Wage Growth Acceleration Not Likely Unless Skills Gap Narrows

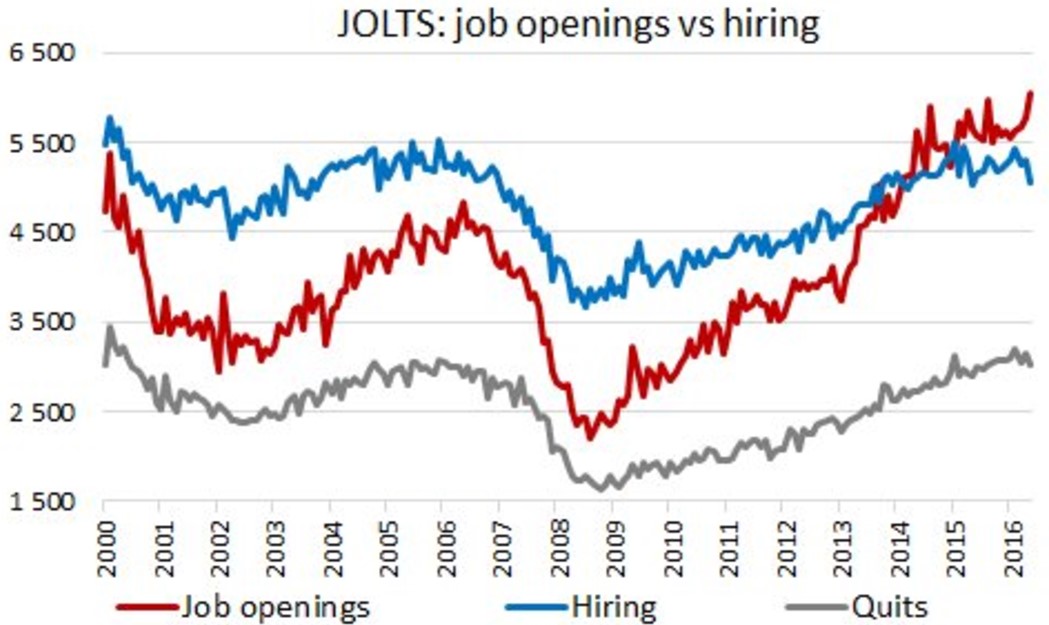

The increase in demand for workers isn’t leading to accelerated wage growth because there is a skills gap between what the labor force has and what employers want. The chart below reinforces the chart I showed in a previous article which had survey data. As you can see, hiring has fallen while the job openings have risen. The economy is changing and the workers haven’t adapted to the change. The brick and mortar retail sector will continue to hemorrhage jobs while some in-demand jobs like engineering will continue to go unfilled. The low-wage workers who lose their jobs in manufacturing and retail will be crushed. The next potential sector get hit will be taxi drivers and truck drivers as automation takes their jobs.

The Fed shouldn’t make policy based on these changes in the labor market because interest rates cannot affect whether these people acquire new skills. Some doves claim that the Fed should wait for more wage gains because some groups haven’t shared in the prosperity of this cycle. The reality is if you don’t acquire the necessary skills to get a new job, you will never share in the wage gains. Secondarily, the Fed shouldn’t raise rates ahead of anticipated wage gains because 4% wage growth will likely never happen. The labor market is tight, but the lack of productivity growth and the skills gap prevents the wage growth from pushing inflation higher. The economy won’t be accelerating to 3% GDP growth this year, so there won’t be enough demand improvements to boost inflation.

As you can tell, my point doesn’t mean the Fed should be hawkish or dovish. It’s about recognizing the factors which are affecting the labor market. It explains the unusual lack of accelerated wage growth even though jobless claims are low. This exemplifies why it’s impossible to categorize the labor market in one fell swoop as different sectors have different aspects which affect them. The labor market could be great for engineers, but terrible for those trying to get an entry-level job in retail. The decline in retail jobs and fast food jobs (due to the implementation of kiosks) is another factor which will suppress the ability for young people to get jobs. It’s not a great situation for young people as college tuitions rise and it’s also tougher to get a job as old people are competing more for the same jobs and because the jobs are disappearing.

The chart below provides evidence for why wages aren’t increasing as much as you’d expect them to. Return on capex and labor productivity are weak. Often, I blame the lack of investment into initiatives by firms for the lack of productivity growth as they have a record $1.5 trillion on their balance sheets. However, the other aspect at play is the skills gap which may be preventing large companies from hiring the workers they need to execute on the innovations they want to achieve. There’s always a reason for everyone’s action in the economy. Businesses wouldn’t stop innovating if they could get good returns by hiring workers at competitive wages.

Speaking of negative economic trends, Bank of America just lowered its forecast for 2018 GDP growth from 2.5% to 2.1% because it is worried about the prospects of fiscal stimulus, the weak auto sector, and because policy uncertainty will delay production. The chart on the left shows the lowered forecast is in-line which the Fed’s forecast and the blue-chip forecast. The chart on the right shows the consumer sentiment surveys have come down because of the lack of fiscal policy action. I agree with the point on autos as I have been saying the auto loan bubble will burst this year. The points on fiscal policy reform will depend on what happens this summer. I think it’s too early to project what will happen in 2018; it’s also unnecessary for investors to bother with that. I’m more concerned with the immediate future which is the Q2 earnings season, the prospect of healthcare reform, the debt ceiling, and the price of oil.

On the healthcare debate, Ted Cruz made a statement on Friday. He called for some free market solutions, such as the ability to buy healthcare across state lines (which was what candidate Trump campaigned on), capping medical malpractice lawsuits, and implementing tax-free health savings accounts. These are predictably conservative points. He said he would work with Congress to get a plan done. I think Ted Cruz is making a calculated move to get some more of what he wants in the bill. All Republicans want to get something done. I’m optimistic on the chances for a plan to be passed by August.

One of the best ways to determine where the economy is headed without reviewing each report is to look at the bond market. The 2s 30s spread has moved to the lowest difference this cycle. It’s more pessimistic than the 2s 10s spread. The bears and bulls both have faulty interpretations of this. The bears claim the next recession is very close, but the reality is we’re at least 6 months from seeing the yield curve invert. After the yield curve inverts, a recession could be a year later. Claiming a recession is incoming when this signal shows it’s at least 18 months away is disingenuous. The bulls are wrong because they claim the yield curve doesn’t matter anymore because the Fed is selling bonds. This is also disingenuous because that makes it look like they only pay attention to data which supports their entrenched thesis.

Conclusion

The Fed is anticipating wage growth which won’t come. It’s using this potential inflation as a reason to raise rates. My point may not matter because it’s not as if declines in inflation will change their minds on the December rate hike or the unwind of the balance sheet. I gave them the benefit of the doubt in the July meeting saying the Fed would do a dovish hike because inflation growth had fallen so fast. That ended up proving to be a failed prediction, so I’m learning from my mistake and expecting hawkishness despite poor inflation data.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more