News From The Crude Oil Market

Oil markets have whipsawed in recent weeks. Prior to the November 30 meeting of OPEC countries and Russia in Vienna, Austria, there was serious doubt about OPEC’s ability to cut production.

For starters, OPEC member countries in Saudi Arabia, Iraq, Iran, Nigeria, Venezuela, and others often have diverging objectives. Iran has only recently been readmitted into the international fold, and it is determined to ramp up production and maximise revenues from oil. Saudi Arabia and Iran are regional foes, and consensus between these two countries is often difficult to come by.

Nonetheless, OPEC announced that member countries had agreed in principle to cut production by some 1.2 million barrels per day. This is a significant milestone given that no agreement on production cuts has been brokered for years. Markets reacted as expected: the oil price rose and global indices roared to life.

The Nymex Paradigm Sets the Stage for Binary Options Traders

The oil market, like so many other commodities markets, is subject to locked-in contracts. In other words, sales for coming months are now locked in at approximately $50 + per barrel of crude oil.

Companies don’t want to be paying more for crude oil if the price rises, but at the same time, they don’t want to be selling crude oil for less if the OPEC deal falls apart at the seam. They are effectively hedging their bets with massive contracts extending well into 2017. This is evident at top binary options brokers where traders are following the Nymex paradigm and placing call options on crude oil. The optimism in oil prices is seen in the volume of trading to lock in deals. This hedging philosophy will obviously have the effect of flattening out the futures curve for crude oil.

Thus, we will ultimately see downward pressure being exerted on the crude oil market in 2017. OPEC on its own is incapable of manipulating the oil price significantly. It needs Russia and WTI crude oil producers to cooperate to raise the price of crude oil.

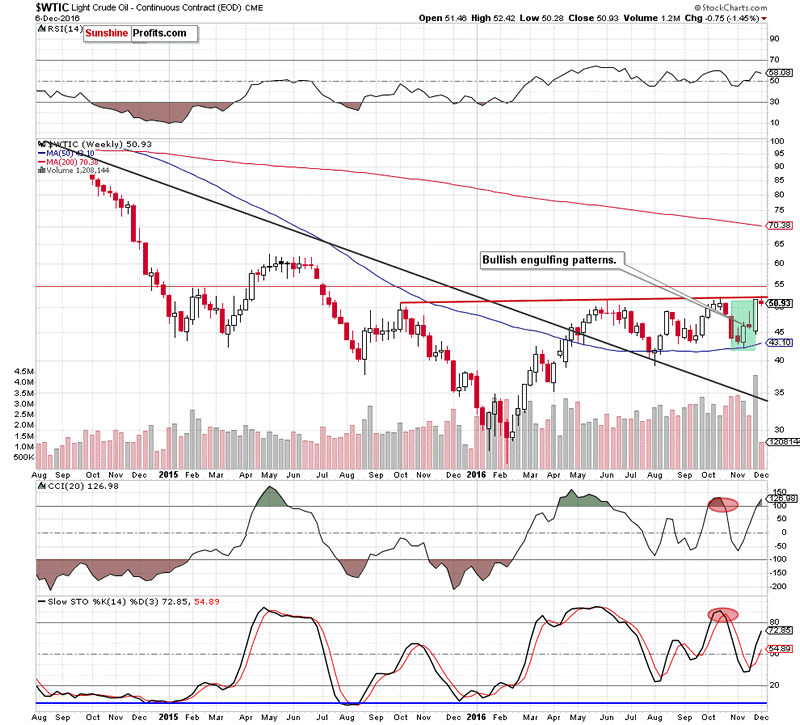

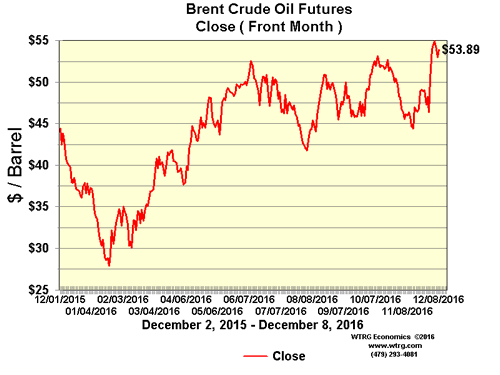

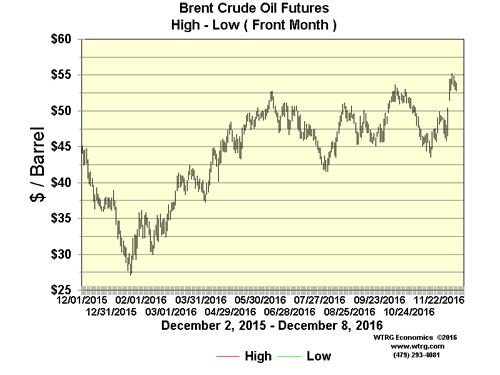

As at Friday, 9 December 2016, WTI crude oil (West Texas Intermediate) was trading at $51.47 per barrel on the Nymex. Brent crude oil – the international benchmark was trading at $53.89 per barrel. As expected, many other energy commodities such as heating oil, gasoline, and natural gas are now in bullish territory.

The 1-year forecast for WTI crude oil is $58 per barrel and rising. Despite these price rises, there is a degree of trepidation among commodities traders. The consensus is that oil production from OPEC (33% of global oil) will be cut, but by how much nobody knows. Further, it remains unclear precisely what volume of crude oil cuts are needed to change the price of crude oil. OPEC has resisted production cuts for fear of losing market share. It is constantly at loggerheads with WTI crude oil producers in the US and Canada, and therefore we have seen a supply glut plaguing the markets.

Binary Option Traders Caution about Contango Effect

Contango is also playing a part in binary option trading decisions. This phenomenon refers to trading short-term crude oil contract at a discount to long-term crude oil contracts. The short-term perspective indicates a serious oversupply of crude oil and this is the reason we are seeing prices as low as they are. To get rid of the oil, it needs to be sold at a discount. Speculative trades on this commodity are taking contango into account.

By January, we should see a reversal in trading activity if OPEC makes good on its word. 1.2 million barrels of crude oil will be removed from the markets and this could lead to net long positions on crude oil.

Call options already starting to come in, but the introduction of WTI crude oil will soften the overall impact. If traders are looking to profit off the inevitable oil price rise, they can start buying up crude oil en masse and storing it in containers and tankers offshore. Then, when prices rise they can dump the oil onto markets. These are important factors to bear in mind as a commodities trader. If inventories are dumped onto markets, the price will fall further. This will have a dampening effect on the price rises that we are expecting in the first place. Contango is an important phenomenon to consider when trading binary option commodities.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor ...

more