Hartstreet Oil: Occidental Uses Less Expensive Well Design, But Current Results Are Much Better

Occidental (OXY) has 2.5MM net acres in the Permian. 1.4MM net acres are an unconventional resource with the rest being EOR. 150,000 net acres are in the Texas Delaware Basin. It continues to improve well design, with the most recent wells being over 7,000 feet, compared to last year's 5,950 feet. Costs have decreased by 30% to a little over $1 million per 1,000 lateral feet. Current designs use 1,700 lbs of sand per foot. This is an increase of 600 lbs. Its 19 stage frac' uses 3 more than 1Q15, and is a slickwater. In 2015, it still used a hybrid design. The new design has improved production over 180 days from 120 MBoe in 2014 to 300 MBoe in 3Q16. The newer results are impressive in 2nd Bone Spring of New Mexico. Some of these changes should provide an improvement in the southern Delaware Wolfcamp. The improvements in breakeven prices for Permian players have increased production from west Texas. This adds to the current crude glut and increases the amount of time needed to bring world inventories down. This could keep oil prices and the US Oil ETF (USO) lower than analysts expect.

There are a large number of operators in southern Reeves. The well performance is much different from one design to the next. The production results are listed below for the area by operator:

|

Name |

Well Count |

CUM Gas (MCF) |

CUM Oil (BBL) |

|

OXY USA WTP LP (NYSE:OXY ) |

72 |

7,548,237 |

5,708,539 |

|

COG OPERATING LLC (NYSE:CXO) |

37 |

9,882,762 |

4,789,985 |

|

OXY USA INC. |

19 |

1,813,180 |

1,625,167 |

|

THOMPSON, J. CLEO |

14 |

4,792,593 |

2,331,952 |

|

PATRIOT RESOURCES, INC. |

12 |

1,819,197 |

1,628,389 |

|

CENTENNIAL RESOURCE PROD (NASDAQ:CDEV) |

11 |

2,607,557 |

1,009,181 |

|

ROSETTA RESOURCES (NASDAQ:ROSE) |

8 |

2,237,934 |

795,618 |

|

PARSLEY ENERGY OPERATIONS (NYSE:PE) |

7 |

925,050 |

475,207 |

|

PRIMEXX OPERATING CORPORATION |

7 |

1,407,558 |

682,560 |

|

BRIGHAM RESOURCES OPERATING |

6 |

1,643,668 |

887,248 |

|

WILLIAMS, CLAYTON ENERGY (CWEI) |

6 |

1,107,492 |

795,378 |

|

JAGGED PEAK ENERGY LLC (NYSE:JAG) |

4 |

708,073 |

716,827 |

|

Apache Corporation (NYSE:APA) |

3 |

247,327 |

217,298 |

|

DIAMONDBACK E&P LLC (Nasdaq:FANG) |

2 |

131,310 |

87,188 |

|

ARRIS OPERATING COMPANY LLC |

1 |

493,279 |

82,474 |

|

ELK RIVER RESOURCES, LLC |

1 |

246,786 |

218,139 |

|

MDC TEXAS OPERATOR LLC |

1 |

843,243 |

193,400 |

|

SAMSON EXPLORATION, LLC |

1 |

194,673 |

156,401 |

(Source: Welldatabase.com)

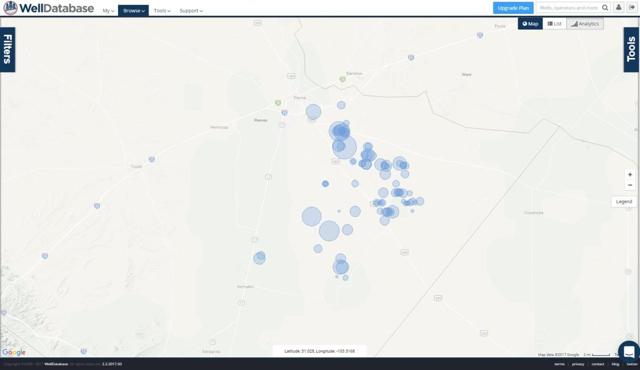

We placed Occidental's well locations below. Much of the bigger wells are closer to Ward on a cumulative production basis.

(Click on image to enlarge)

(Source: Welldatabase.com)

The larger the circle the more production. The results differ significantly by location.

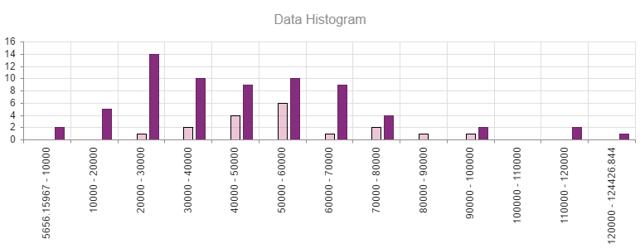

(Click on image to enlarge)

(Source: Welldatabase.com)

The histogram above provides cumulative oil production and the number of wells in that range. It provides the issue many operators have. While a few wells produce significantly less than the average, there are couple that are much better. Two wells produced less than 10,000 BO and three over 110,000 BO.

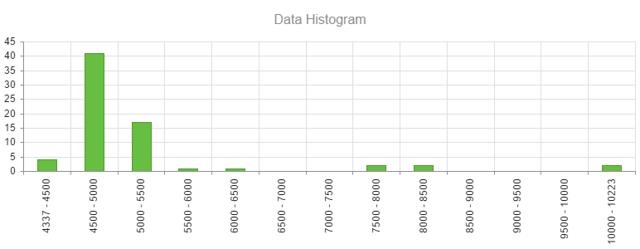

(Click on image to enlarge)

(Source: Welldatabase.com)

The majority of OXY wells have laterals under 5,500 feet. Shorter laterals mean less total production. This is much of the reason for some wells lagging. It has completed a couple of 2-mile laterals.

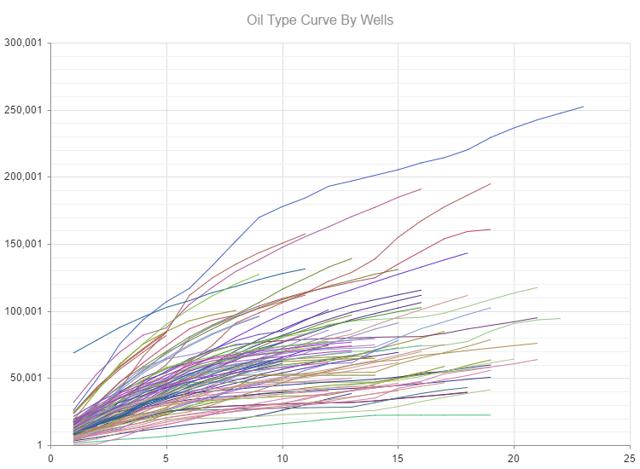

(Click on image to enlarge)

(Source: Welldatabase.com)

The type curve above is derived directly to production. While a number of wells produce less than 50,000 BO in approximately 1.5 years, it has one well over 250,000 BO in 24 months. This could either be a sign of things to come, or it could have just been a sweet spot. An average EUR was provided below. It has significantly underperformed its competitors in southern Reeves. Much of this is due to its focus in New Mexico. This has produced a lag in the southern Delaware. Newer designs are much better.

|

EUR: 111,692.73 |

111,692.73 |

|

|

Months: 23 |

23 |

|

|

Selling Price: |

$50/Bbl. |

|

|

Initial Capital Expense: |

$7,000,000 |

|

|

Lease Operating Cost (monthly): |

$48,562 |

|

|

Total |

NRI |

|

|

Total: |

$5,584,636.45 |

$4,188,477 |

|

Recovered: |

$5,584,636.45 |

$4,188,477 |

|

Total |

NRI |

|

|

Total: |

($8,116,926.00) |

($8,116,926.00) |

|

Recovered: |

($8,116,926.00) |

($8,116,926.00) |

|

Total |

NRI |

|

|

Total: |

($2,532,289.55) |

($3,928,449) |

|

Recovered: |

($2,532,289.55) |

($3,928,449) |

(Source: Welldatabase.com)

Even after we add natural gas revenues, there is still $3.5 million left to pay back D&C and LOE. Although I used a $7MM D&C cost, we could comfortably reduce well costs to $5.5MM. This would decrease the payback deficit to $2MM.

In summary, OXY has used a well design much less complicated than its peers, and this is shown in production results. Better designs, like CXO, show that 2-year oil production can increase to 174MBO. We continue to see better well designs produce improved economics, and believe OXY's production to improve closer to the top end of the average for this area. There are a large number new wells that are well above OXY's average in this area. The Permian is going to be the center of consolidation. If uncertain which names to own, one could either buy the XLE or XOP. Both have exposure to west Texas.

Disclosure: Data for the above article is provided by welldatabase.com. This article is limited to the dissemination of general information pertaining to its advisory services, together with access ...

more