An Inflationary Message From Gold-Commodities Ratios

Gold established an uptrend in ratio to virtually all commodities during the global deflationary phase that began to bite hard in 2014. Since then gold has broken down vs. silver and later, palladium. What does this mean?

Well, I find it interesting that gold broke down vs. the two commodity-ish precious metals, Ag and Pd but held up against other commodities that are more positively correlated to the global economy. This is as it should be during a phase of global deflationary pressure. But the first signal was the Au-Ag breakdown, and the next was Au-Pd. We then began to scout for an inflationary phase out on the horizon.

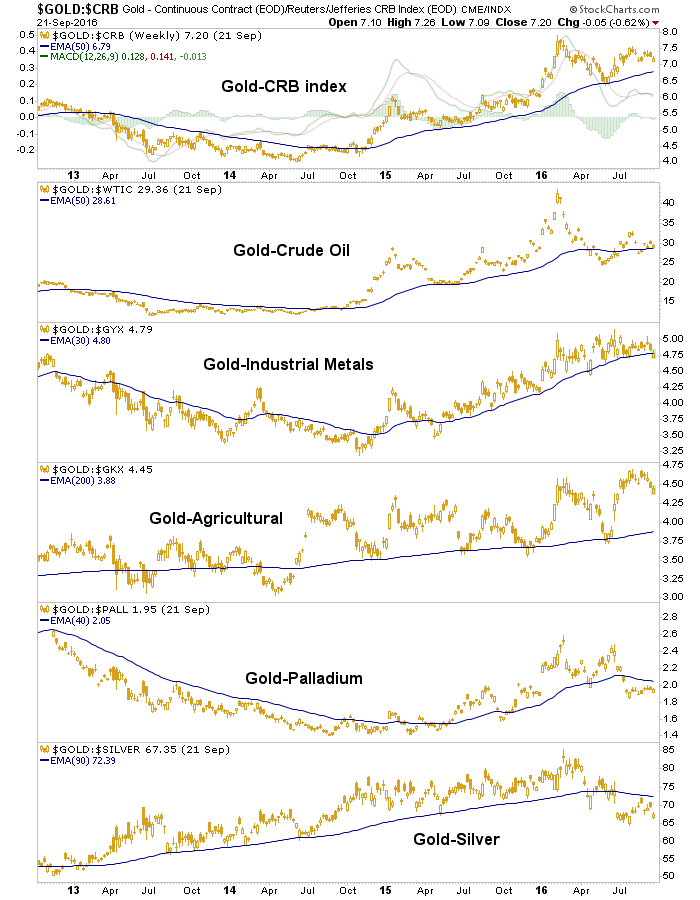

Before we go on, let's review the multi-ratio chart of gold vs. these items.

Note the key breakdowns in the last two chart panels. Silver's outperformance to gold was very bullish for the precious metals sector (given that both metals were rising) and palladium's outperformance to gold (as Au-Pd broke down) was one of the key market indicators we used to abandon a bearish stance on the stock market a few months ago. Now gold is starting to turn down vs. agriculture, industrial metals and the whole of the CRB index.

If this continues, it would be exactly in line with the message of a quietly persistent CPI (see Michael Ashton's extensive breakdown, post-CPI). None of this need be bearish for nominal gold, however. For reference, recall the Greenspan years of 2003 to 2007. Gold did quite well during that overt inflationary phase, although it underperformed many headline commodities as the economy and stock markets remained firm while inflation masked the damage being done beneath the surface (which was neatly addressed in Q4, 2008).

To summarize, gold led a raft of asset markets by bottoming in December 2015 and turning up in January. But as a deflationary phase turns to an inflationary one, gold then tends to underperform other assets that benefit more directly from inflation. We should watch indicator charts like the one above to gauge the progress, but as of now it appears gold's ratios are signaling a strong likelihood of an oncoming inflation cycle. It would be best to position accordingly in items that traditionally do well in an inflationary backdrop.

For more on the gold ratios, inflation and the Fed's role in it all, see this pre-FOMC post at NFTRH.

Disclosure: Subscribe to more

Wages would have to go up significantly to guarantee inflation. Without that, monetarism and asset inflation is just another tax on main street. I think monetarism can be helpful, but not always. Petroleum inflation may have helped create the crash, along with Fed tightening and destroying all subprime, even the good subprime, in 2007/2008. Once subprime was destroyed, banks were forced to take off balance loans onto their balance sheets, and HELOCs went away. That was the final straw for the economy, IMO. But high gas prices did not translate into prosperity.

I like the link to your home article, Gary. I just don't see much heating up of the economy, but Christmas season could tell us a lot.

Well Gary, it's all relative and I don't think any of it is positive beyond those trading it. Indeed, the regime of systematic inflation has been highly destructive to the point where real deflation is not an option. Imagine a system that is geared to jack prices instead of put money back in savers' and non-asset owners pockets.

Yes, we pretty much have that, continual asset inflation. But sometimes it doesn't work very well when mainstreet doesn't cooperate in the dirty plan. Then the banks, as Will Rogers said, have [an asset deflation] nightmare and the nation has to put them back into bed.