability within the Kingdom rises, Prince Salman is seeking to centralize power in order to quell the possibility of a ‘palace coup’. More importantly, he is also going after significant wealth in Saudi Arabia (before that wealth tries to make its way overseas). The biggest surprise this weekend was the arrest of Prince Alwaleed Bin Talal, a billionaire investor who is also a member of the Saudi royal family. Despite the prince’s cavalier attitude towards the Saudi government, he has publicly supported Mohammad bin Salman’s vision for reform in the past. Unfortunately, his proclamations did not spare him from the ongoing corruption crackdown, and his significant wealth made him an obvious target.

Implications for crude and the dollar

Looking at crude oil, the implications for the commodity are fairly obvious. Beyond the specter of increased domestic political instability in Saudi Arabia, Prince Mohammad bin Salman has also accused Iran of inciting war after Yemen-based forces recently launched a missile towards Riyadh. As Saudi Arabia and Iran are some of the world’s largest crude oil suppliers, even an escalation in rhetoric is sufficient to drive crude oil higher. This is because the commodity remains sensitive to the prospect of lower supply. Last Monday, WTI crude prices jumped from $55.60 to $57.20 following this weekend’s news.

Looking at the dollar, the purge is also positive for the currency for less obvious reasons. The first reason is one that we covered in a recent commentary on how stronger crude oil prices help the US dollar. Given that US GDP growth continues to accelerate today, the additional prospect of accelerating inflation is more likely to result in the Federal Reserve raising interest rates. The second reason is due to the Saudi riyal’s peg to the US dollar. As Saudi reserves continue to fall and the Kingdom cracks down on wealthy Saudis, capital flight out of the country is set to accelerate. As the dollar is the natural destination for funds fleeing the country, the currency is set to appreciate further.

Any opinions, news, research, analyses, prices or other information is provided as general market commentary and does not constitute investment advice. MarketsNow will not accept liability for any ...

more

Interesting analysis, logically it makes sense, as geo political uncertainty in the middle east ramps up it will increase oil prices and cause capital to flee. Is it possible that Saudi Arabia will enact capital controls to discourage that similar to what China is doing now?

While SAMA (Saudi central bank) claims that foreign currency transfers continue 'as usual', implementing capital controls is a real possibility. Usually, central banks will only consider publicly announcing capital controls as a final step given the effect they have on confidence. In practice, they are likely to make outbound transfers much more difficult by enacting additional paperwork or purposelessly slowing down the process (similar to China). Having moved from Hong Kong to Switzerland earlier this year, I've heard quite a few interesting stories about getting money out of China!

Woul dlove for you to share some of those stories, @[Deb Shaw](user:55820).

You guys have given me a great idea for a future article. Thanks! The stories are a bit too long to share as a comment, so expect something from me next week (I need to get permissions first).

Agreed!

Things are really heating up in the Middle East. While ISIS in retreat is always a good thing, tensions between Iran and Saudi Arabia and their proxies are eventually going to blow up.