Will Rising Interest Rates Tank Your Income Portfolio?

With the Fed about to raise interest rates, the dollar’s record climb, and the oil supply glut, high-yield income investors should be extra cautious right now. Navigating these choppy market conditions is paramount, and Tim Plaehn is recommending two high-yield investments that will help you do just that. They’re on sale right now so don’t miss out!

So far, 2015 is not a repeat of 2014 for investors. Last year, the investing public rushed into the different types of income stocks such as master limited partnerships, MLPs, and real estate investment trusts, REITs. The quest for yields greater than the 0% to 2% available in the investment grade fixed income markets helped push share prices higher and higher. The MLP gains party came to a stop (a temporary stop in my opinion) with the drastic declines in the prices of crude oil and natural gas in the second half of the year. REITs kept on chugging upward until just about one month ago. Now REITs are falling, with most of the blame based on fears that market interest rates will soon start increasing. The market is over-reacting to drive down REIT share prices, providing an excellent buying opportunity.

Stock market participants tend to view REITs almost as another form of fixed income investing. A commercial building with a long term lease contract sort of looks like a long term bond with fixed interest payments. This perceived correlation between REITs and bonds causes the market to buy or sell REIT shares in response to expected interest rate changes. The possibility of rising interest rates poses three challenges to REIT share prices.

- First, the mathematical effect of rising rates for bonds is lower prices. The same expectation is often applied to REIT values.

- Second is the belief or expectation that higher interest rates in the bond market will cause investors to sell REIT shares and reinvest that money in “safer” bonds, once bonds are paying comparable yields.

- Third, REITs themselves use significant levels of debt in their capital structures, and higher interest rates could increase interest expenses and reduce the cash available to investors.

These factors do not need an actual increase in market interest rates to cause a sell-off in REITs. An expectation of higher interest rates starts the spinning of the above factors in the minds of the general public and financial network pundits, leading to share selling and share price declines.

The dangers to longer term REIT returns are overblown and sell-offs in the sector like we have seen in the past month are opportunities to add to your favorite, quality REIT positions. Here are the reasons why rising rates will not affect REIT returns in the long run:

- Currently REITs yield significantly more than investment grade bonds. The 5-year Treasury yields 1.6% and the 10-year Treasury pays 2.1%. The average yield in my equity (property owning) REIT database is 3.8%. This means you can easily build a REIT position in your portfolio that has an average yield of 4.5% or higher. Quality REITs on the financing side can be found with yields in the 6% to 8% range. If and when interest rates finally do start to increase, I do not think that the 10-year Treasury is going to zoom to a 6% yield. Do you? REIT investors are earning a significant premium, which adds a significant amount of cash earnings above what high quality bonds are paying. Higher bond interest rates will just reduce the spread, not make bonds more attractive.

- The best run REITs offer the additional benefit of a growing dividend stream. About two-thirds of the 120 REITs in my database have increased their dividend rates once or more in the past year. For dividend-focused investors, steadily rising dividends are the cure for any short term disruptions in the market. After a few years of owning a rising dividend stock, your yield on the original investment is so attractive, it is easy to mentally weather downturns in the market.

REITs as a group have declined by about 6% over the past month. After more than a year of steadily increasing share prices, some of the higher quality companies – in my opinion – had become too expensive (resulting in a less than attractive yield). Now some of these companies have come down, pushing yields up and offering much more attractive total return potential. Here are two top tier REITs that now deserve a closer look from some of your investment dollars.

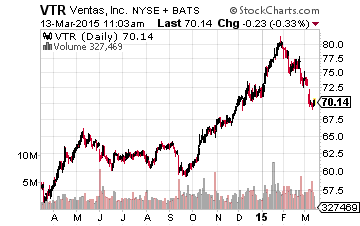

Ventas, Inc. (NYSE:VTR) peaked just above $80 per share in late January, which pushed the yield below 4% down to about 3.8%. I like VTR when it yields above 4.5% and at the current $70.40 per share, the yield is now 4.48%. Ventas increased its dividend by 9% late in 2014.

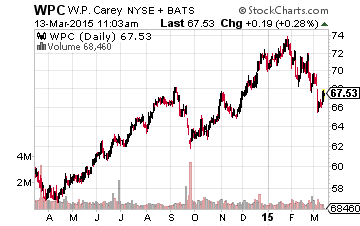

W.P. Carey Inc. (NYSE:WPC) topped out earlier this year at just under $74, with a yield of 5.1% at that price. Now at $67.30, the yield is a more attractive 5.65%. WPC typically increases its dividend rate every quarter, with 6% growth in the per share payments over the last year.

A well-chosen mix of equity and finance REITs will provide both a high yield and growing dividends. The average yield of the REITs on my Dividend Hunter recommendations list is over 7%, and every REIT I recommend grows its dividends. Rising bond interest rates are not a concern or of interest with this type of income return.