Charts That Matter

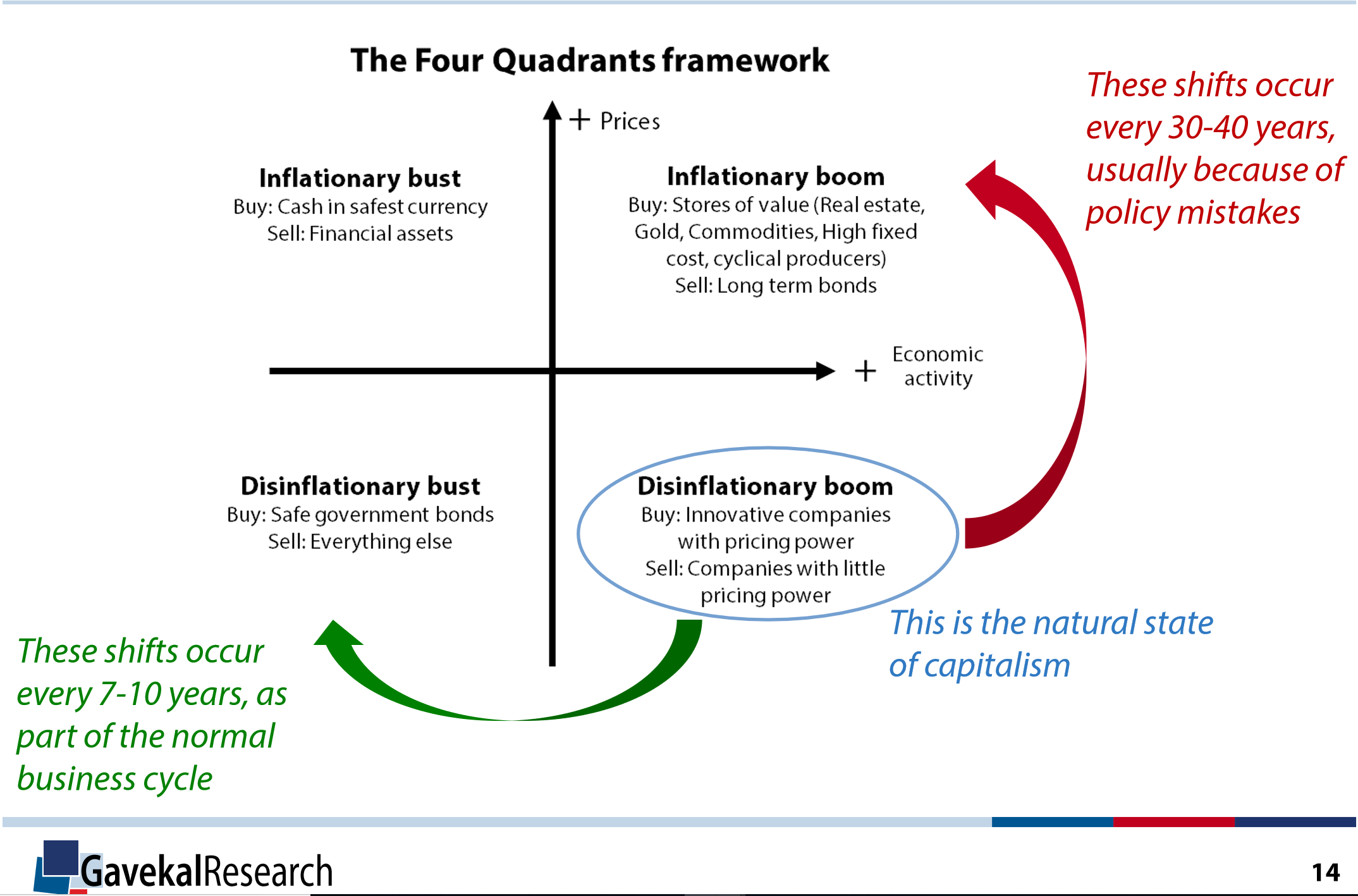

The forecast is clear – which has been Henrik thesis for a long time! We are in the deflationary (disinflationary bust) part of the economic slowdown caused by Fed hike and QT. Coincident economic numbers are not showing this yet (GDP, employment etc.) – but soon the slowdown will be clear to all.

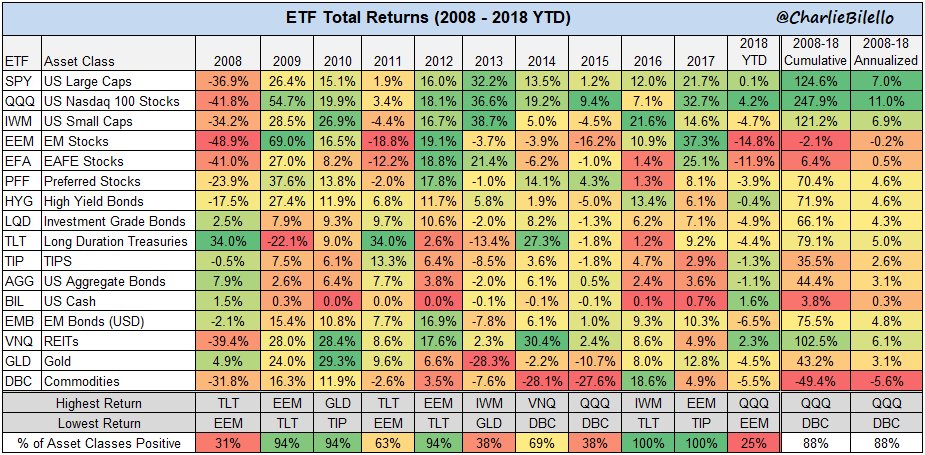

Yeah right, nothing seems to be working this year. Lowest positive returns in asset classes in the last 10 years.

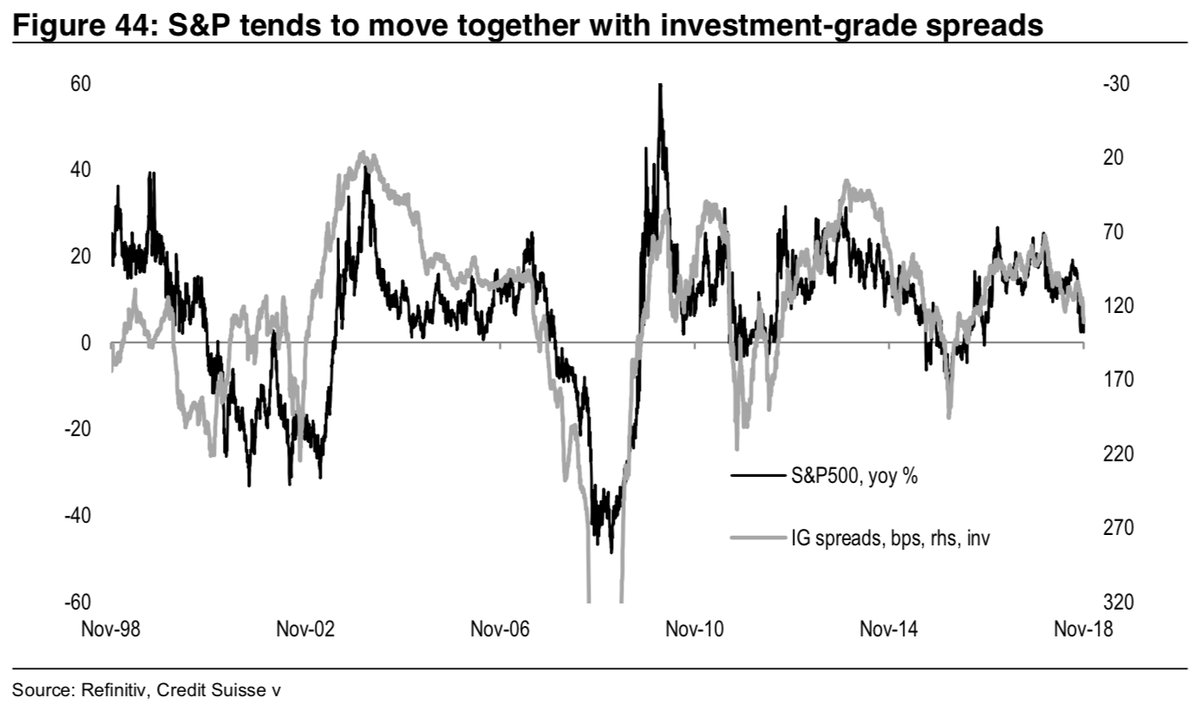

S&P tends to move together with investment-grade spreads – Credit Suisse

And it seems there could be a crisis developing in investment grade bonds where spreads have broken out of the downtrend.

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!