Are We Close To The Bottom In Gold?

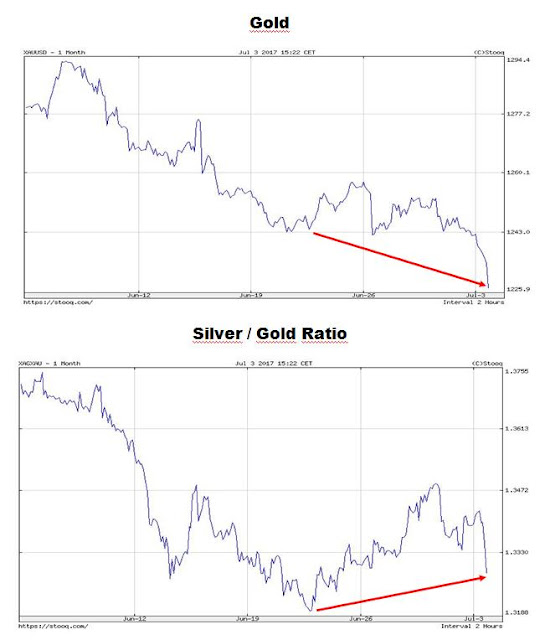

Look at these two charts:

Source: stooq.com

It happens all the time - there is another divergence (red arrows) between gold prices (the upper panel of the chart) and the silver/gold ratio (the lower panel of the chart).

Generally, when gold prices are diving and the silver/gold ratio is going up, the precious metals market is close to its local bottom.

Disclaimer: This article is not an investment advice. I am not a registered investment advisor. Under no circumstances should any content from here be used or interpreted as a recommendation for ...

more

TalkMarkets has been full of articles putting forth theories as to what would be the direction of gold. Here what a number had to say: 1. DailyFX got it wrong when they suggested that "Gold Prices May Rise" (www.talkmarkets.com/.../gold-prices-may-rise-as-us-gdp-downgrade-cools-fed-rate-hike-bets) but they did get it right when they said >"a reversal below chart inflection point support at 1241.20 clears the way for testing a rising trend line at 1231.74." Gold has crashed through that rising trend line and is now at $1,220.75! 2. Orbex put forth 2 opposing alternatives in its article on TalkMarkets (www.talkmarkets.com/.../two-scenarios-for-gold-rally-or-deeper-retracement) riding the fence in concluding that: >"The bullish outlook remains unchanged as long as gold continues to trade within the higher lows formation. Otherwise, gold would be at risk to visit 1220 once again." Gold was trading at $1,220.75 at 1:30 Monday afternoon. 3. AG Thorson contended in a TalkMarkets article (www.talkmarkets.com/.../metals-and-miners-are-bouncing) that: >"A breakout in the dollar should lead to a 1-3 month rally. Precious Metals and Miners are expected to descend into their 6-Months lows as this occurs." 4. Jordan Roy-Byrne in a TalkMarkets article (www.talkmarkets.com/.../gold--gold-stocks-nearing-a-big-move) got it right when he said: >"Until Gold breaks $1300 and GDX retests $25 the bias for the next big move...should remain to the downside. That is why we remain cautious." 5. Hubert Moolman illustrated that fact in a graph in an article (www.munknee.com/gold-chart-says-a-massive-move-up-or-down-is-imminent/) that showing that: >"Gold is currently trading near a critical 6-year resistance line that the gold price has to overcome, for the continuation of the gold bull market but, since price has now failed more than four times at the line, there is a great chance that we could see a big drop...When gold breaks through the resistance line, however, we will see a gold rally like that of 1979/1980." 6. Sean Brodrick looked at the situation slightly differently but came to the same conclusion, more or less, saying in www.munknee.com/this-could-be-the-most-important-gold-pullback-ever-to-consider-buying-into-heres-why/ that: >"IF gold breaks support...then you should buy gold and miners with both hands because that will likely mark the beginning of the next Mega Bull trend. The market won’t really turn bullish on gold again, however, until it pushes up through $1300." I'd like to hear from anyone who would like to expand on what Alp, Orbex, Thorson, Jordan, Hubert or Sean have had to say. Indeed, "Are We Close To The Bottom In Gold?" Is $1220 the bottom?