Bakken Update: Well Design Improvements Drive Production - Part III

<< Read Part I: Bakken Update: Economics Improve As Costs Decrease And Enhanced Completions Improve Production

<< Read Part II

Decreased oil prices have been difficult for the industry, but it has also done some good. Operators have moved to decrease costs.Lower oil prices have pushed E&Ps to improve well design.Sliding sleeve completions have decreased in number. A move to cement liners has provided completions crews with more points to frac shale. Fractures are now focused closer to the well bore, which has improved production from induced fractures.

Lower oil prices have been hard on investors in the US Oil ETF (USO). This could continue as the market is still in contango. The oil glut has become a refined product glut. This could push refiners to decrease throughput or go to seasonal maintenance early.Refiners have already reported crack spreads tightening even with some reporting record exports of gasoline and diesel.

Just five years ago West Texas Intermediate was trading over $100/bbl. As a general rule, oil prices pull back quickly and can rebound the same way. Gluts can also be drawn out like this one, where it is hard to find a light at the end of the tunnel. Gluts can be caused by over supply or a drop in demand.Sometimes both occur.Demand based oil gluts can be caused by recessions, or decreased world growth. Demand can wane due to technology.If an engine is developed that increases miles per gallon or uses a different fuel source can cause issues. Governments and countries also need to be careful not to cause decreases in demand. Supply driven gluts are worse, and that is what we are currently in. When demand decreases, countries can add stimulus or cut rates to increase growth. Supply gluts are a little more difficult. When a large, new supply source is introduced prices may drop. When the drop occurs, countries will increase production to make up for lost revenues. The lowest cost producers can drag down the market further. The hope is lower prices will increase demand. Natural demand increases as automobiles are added and populations increase will balance supply and demand at some point.

The length of time this supply glut has amassed has created problems in the US oil market. When a short term price change occurs, usually most operators are hedged to protect cash lows. As each quarter goes by, hedges begin to roll off and operators aren’t able to hedge new production.If they are able to hedge, realized prices are much lower. When oil was at $100/bbl, operators didn’t have to watch costs as closely. Up here in ND, E&Ps paid what it took to get wells drilled and completed. That is no longer the case in a lower for longer environment. Operators are now focusing on its best core acreage.Rigs have been moved to leasehold with the best economics. High-grading has been very effective, and it provides investors with an idea of where the best economics are.It is possible oil prices will head lower in the short term.I doubt the 52-week low is in danger of being breached, but $35 to $36 is a possibility.We still think we see oil at $60/bbl by year end or in 1Q17.

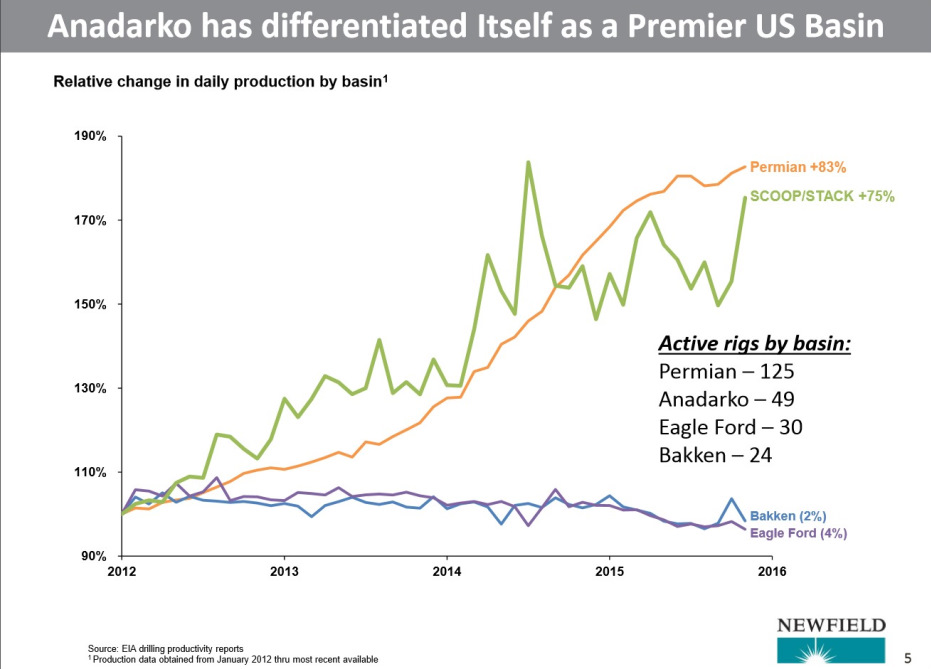

(Source: Newfield)

The above slide shows the number of rigs in each of the top four US basins.The 125 rigs in the Permian, 49 in the Anadarko, 30 in the Eagle Ford (Western Gulf), and 24 in the Bakken (Williston).The number of rigs is a general representation of economics.The better the economics, the more operators are motivated to put capex to work in that play.This is also why daily production has surged by 83% in the Permian and 75% in the Anadarko since 2012.The jump in Anadarko production has been quite large from late 2015 to year end.When an operators high-grades, it can either be to better acreage in the same play or another.Operators with acreage in other plays are focusing on the Permian and STACK.

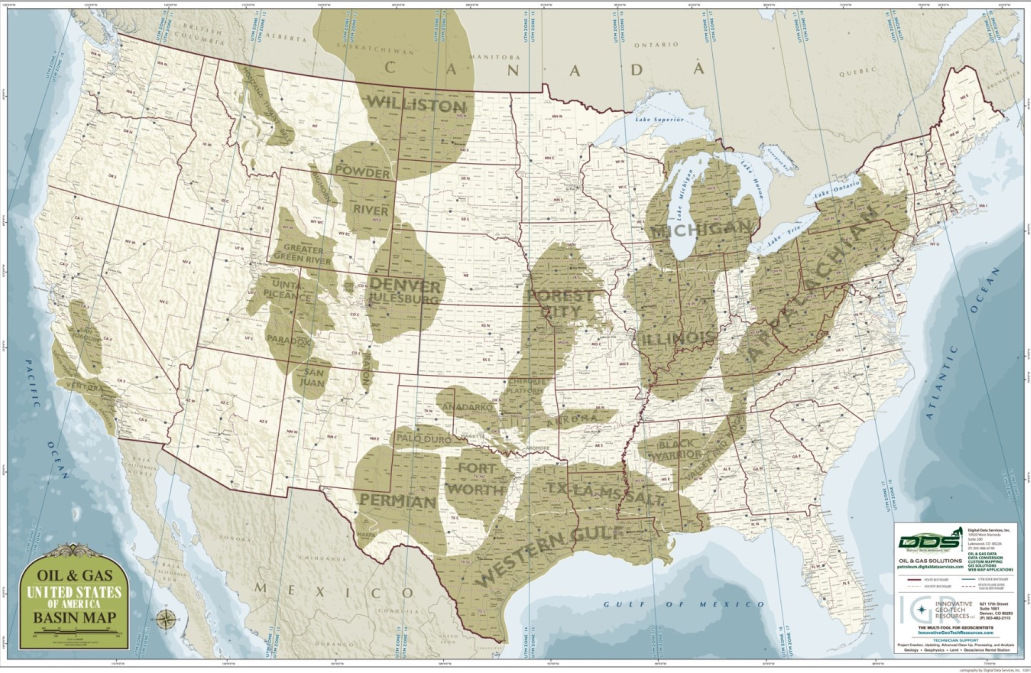

(Source: Digital Data Services)

For clarity, the Bakken is an interval found in North Dakota and Montana in the Williston Basin.That interval is what the Williston Basin is known for and not located or economic basin wide.Its core or best acreage is located in northeastern McKenzie, southeastern Williams, southwestern Mountrail and northwestern Dunn counties.The Eagle Ford is an interval located in the Western Gulf Basin of southeastern Texas.Its core is located in Karnes County but there have been some phenomenal results out of Gonzales.The Permian Basin is interesting because there are basins within.Both the Delaware and Midland basins are located in the Permian.The Delaware is in the west and Midland in the east.Both contain some of the best pay zones in the country.They share the Wolfcamp.The Delaware and Midland have a large number of intervals which provides some of the thickest in the country.The Anadarko Basin is located in Oklahoma and home to the STACK and SCOOP plays.This is a newer play with respect to traffic, so we aren’t totally sure how good the STACK is.Initial results point to its unconventional economics being as good as anywhere in the US.

Newfield (NFX) is one of the better operators in the US.That is just my opinion, but it seems to do a very good from a production per foot perspective.It has acreage in the Bakken, Eagle Ford, Permian, STACK, etc.Even with all of this leasehold, it is STACK focused.This is one of the reasons for its recent acquisition from Chesapeake (CHK).

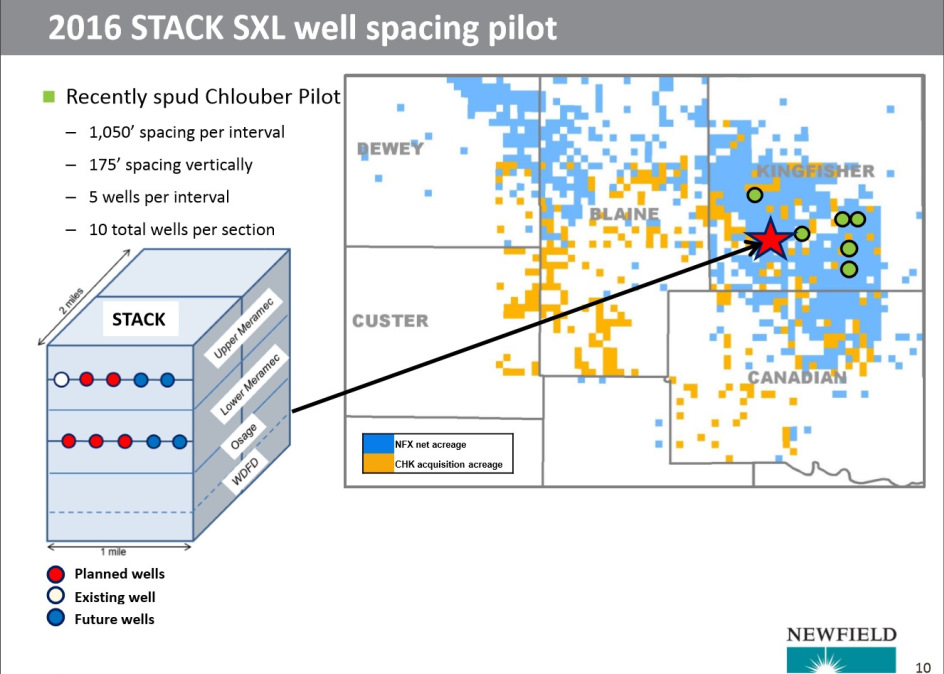

(Source: Newfield)

Its focus is Kingfisher and Blaine counties.This is core and producing excellent initial results.It currently believes core acreage will support 10 wells/section.This includes the upper and lower Meramec.Better well design doesn’t just improve on wells already completed, but also aids operators in outperforming initial estimates.

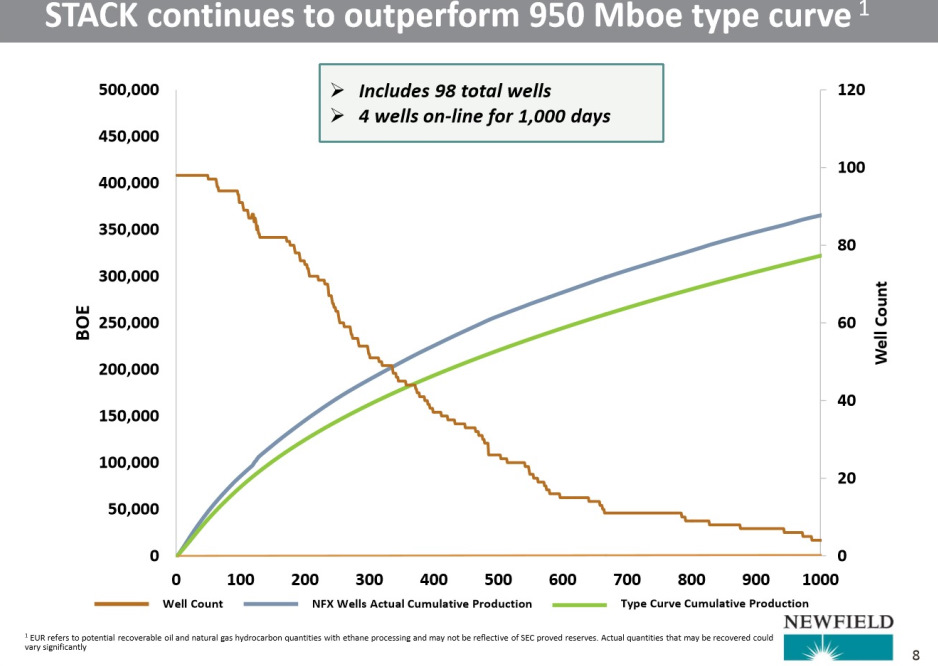

(Source: Newfield)

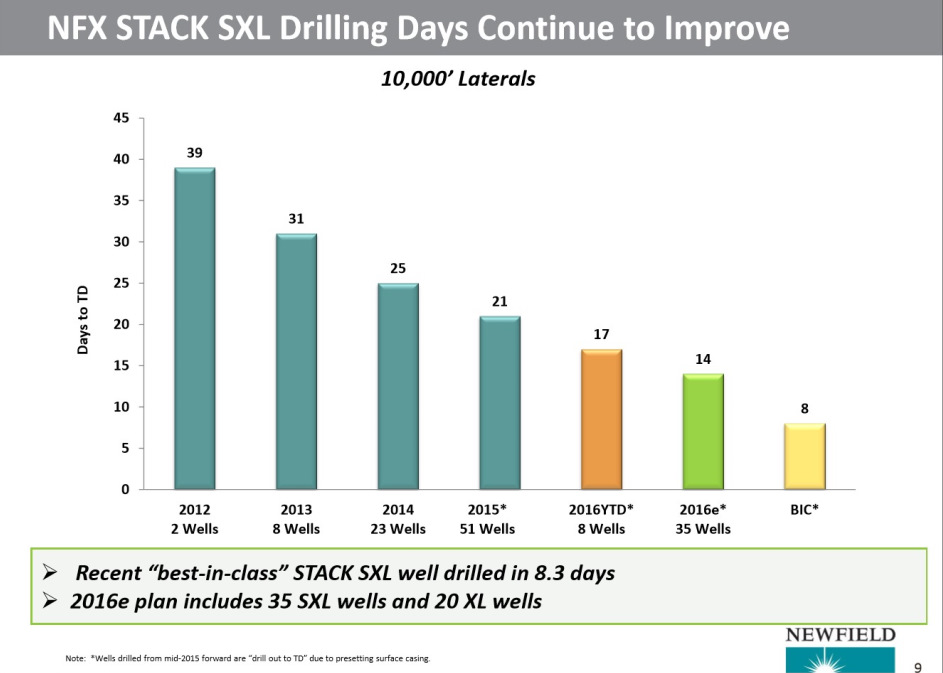

NFX’s current locations are producing better than the initial EUR of 950M Boe.In the first year, these wells produce over 200,000 BOE.Cost reductions are also key.As I have stated in the past, drilling days are being cut substantially.

(Source: Newfield)

In 2012, wells took an average of 39 days to drill.It is currently down to 14 days as an estimate for this year.Further improvements are expected.

(Source: Newfield)

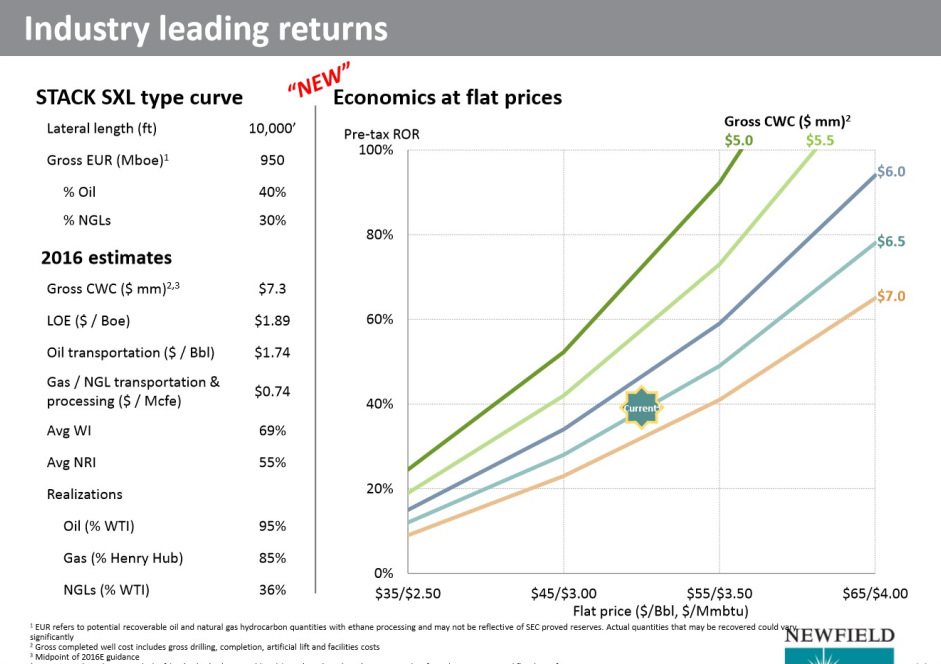

Well costs are also headed lower.Initial estimates were for $7.3 million per 2-mile lateral.That has decreased to $6.5 million.Operators in new plays generally can cut costs quicker than those in mature plays.Once pipe is in the ground and exploration moves to development there are significant costs decreases in drilling and completions.

Cimarex (XEC) is another interesting play with acreage in the Permian and STACK.It is more of a natural gas focused company but has increased liquids production to approximately 53% last year.This is a 5% increase since 2012.The Delaware Basin is its flagship play with more than half of its capex spent there.The rest will target the Woodford and Meramec in the STACK.

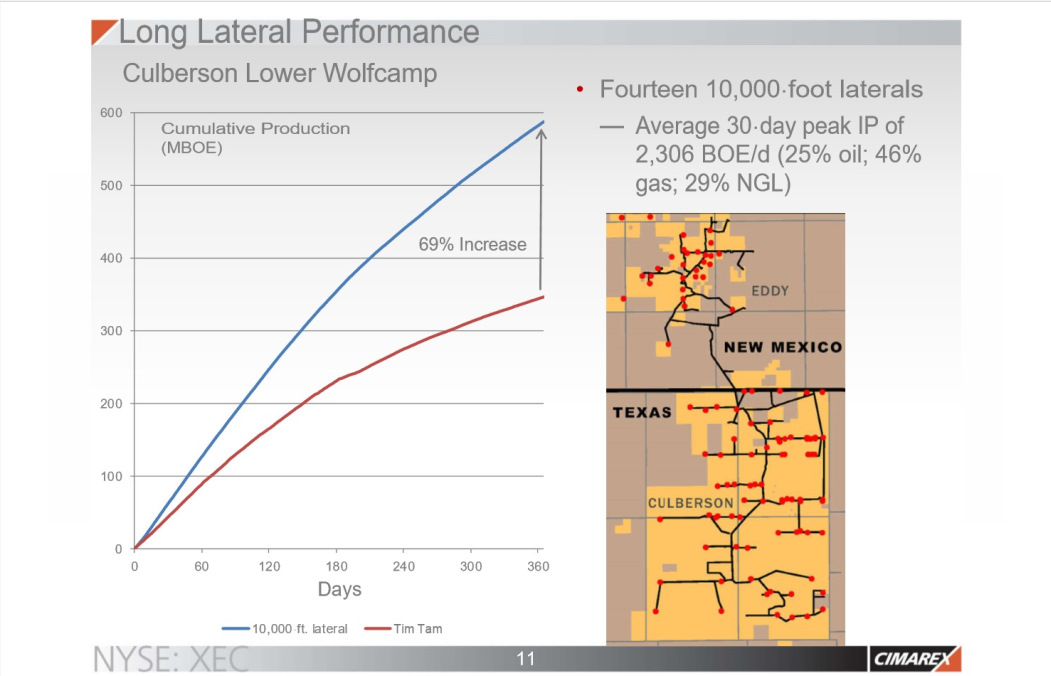

The big story for Cimarex is well design.It has begun upsizing fracs, which has paid off.

(Source: Cimarex)

It has seen a 69% increase in production from its Culberson Lower Wolfcamp wells.These wells are very high pressured given the depth and percentage of natural gas produced.Eddy and Culberson counties are core in the Delaware.Some of this increased production is due to longer laterals, but also better completion work.

(Source: Cimarex)

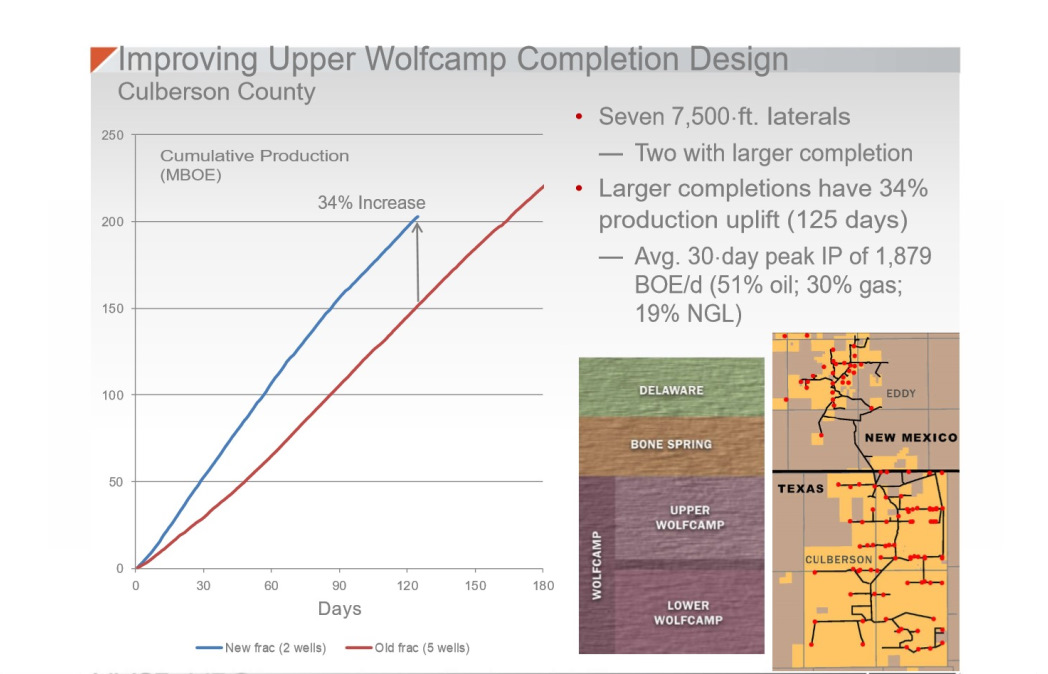

When we isolate production increases from frac improvements, the results are good.Enhanced completions have worked well in the Wolfcamp.When 2 recent wells are compared to 5 wells in the same area, a 34% improvement is seen.At 125 producing days (not calendar days), the new fracs produce over 200,000 BOE.It is important to note producing days as it would account for times when wells are shut in while adjacent wells are completed.If one was to only take calendar days, it skews results as there are times when wells are not on line.When some report results, they are only concerned with calendar days because it takes a significant amount of time to pull monthly producing data.Some states do not provide it at all.

(Source: Cimarex)

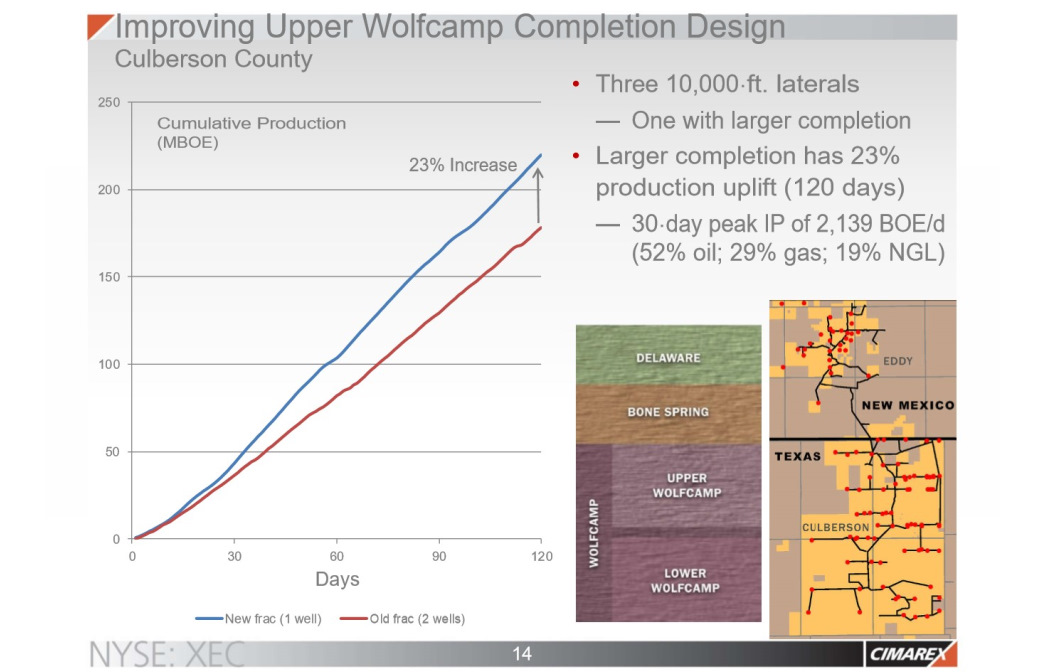

Production improvements were also seen on a different pad in Culberson County.These wells are 2-mile laterals versus the previous slide’s 7,500 foot.At 120 producing days, this well saw a 23% improvement.This well produced better, but not on a per foot basis.The lateral length is 25% longer but production came up a couple of points short.This is not strange as the longer the lateral, the more difficult it is to complete the toe.As a general rule, operators are motivated to increase the lateral length as economics are usually better.

(Source: Cimarex)

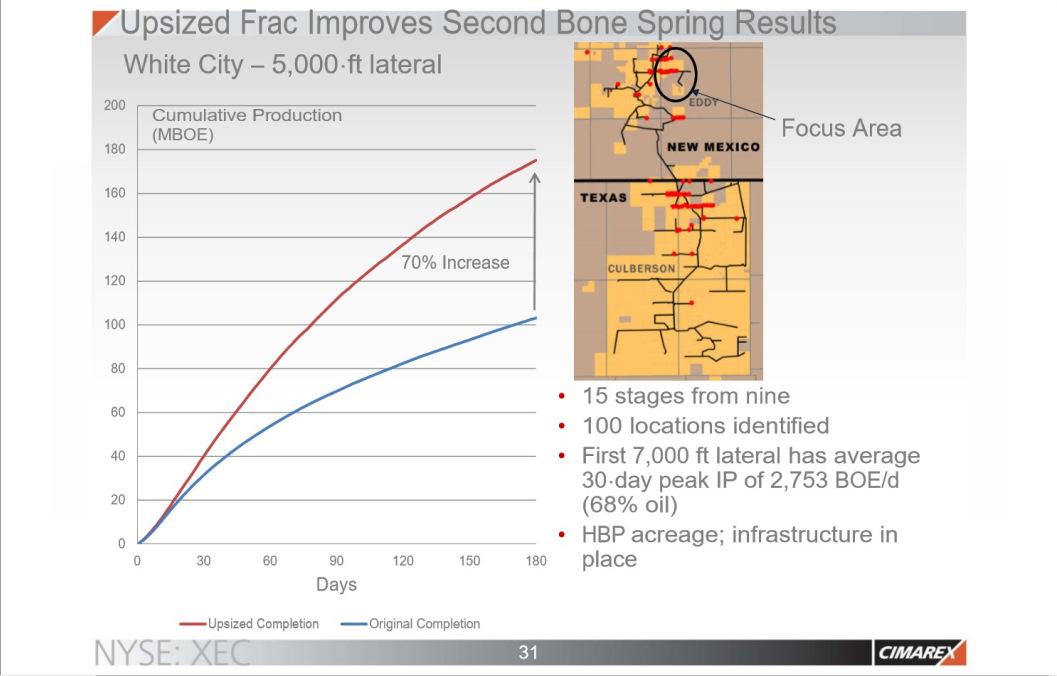

XEC’s recent well design improvements give us a better idea as to further upside.There are a few ways that an operator can improve production per foot.It is important to use a proper sample.By this I mean wells in the same general vicinity, or better yet, the same pad.This provides a like geology to compare design improvements.Once we isolate the geology, we can focus on the completion.It has increased the number of stages from 9 to 15.The shorter the stage usually means the operator can frac or break up the shale better.One way to follow this improvement is through proppant and frac fluid volumes.The more the rock is cracked the larger the void.This means more square footage is in contact with the well bore, and more production per foot.The larger the void, the more proppant needed to fill and prop open the induced fractures.This can mean frac sand, ceramic coated sand or a large number of differing ceramic proppants.Whether it is a sliding sleeve versus cement liners also provides some insight.Although sliding sleeves are much cheaper and faster, it provides access points to the source rock.Cement liners allow for a large number of frac clusters to be used.Cimarex has increase proppant usage to 1,200 lbs/ft.

(Source: Cimarex)

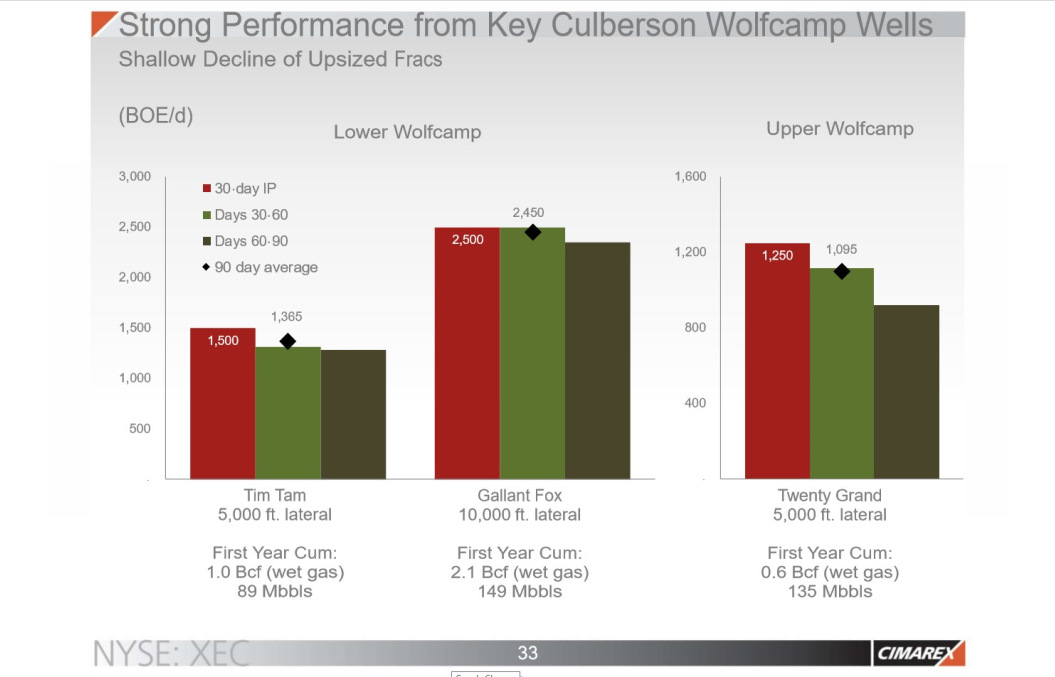

When analyzing data, initial production is not the most important variable.Decline rate improvements have been substantial and are especially evident in the Permian.The Lower Wolfcamp has higher well pressures due to resource percentages and depth.These well pressures remain higher for longer periods of time.Well pressures help to propel resource up and out of the well bore.In the above cases, we are seeing this through the first 90 producing days.

Production improvements continue in the STACK.Much of the initial development used a 5,000 foot well design.

(Source: Cimarex)

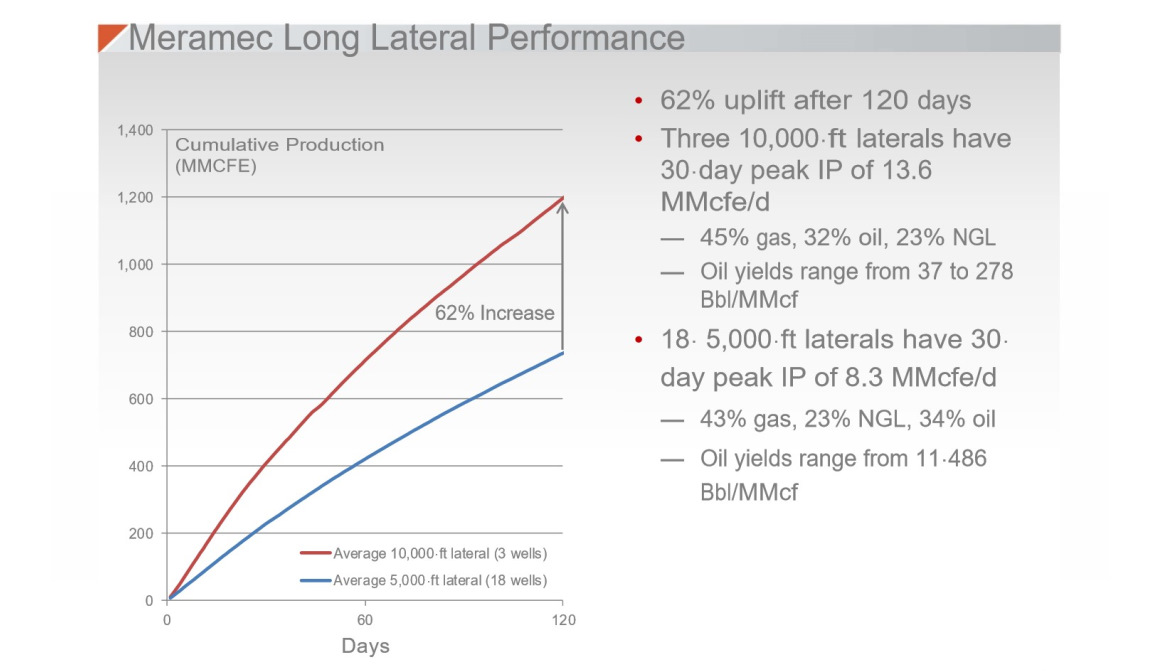

Cimarex does report a 62% increase in production over the first 120 producing days.Longer laterals mean higher costs, but operators estimate increased production offsetting additional costs.These are the types of comparisons to watch for, as costs per foot need to be figured along with increased resource garnered.

Matador (MTDR) is at the forefront of well design.It has made good moves as an operator, especially purchasing Delaware Basin acreage.MTDR saw lower longer term oil prices and bought acreage in an area with better economics.It also worked on some of it leasehold with EOG Resources (EOG).This work provided much needed instruction in well design.

(Source: Matador)

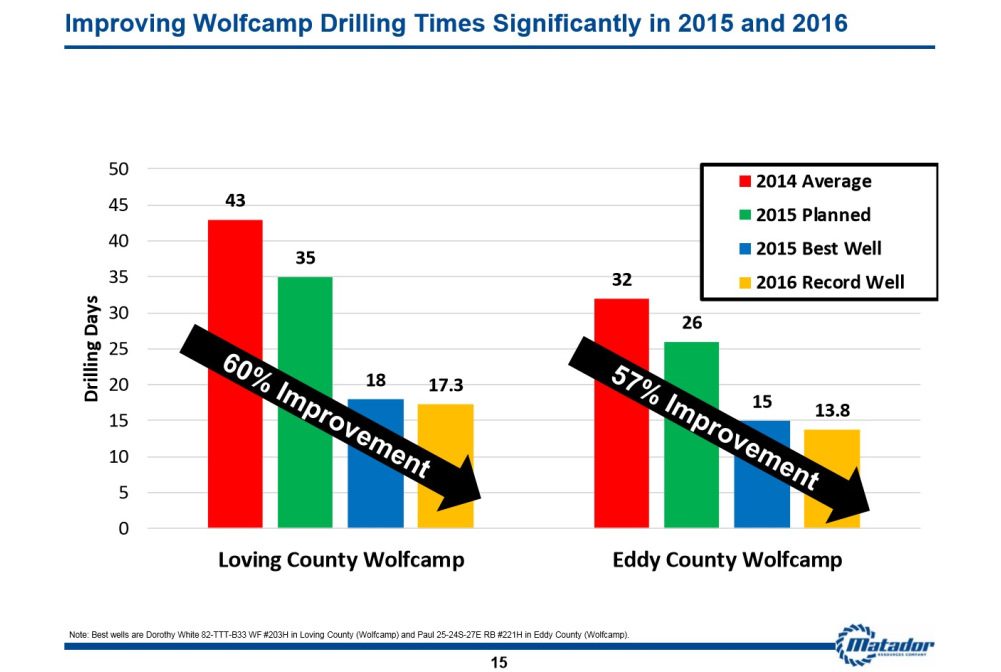

In Loving and Eddy counties, Wolfcamp drilling times have seen an improvement for 57% to 60%.This improvement is from the 2014 average to play’s best location.Drilling cost improvements are substantial.

(Source: Matador)

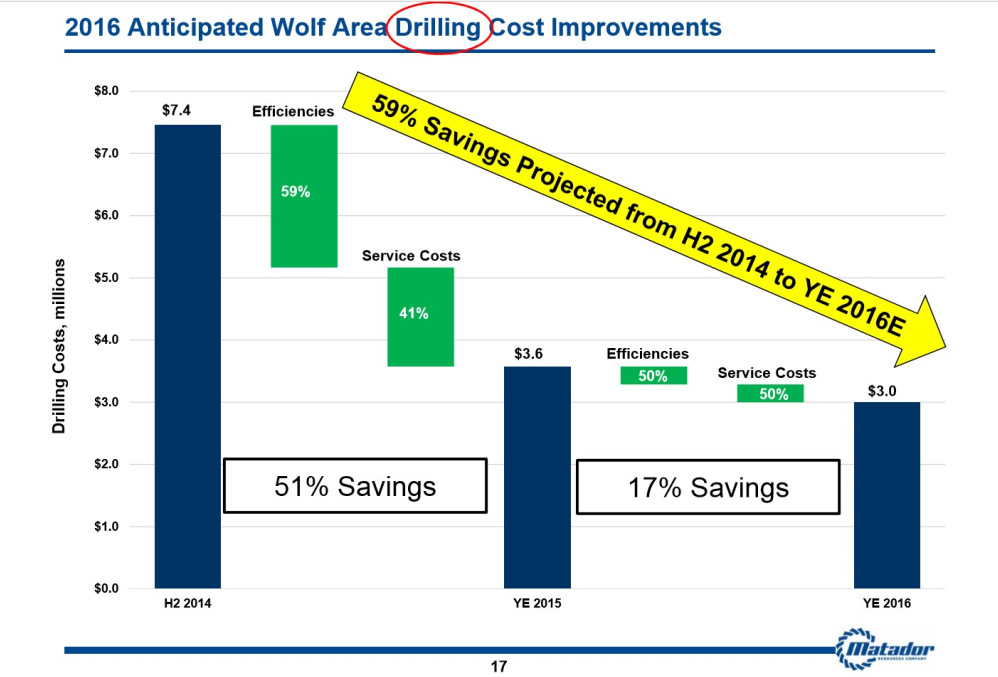

Drilling cost improvements are related more to efficiency than service costs, but not by much.Both are a responsible for cost reductions from $7.4 million to $3.0 million by year end.Completion costs are also heading lower.

(Source: Matador)

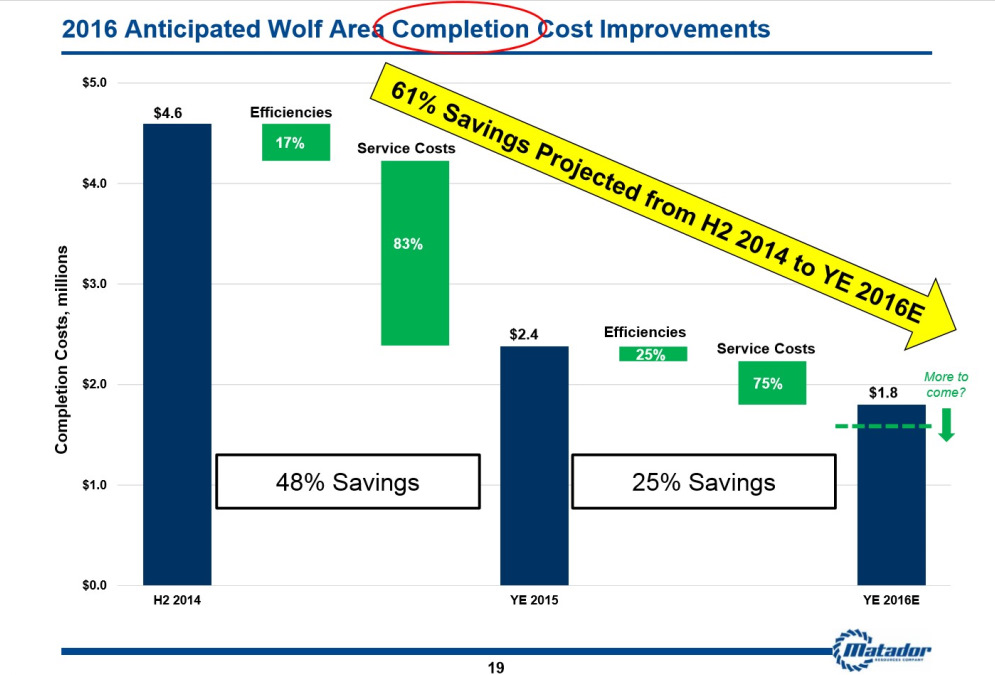

Improvements in completions costs are levered to oil service.These anticipated improvements are better than drilling by 2%.The largest decreases in costs occurred between 2H14 and 2015.

(Source: Matador)

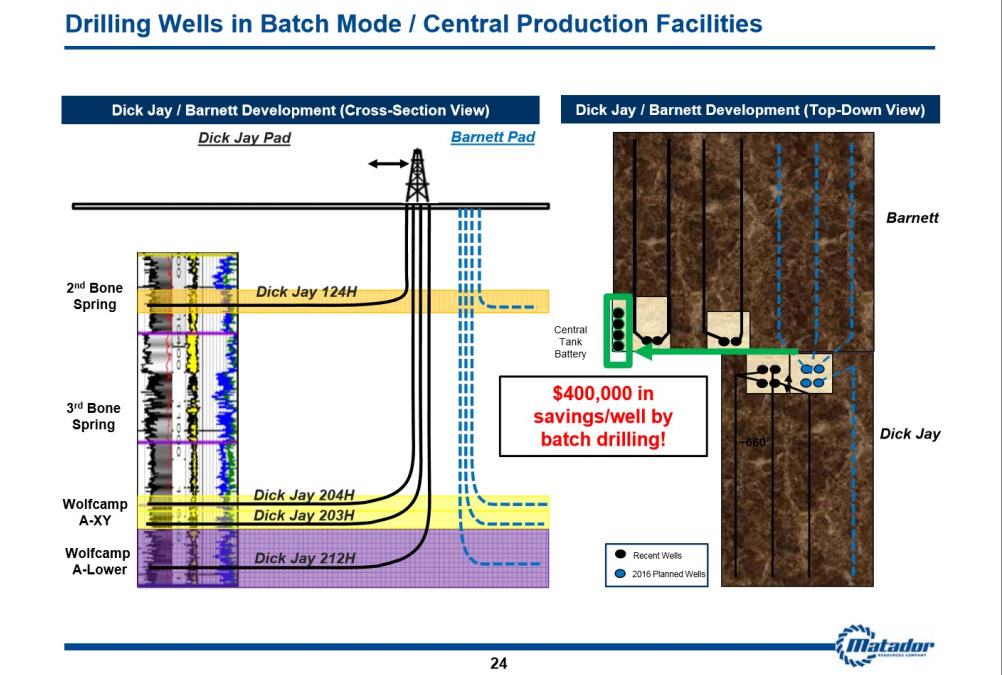

There are numerous ways operators can save drilling multi-well pads.By drilling and completing all wells together (for drilling it just means the rig stays on the pad) relatively large savings can occur.MTDR is seeing savings of $400,000/well by batch drilling.This does not include savings seen by doing zipper fracs.Further cost reductions are expected.

Increased production per foot continues even as costs have decreased.

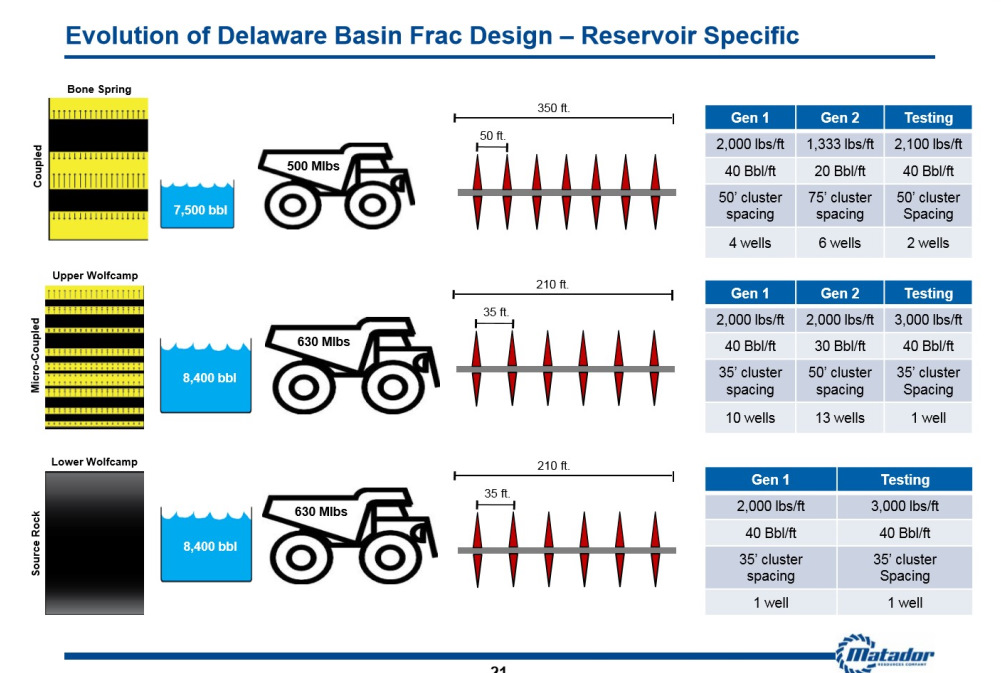

(Source: Matador)

The above slide shows how MTDR has changed its well design.Well design is changed to fit geology.Any number of things can affect how a producer might alter its completion.The Bone Spring is still using 350 foot stages which will probably decrease with time.From Gen 1 to Gen 2 it decreased proppant and fluids volumes and increased the distance between frac clusters.Since that time it has increased proppant and fluid volumes and moved back to 50 feet between frac clusters.The upper and lower Wolfcamp are increasing proppant volumes to 3,000 lbs/ft.Wells in those two intervals are using 40 bbl/ft of frac fluids.To provide an idea of how this design has changed, we could base it on a 2-mile lateral.The table below provides a standard well design to compare it.

|

Well Design |

Stages |

Fluids Bbls |

Proppant |

|

Standard |

30 |

40,000 |

4,000,000 |

|

MTDR Wolfcamp |

48 |

400,000 |

30,000,000 |

|

Difference |

18 |

360,000 |

26,000,000 |

MTDR’s well design, when adjusted for a 2-mile lateral length, uses huge amounts of fluids and proppant. The “standard” well design would vary significantly from one play to the next, but many operators use this standard design with sliding sleeves.This is done because completions work is done quickly and cheaply.When we take a MTDR Wolfcamp well and adjust its design to a two-mile lateral, the volumes of fluids and proppant are astounding.It is also important to note that if MTDR is doing this, others are probably doing the same.MTDR’s well design has produced some very nice wells.This has accounted for EUR increases across its acreage.

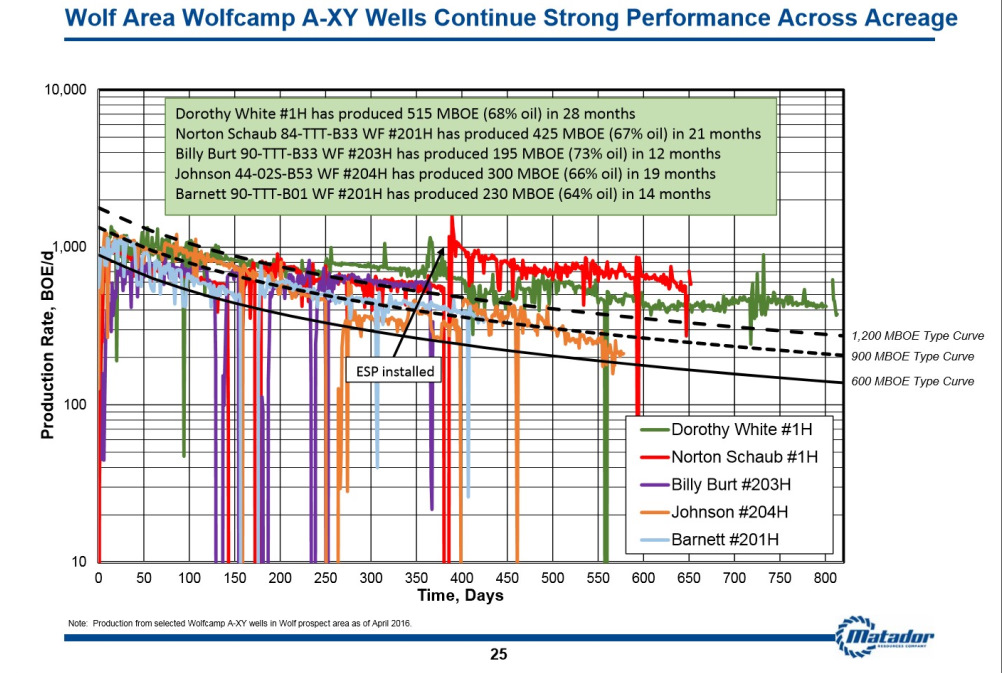

(Source: Matador)

EURs vary significantly across MTDR’s acreage.This is due to it being spread out across many different areas.Its Wolf prospect is considered core, and has proved up with some of its best wells.Initially, MTDR had an EUR of 600M BOE for Wolf Wolfcamp A-XY locations.This was increased to 900M BOE after several very good completions and again increased to 1,200M BOE.MTDR has several wells tracking above the 1,200M BOE curve.The combination of improve production and lower well costs have been positive for economics.

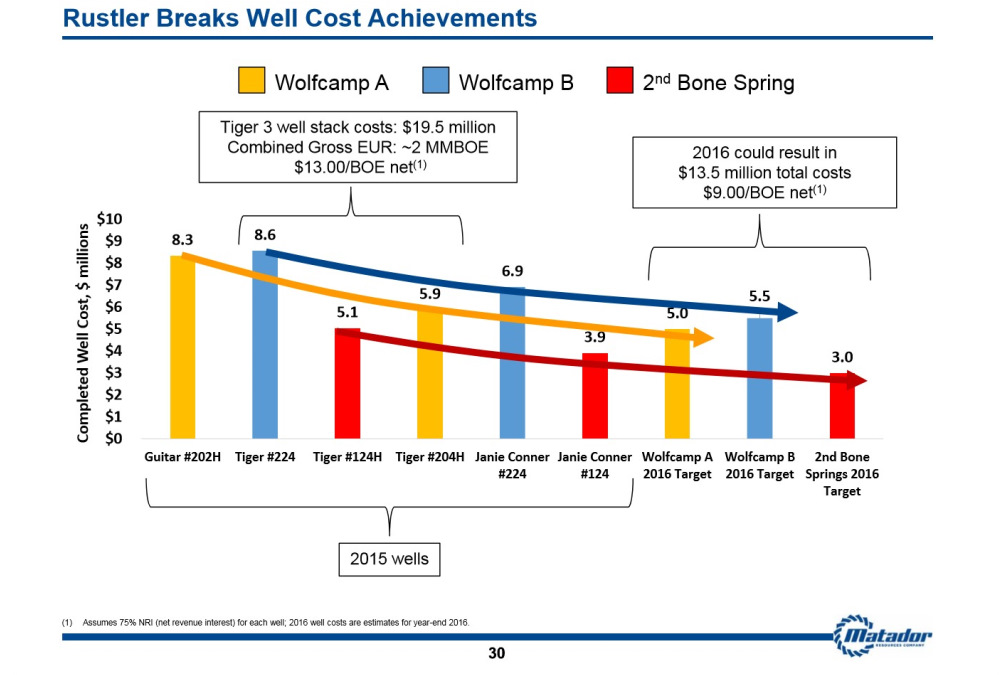

(Source: Matador)

The 2nd Bone Spring, Wolfcamp A and B have all seen a large improvement in well costs.The Three Tiger wells had combined well costs of $19.5 million with one well coming from each pay zone.The combined EUR for all three wells is estimated at 2MM BOE.For those older wells, MTDR would receive $13/BOE net.This would be over the life of the wells so we could be talking 30 to 40 years.MTDR did a more recent three wells, with all targeting differing intervals.Those well costs reduced to a total of $13.5 million.MTDR would still see $9/BOE net with much lower oil prices.Costs continue to offset lower realized oil prices.

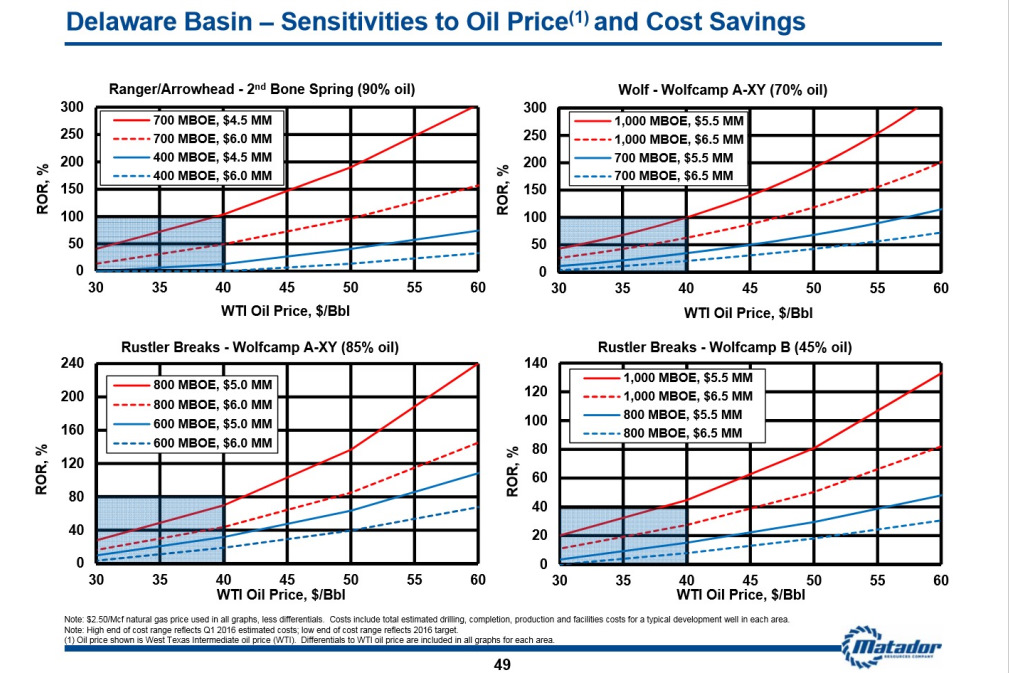

(Source: Matador)

Lower well costs and better production is the reason for MTDR’s success.It has several wells in each area targeting the above intervals outperforming the highest EUR.It also has completed wells at lower costs than the above slide provides.Economics are still quite good in all prospects.At $45/bbl WTI, the ROR has a range of 60% to 150%.

Operators have shown well design changes can improve production.Many operators are seeing large improvements in both production and costs.We think operators can continue to improve production per foot as better design breaks up the source rock more. E&Ps continue to become more efficient. Drilling and completing wells takes less time which saves money.We are just beginning to see how this affects well economics.While some operators won’t do this as well, some operators do and we are trying to highlight these names in this series of three articles. While well design is important, it cannot replace geology. Operators with the best leasehold will make it through the downturn and emerge better companies when oil prices recover.

Data for the above article is provided by welldatabase.com. This article is limited to the dissemination of general information pertaining to its advisory services, together with access to additional ...

more