GOLD - Surprises Will Be To The Downside

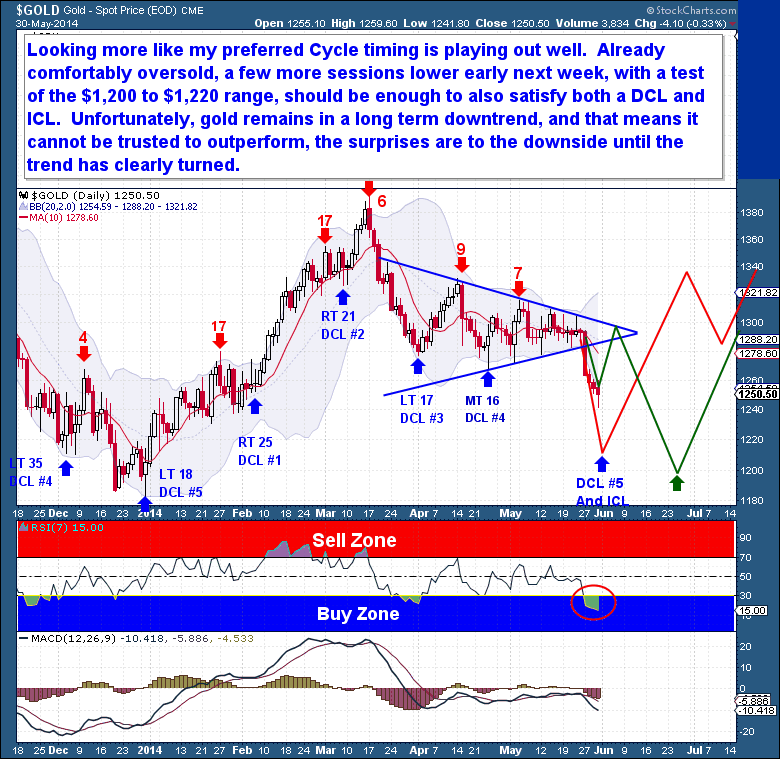

Gold's breakdown this week from a triangle toward an expected DCL was textbook Cycle behavior. Although it took longer than I anticipated for Gold to move lower, the setup was never compromised and is now playing out as expected. The primary reason I've been steadfast in my expectation of the current decline is that similar setups -coiling action late in a DC/IC – have historically played out to the downside, so this was a high probability move.

With Gold’s decline, the influence of the approaching Investor Cycle Low has finally asserted itself. Gold’s ability to withstand the pull of the ICL for so long speaks volumes about the underlying strength of the Gold market, and is representative of the accumulation that I believe continues to occur there. But no asset can resist the pull of an ICL indefinitely, and natural asset ebbs and flows must be respected.

As with the movement of ocean tides, asset prices move up and down across timeframes in an intertwined manner. It’s the goal of the Cycle analyst to, first, understand each Cycle independently, and then to consider them together. More specifically, an analyst needs to assess how longer, more dominant Cycles will impact shorter Cycles. Once the Cycles are well-understood and a framework of expectations has been developed, trading strategies can be constructed to take advantage of the most powerful portions of the Cycles – and to avoid unfavorable scenarios. Analysts need to acknowledge when the cycles are not obvious. Doing so will maximize the chance of avoiding biases and will minimize the likelihood of trading simply to trade.

Now that Gold has broken down and is on to Day 26 of the Daily Cycle, it should be obvious that we’re very close to the next DCL. We know from experience that declines into a low can often overshoot expectations, and in this case an extra 2 days of decline could easily shave an additional $50 from Gold's price before it bounces out of a low. For the benefit of Gold longer term, let's hope the coming DCL plays out this way – an additional decline would almost certainly confirm that an ICL is also at hand (the red scenario below).

This is a special report from this week's premium update from the The Financial Tap, which is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets delivered twice weekly. Promo code ZEN saves you 10%.

None.