Cocoa, A Huge Opportunity People Shouldn't Ignore

Going into 2018 traders are feeling good; U.S markets continue to hit all-time highs; emerging markets have just had their best performing year since 2009; for some reason bitcoin continues to surge and even oil is up for the second year in a row. However, one corner of the trading universe seems to have forgotten that we are in the bull market: soft commodities like coffee, sugar, orange juice and cocoa. While the fundamentals continue to look bearish for most of these commodities, one has the potential to pose a remarkable comeback... cocoa.

Most people are unaware that cocoa, the main ingredient in cocoa powder that is used to make chocolate, is traded, let alone have any interest in investing in it. This makes sense, but while cocoa may not be as widely traded as other commodities like oil or gold, cocoa futures do have enough volume and liquidity to allow traders to speculate on prices. Often times the best opportunities come from the places you least expect.

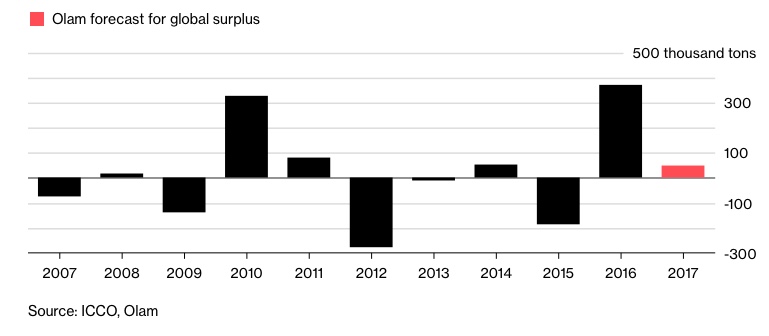

Cocoa did not have a good couple of years, futures were down almost 20% in 2017 and 30% in 2016 on the back of a huge supply glut, one that is expected to continue going into 2018. However, there are signs that the bear market in cocoa is beginning to subside. To understand how cocoa prices can rebound it is necessary to understand what caused them to melt down in the first place.

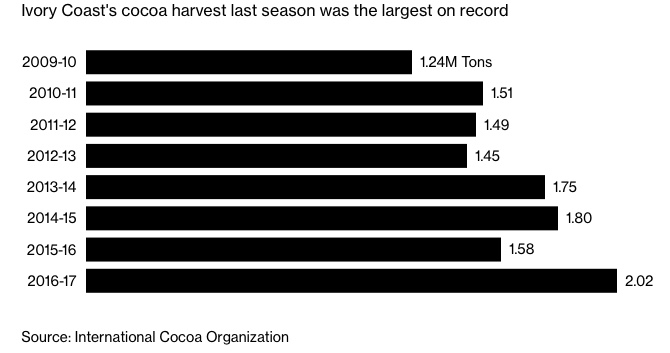

Cocoa’s collapse over the last two years can be mainly attributed to a large crop in West Africa that caused a huge surplus to occur (basic economics, when supply outstrips demand prices go down). Over 70% of cocoa production takes place in West Africa, from countries like the Ivory Coast and Ghana. This means that cocoa prices are highly sensitive to events in the region be it weather, political or economic in nature. In this case, abnormally favorable weather in West Africa caused countries like Ivory Coast to produce far more cocoa than usual, over two million tons to be exact. Large supply coupled with the fact that the global confectionary market experienced a broad based slowdown during 2016, meant that a surplus of 347,600 tons formed, hence falling prices.

By looking at the chart it is clear that cocoa prices have bottomed out, and have begun to trade in a range between $1,800 and $2,200 a ton. This seems to indicate that the market has already priced in the large surpluses that exist in the market. At the moment cocoa is trading at the bottom of its trading range that it has held through most of 2017, following a steep selloff in December. This heavy December selloff has sent many investors panicking, believing that a fresh collapse in cocoa prices is imminent. These fears are widely overblown for many reasons. The first of which is that this most recent drop in prices is keeping with cocoa’s most recent trend (you can see this trend in the chart above). In fact the December selloff only strengthens this trend, which has cocoa trading mostly flat.

Another reason that fears are overblown is because a large amount of the selling can possibly be attributed to a single party. This party is Anthony Ward and his cocoa and coffee focused hedge fund, Amajaro. Anthony Ward is one of the biggest and most prominent cocoa traders out there, so much so that the media has labeled him Chocofinger. In December, Ward announced that he will be closing Amajaro following the funds first annual loss since its inception. It is possible that the selloff in cocoa in December was caused by Amajaro liquidating its positions, which considering that the fund was said to manage over $500 million in outside capital were probably huge. If the selloff in December was caused by a combination of trend following and liquidation by Amajaro, it is easy to see cocoa returning to the $2,200 level at some point in the near future (that is a 20% premium to current prices).

However, it is also possible that cocoa breaks lower at this point but this is also unlikely due to a number of different fundamental reasons. Chief among which is the declining surplus, which has consistently plagued the market over the last year, as well as higher demand from emerging markets for chocolate.

Although West African producers are expected to produce another large crop this upcoming season, many analysts including those from Goldman Sachs and ABN Amro believe that it will be significantly smaller than last year, due to excessive rain in West Africa. Heavy rain increases the chance of disease in cocoa trees, which reduces their output. Disease is already a problem in West Africa with an estimated 20% of trees in Ghana (the second largest cocoa producer in the world) being infected. Low prices for cocoa have also hurt farmers’ incomes which prevents them from buying much needed fertilizer and pesticides, which in turn will make disease even more of a problem. The weather is not expected to improve either, due to La Nina’s affect on West Africa (La Nina has historically brought heavy rain to the region). Due to this adverse weather at the beginning of the season, nobody expects cocoa production to be as massive as last season.

Current Predictions put 2017-18 main crop at 1.4 million tons.

Another thing that will likely support cocoa prices is a higher demand from the chocolate industry as well as changing consumer tastes. Global cocoa processing is set to increase 3-5% next year as lower costs boost demand from the chocolate industry. The chocolate market seems to have finally returned to growth in 2017 after over a year and a half of declines. This renewed growth could have something to do with the fact that demand from developing countries for chocolate, one of the most popular and widely consumed products in the world, is starting to speed up.

There is also a growing trend of people favoring dark chocolate over milk chocolate, a trend that will certainly strengthen cocoa prices. This is because milk chocolate accounts for 50% of the global chocolate market and is made of only about 10% cocoa. Dark chocolate on the other hand contains over 60% cocoa. This switch to dark chocolate is being fueled by a health craze that has people cutting what they consider unhealthy fattening foods and sweets, in other words milk chocolate. At the same time health experts and studies have begun to show that eating a little dark chocolate could actually be healthy for you and even prevent some diseases. This is due to dark chocolate and specifically, cocoa, being rich in anti oxidants. Demand for dark chocolate is only expected to grow as people begin to appreciate its potential health benefits and more natural production.

Another consideration which will help cocoa prices is a growing demand from the emerging markets. Demand from Asian countries like China, India and the Philippines is expected to grow from 3-4% a year, while demand from developed countries is predicted to grow at a steady 2%. According to the ICCO (International Cocoa Organization) and analysts at major banks such as Citi, overall cocoa demand grew 5% in the 2016-2017 season, and is expected to keep growing in the future. At the same time as demand is increasing supply is decreasing with production from West Africa in the 2017-2018 season expected to be 5-7% lower than last season (according to analysts from Citi Group). These factors mean that the cocoa surplus is very likely to decrease in 2018.

Based on both technical and fundamental factors, cocoa prices look poised to make a comeback. When you consider the expected lower production in West Africa, growing demand for chocolate in emerging markets and growing popularity of dark chocolate, it is very easy to see cocoa rebounding to $2,200 a ton sometime in early 2018. Investors who want to get exposure to cocoa have several options. They can buy cocoa futures traded in the U.S on the Intercontinental Exchange under the symbol CC. For investors hoping to avoid the intricacies involved in futures trading, there are multiple cocoa ETF’s out there. The best (the one with the highest average volume) is iPath Bloomberg Sub index fund, traded under the ticker NIB. Investors hoping to take advantage of the opportunity in cocoa can buy this ETF which accurately tracks the price of cocoa.

However, there are still risks. Even though the cocoa market is expected to become more balanced in the coming season, a surplus will persist. JSJ Commodities expects cocoa supply to outstrip demand by 88,450 tons in 2018. Although this surplus is considerably smaller than last years, it still means cocoa is unlikely to have a prolonged break out. Despite this, the cocoa market continues to look healthier, and barring any bearish news (such as a larger than expected crop in West Africa), the cocoa market can very well become completely balanced by 2019. If this happens we will probably see a break out past $2,200, which would mean being bullish on cocoa now at these low prices could become an extremely profitable going forward.

Disclaimer: This material has been distributed for informational purposes only and is the opinion of the author, it should not be considered as investment advice.

I love this piece. Makes a lot of sense and fairly outlines the risks. I had NO idea about the big chocolate holder. I know the speculators have been heavily short cocoa for a while and blamed them for a lot of the excess selling pressure.

Yes, good insight.

Recently it seems hedge funds have begun to pair back their cocoa shorts, which makes sense given the fundamentals and the chart set up.

Going short at this point is a very poor risk/reward. It would be a bet on even more extreme conditions...

Completley agreed

I've read that the cocoa bean may go the way of the dodo. How does that factor in?

As dark chocolate becomes more popular demand for cocoa will increase. If cocoa starts having wose and worse crops then prices will soar.

#ClimateChange is having an adverse impact on the #cocoa crops and it will only get worse. But a genetically engineered solution could change everything. $NIB

Yes, it's on the path to being extinct, mainly due to increased demand and lower crop yields. That's because of warmer temperatures and dryer weather conditions. The good news is that the top chocolate companies are working to genetically engineer cocoa to survive the climate change.

I wonder how likely they are to succeed. And if they do, if it will taste as good.