Why US Bonds Love Chinese Tariffs

For many, one of the most surprising impacts of the administration’s $50 billion in tariffs on Chinese imports announced recently has been a rocketing bond market.

Since a recent low, the iShares 20+ Year Treasury Bond ETF (TLT) has jumped by 2.75 points, the largest move up so far in 2018.

The tariffs are a highly regressive tax that will hit consumers hard in the pocketbook, thus reducing their purchasing power. It will dramatically slow US economic growth. If the trade war escalates, and it almost certainly will, it could shrink US GDP by as much as 1% a year. A weaker economy means less demand for money, lower interest rates, and higher bond prices.

There is no political view here. This is just basic economics.

And while there has been a lot of hand-wringing over the prospect of China dumping its $1.1 trillion in American bond holdings, it is unlikely to take action here. The Beijing government isn’t going to do anything to damage the value of its own investments. The only time it actually does sell US bonds is to support its own currency, the renminbi, in the foreign exchange markets.

What it CAN do is to boycott new Treasury bond purchases, which it already has been doing for the past six months. This is a major reason why 10-year US Treasury bond yields have soared from 2.03% to 2.95% since July.

The tariffs also raise a lot of uncertainty about the future of business in the United States. Companies are definitely not going to increase capital spending if they believe a depression is coming, which the last serious trade war during the 1930s greatly exacerbated.

While stocks despise uncertainty, bonds absolutely love it.

Those of you who are short the bond market through the ProShares UltraShort 20+ Year Treasury ETF (TBT) have a particular problem that is often ignored.

The cost of carry of this fund is now more than 6% (two times the 2.85% coupon plus management fees and expenses). Thus, long-term holders have to see interest rates rise by more than 6% a year just to break even. The TBT can be a great trade, but a money-losing investment.

China, which has been studying the American economic and political systems very carefully for decades, will be particularly clever in its retaliation. And you thought all those Chinese tourists were over here just to buy our Levi’s?

It will target Republican districts with a laser focus, and those in particular who supported Donald Trump. It wants to make its measures especially hurt for those who started this trade war in the first place.

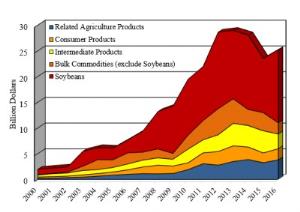

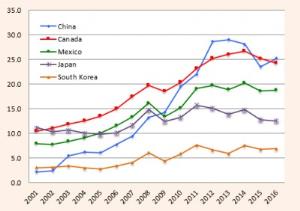

First on the chopping block: soybeans, which are almost entirely produced in red states. In 2016, the last full year for which data is available, the US sold $15 billion worth of soybeans to China. Which are the largest soybean producing states? Iowa, followed by Minnesota.

A major American export is aircraft, some $131 billion in 2017, and China is overwhelmingly the largest buyer. The Middle Kingdom needs to purchase 1,000 aircraft over the next 10 years to accommodate its burgeoning middle class. It will be easy to shift some of these orders to Europe’s Airbus Industries.

This is why the shares of Boeing (BA) have been slaughtered recently, down some 13.5% from the top. While Boeing planes are assembled in Washington State, they draw on parts suppliers in all 50 states.

Guess what is the biggest selling foreign car in China? The General Motors (GM) Buick, which saw more than 400,000 in sales last year. I have to tell you that it is hilarious to see my mom’s car driven up to the Great Wall of China. Where are these cars assembled? Michigan and China.

The global trading system is an intricate, finely balanced system that has taken hundreds of years to evolve. Take out one small piece, and the entire structure falls down upon your head.

This is something the administration is about to find out.

Soon to Become an Endangered Species

The Diary of a Mad Hedge Fund Trader, published since 2008, has become the top performing trade mentoring and research service in the industry, averaging a 34.84% annual return for ...

more