3 Trends The “Experts” Got Dead Wrong

One thing that can be said with almost certainty, take what you hear on the mainstream financial media outlets with a grain of salt. Here are the three biggest trends going on right now, how the mainstream “experts” got them wrong, and three investments that take advantage of the media’s missteps.

It always amazes me how many times the economic consensus is wrong but yet how many investors still follow the so-called “experts” when it comes to macro forecasting. At the beginning of the year, the International Monetary Fund as well as most well-known economists predicted once again this would be the year that the United States would break out of almost a decade of below trend growth. GDP was widely forecasted to increase at a 3.5% annual clip or better despite the fact the Federal Reserve had finally exited over five years of extraordinary liquidity support in October as well as tepid global growth prospects. Recently printed first quarter GDP growth of just 0.2% put those optimistic forecasts to rest for now and investors can expect another year of 2.0% to 2.5% GDP growth in what remains the weakest post-war recovery on record.

There also seemed to be no end in sight a few months back to the huge plunge in crude prices. However, oil markets have strengthened in April and oil stands near $60 a barrel from its recent lows in the mid $40s. The bottom happened right around the time more and more forecasters were calling for oil to hit $30 or even $20 a barrel.

It seems only last month the consensus was the dollar would soon reach parity against the Euro and continue to strengthen against other major currencies as well. This made sense on the surface as the greenback had been on a massive run against other currencies since early summer, gaining more than 20% against the Euro in less than nine months. The Euro dropped over 11% against the dollar in the first quarter alone, the biggest movement from this currency pair since the Euro was adopted in the 90s. With the European Central Bank just initiating its own huge quantitative easing program, which some have dubbed “money printing”, the consensus made sense logically that the Euro would drop further against our currency.

It also turned out to be dead wrong.

Since dipping below $1.05 against the greenback, the Euro has strengthened to $1.13 in recent weeks confounding the predictions of pundits. The driver of this reversal is weaker than projected growth in the United States which is also pushing off the time of the Federal Reserve’s first interest rate hike since 2006. In addition, some “green shoots” are starting to appear in the European economies. Growth prospects should continue to strengthen on the continent provided another funding agreement with Greece can be reached so the country does not have to withdraw from European Union causing disruption.

If the dollar stays at its current level, earnings from American multi-nationals whose profits were crimped significantly in the first quarter by a strong dollar should improve in the second quarter. It is one more reason to add some shares in the likes of Microsoft (NASDAQ: MSFT) which managed to post strong first quarter results despite some substantial currency headwinds. Those headwinds could turn into a slight tailwind if the recent ebb in the dollar continues throughout the second quarter.

Commodities and emerging markets have also started to behave better since the dollar’s recent run has started to fade. The recent rise in crude has happened as the dollar has weakened with oil up some 25% from where it ended the first quarter. This is a correlation that is not coincidental as other commodity prices have also bounced off recent lows. The temporary halt to the dollar’s rally is helpful to commodity export emerging markets such as Brazil, Russia, Canada and Australia.

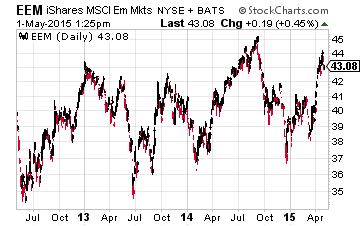

I have started to add a bit of exposure to emerging markets by picking up some shares in one of the largest ETFs in this space. I recently bought some shares in the iShares MSCI Emerging Markets ETF (NYSE: EEM) which at the end of the first quarter was selling pretty much in line to where it was to begin 2012. Expectations around emerging markets have been pretty dismal for quite a while, any improvement in sentiment could trigger a significant rally. In addition, valuations in emerging markets are much lower than for domestic equities as well as European stocks.

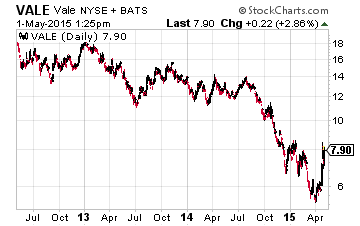

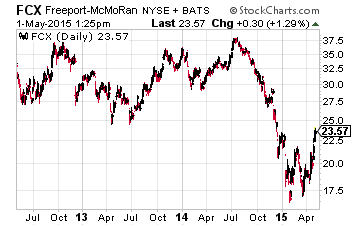

I have added a couple of small stakes in large global miners, Vale Inc. (NYSE: VALE) and Freeport McMoRan (NYSE: FCX) recently, both of whose stocks have behaved much better as dollar strength has reversed and commodity prices have ticked up. Both stocks have rallied recently off multi-year lows. Vale is a low cost iron producer seeing record production and cutting costs. Freeport has cut costs including reducing dividend payouts and the company may soon divest itself of its energy exploration assets. Both will benefit from a lower dollar as well any kind of renewed growth in China.

I have added a couple of small stakes in large global miners, Vale Inc. (NYSE: VALE) and Freeport McMoRan (NYSE: FCX) recently, both of whose stocks have behaved much better as dollar strength has reversed and commodity prices have ticked up. Both stocks have rallied recently off multi-year lows. Vale is a low cost iron producer seeing record production and cutting costs. Freeport has cut costs including reducing dividend payouts and the company may soon divest itself of its energy exploration assets. Both will benefit from a lower dollar as well any kind of renewed growth in China.

I know most of what I have outlined is contrary from what CNBC and other mainstream financial outlets are currently touting. However, one thing I have learned over the past three decades of investing is being contrarian usually pays better dividends than investing along with whatever the consensus is at the moment in the markets. This is especially true for patient investors with longer term investing horizons.

Urgent Stock Recommendations for Making Money Even in a Sluggish Economy

Discover how easy it is to find gains like I did with 457.1% from a carmaker, 199.4% from a medical stock, and a massive 1,200% from an internet stock using the Domino Strategy. This simple investing strategy identifies the tipping point for turnaround stocks and signals when you need to get in and out for maximum profits without requiring you to learn complex hedging strategies, options trading, or complicated software. I’ve used the Domino Strategy to just recently book real life profits like 149% from a trucking company, 198% from an oil E&P, even a quick 64% from a pharma firm while the rest of the market was crashing. These are real gains from my Domino Strategy and they can be yours today.