Question And Answer Period

Her action was as certain as it was swift.

Federal Reserve chairman Janet Yellen suddenly ratcheted down interest rate expectations from four-quarter point rises to only one in 2016. And that one rate rise may not come until December.

Foreign exchange traders all share one unique characteristic. You have to SHOW THEM THE MONEY. No interest rate increases mean no more money and they summon the urge to dump the offending currency.

In other words, GOOD BYE US DOLLAR.

Once again, my call that there would be NO rate rises has been vindicated, as elucidated in my 2016 Annual Asset Class Review (click here).

Traders lulled into an always-fatal sense of complacency were taken out to the woodshed and severely spanked.

The message was clear. Never underestimate the dovishness of my former Berkeley economics professor, Janet Yellen.

The Fed has in effect changed policy direction three times in three months, generating some of the most violent market moves in history. If you can survive this, you can survive anything!

Do you know who the longest living subgroup of people in Japan are? Hiroshima atomic bomb survivors. Welcome to the club.

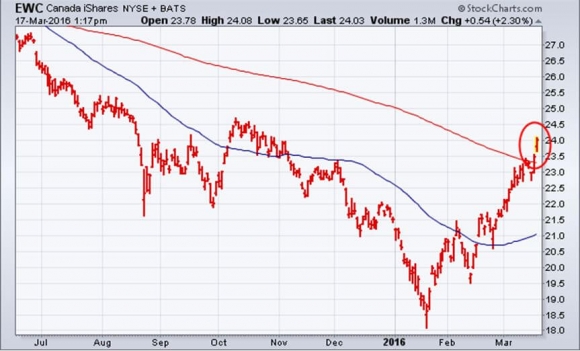

Almost every major hedge fund short play out there rocketed. The Euro (FXE) and the Japanese yen (FXY) soared. Stocks added double-digit gains. Oil (USO) gained a new lease on life. Indeed, the entire weak dollar (UUP) space was off to the races.

Gold (GLD), silver (SLV), and the miners (GDX), (SIL) especially like the outbreak of cautiousness at the Fed.

The barbarous relic made back its entire recent $50 correction in minutes, and then some. Gold sparkles because low rates mean that the opportunity cost of owning it has been pushed back to near zero. Oh, and it’s a weak dollar play too.

I was seconds away from getting executed on another call spread for all of you, but prices moved too far, too fast before we could get the Trade Alert out.

Welcome to show business.

Clearly, international concerns were at the forefront. Janet has, in effect, become the central banker to the world. If Europe, Japan, and China are all weak, it is not time to raise American interest rates.

It doesn’t help that US corporate earnings growth barely has a pulse. Janet’s worst nightmare is that the US goes into the next recession with interest rates at zero, dooming us to a liquidity trap like the one that has mired the Japanese economy for the past two decades.

The Fed action on Wednesday sent a generalized green flag out to all “RISK ON” assets. The problem is that it comes right on top of one of the steepest moves UP in share prices in market history.

So, after flushing out a few stubborn, last stand shorts, I think the market will be RIPE for a correction, possibly a big one. We are not blasting through to new all time highs any time soon, and probably not until year end.

You saw it here first.

And Janet, thanks again for that A+ in economics, and you owe me a phone call.

No Interest Rate Rises Here!

Disclosures: The Diary of a Mad Hedge Fund Trader, ...

more

And while she is doing this Ben Bernanke is writing an article saying don't worry about negative interest rates. Yeah, right.