Not Preventing Market Losses? You Better Start Now

What’s more important? Making gains in the stock market or preventing losses?

Before answering that question, let’s list a few common fallacies about risk:

- The full spectrum of market risk can be accurately defined in a single magic formula or statistic

- Long-term investing always guarantees success, so go ahead and take all the risk you’d like!

- Diversification is the only hedge against risk that you’ll ever need

- Inactivity before, after, and during a market crash is the safest course

- Taking more risk inevitably leads to bigger gains

- Volatility and risk are the same thing

Instead of helping people, these fallacies trick investors into miscalculating risk.

Now, let’s examine the numbers to find out what’s more important: making gains or preventing losses.

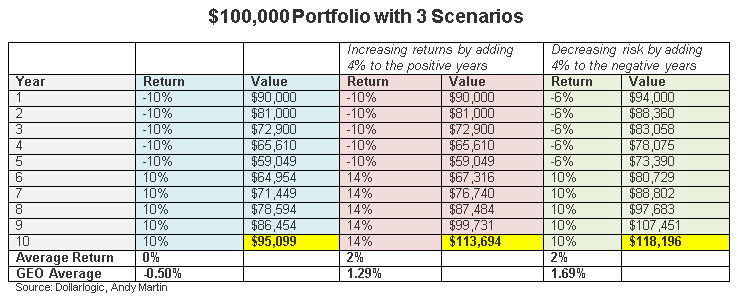

The table below is illustrated in a great book titled "Dollarlogic: A Six-Day Plan to Achieving Higher Investment Returns by Conquering Risk" written by my friend and colleague Andy Martin. The table illustrates a $100,000 portfolio with three different performance scenarios over a period of 10 years.

Scenario one (highlighted in blue), shows the first five years with consecutive yearly losses of 10% followed by five consecutive yearly gains of 10%. The investor began with $100,000 but ends the 10-year period with $95,099.

In scenario two (highlighted in red), the investor suffers five consecutive yearly losses of 10% but manages to recover by gaining 14% for five consecutive years. The investor began with $100,000 and ends the 10-year period with $113,964.

Now look at the green column. Compared to the previous examples, the investor in scenario three (highlighted in green) comes out on top with $118,196. Why? It’s because the investor minimized losses to only 6% during the bad years while the other portfolios lost 10%.

Although the average return for the portfolios inside the red and green columns are the same 2%, the geometric return for the portfolio that minimized market losses did better. Here’s something else: The portfolio that increased returns by 4% during the good years still got a lower total return of just 13.69% while the more conservative portfolio that reduced risk gained 18.20%.

Geometric returns are more accurate measures compared to average returns because they represent the mean. In other words, investment returns are not independent of each other and if you lose 50% of your money in any given year, you need a 100% return just to get back to even.

In summary, a person’s margin of safety is one of the three cornerstones of a well-designed portfolio. All portfolios – big and small – should have adequate protection. My online course Build, Grow, and Protect Your Money: A Step-by-Step Guide teaches you how to calculate and install your portfolio's margin of safety. (PREMIUM members at ETFguide.com get free access to this course plus my other one "How to Fix Hidden Flaws Inside Your Portfolio.")

A margin of safety means much more than just diversifying your holdings across major asset classes like stocks (NYSEARCA:VOO), bonds (NYSEARCA:TLT), commodities (NYSEARCA:GLD), real estate (NYSEARCA:VNQI), and cash. It's all about taking concrete steps to build a permanent cushion within your portfolio.

The above example, mathematically proves why investing with a margin of safety is an essential ingredient to building and managing an architecturally sound investment portfolio.

Making money is important, but not any more than loss prevention.

Disclosure: None

Disclaimer: Ron DeLegge has analyzed and graded more than $125 million with his Portfolio ...

more