OPEC's Decision To Cut Oil Production Could Drive Exxon Mobil Stock

Last Wednesday, September 28, OPEC’s 14 oil producing nations surprised the market by their decision to cut their collective oil output later this year in an effort to support the declining oil prices. OPEC members met in Algiers and decided to cut its production from 33.24 million barrels per day to a range of between 32.5 and 33.0 million barrels per day. The details will be finalized at the group’s next formal meeting, on November 30 in Vienna. Although the agreed cut was quite modest, the decision sent global oil prices soaring by more than 5 percent, since it has been the first time since the global financial crisis in 2008 that OPEC has decided to cut production.

Since OPEC’s announcement Brent crude oil price has soared 7.9%, and WTI crude has increased 8.0%. Moreover, the last price of Brent crude oil $50.75 per barrel is already up 87.2% from its 12-year low on January 20, of $27.11, while WTI crude oil last price of $48.62 per barrel is up 86.6% from its February 11 low of $26.05.

Brent Crude Oil, December 2016 Leading Contract With 50 Day Moving Average

WTI Crude Oil, November 2016 Leading Contract With 50 Day Moving Average

Charts: TradeStation Group, Inc.

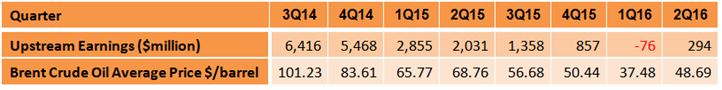

The OPEC’s decision is great news for Exxon Mobil (XOM), the world’s largest publicly traded international oil and gas company. Exxon's upstream earnings are strongly correlated to oil price, as shown in the table below. In the third quarter of 2014, when the average Brent crude oil price was at $101.23 per barrel, Exxon's upstream earnings was at $6,416 million. In contrast, in the second quarter of this year, when the average Brent crude oil price was at $48.69 per barrel, Exxon's upstream earnings was only $294 million.

Exxon Stock Performance

Since the beginning of the year, XOM's stock is already up 11.7% while the S&P 500 Index has increased 5.7%, and the Nasdaq Composite Index has gained 5.9%. However, since the beginning of 2012, XOM's stock has gained only 2.7%. In this period, the S&P 500 Index has increased 71.9%, and the Nasdaq Composite Index has risen 103.5%. According to TipRanks, the average target price of the top analysts is at $94, representing an upside of 8.0% from its October 3 close price, however, in my opinion, shares could go higher.

Dividend

While waiting for a significant recovery in the prices of liquefied natural gas and oil, investors can enjoy the generous dividend. Exxon has increased its annual dividend payment to shareholders for 33 consecutive years. Even during the global economic crisis of the years 2008-2009, Exxon continued to grow its dividend. The current dividend yield is pretty high at 3.45%, and the payout ratio is at 116.8%. The annual rate of dividend growth over the past three years was pretty high at 9.7%, over the past five years was also high at 10.6%, and over the last ten years was also high at 9.7%.

Conclusion

OPEC’s 14 oil producing nations surprised the market by their decision to cut their collective oil output later this year in an effort to support the declining oil prices. The OPEC’s decision is great news for Exxon Mobil since its upstream earnings are strongly correlated to oil price. The average target price of the top analysts is at $94, representing an upside of 8.0% from its October 3 close price, however, in my opinion, shares could go higher.