Udating Inflation Expectations Heading Into FOMC

Let’s take a quick look at the state of bonds, yields and spreads.

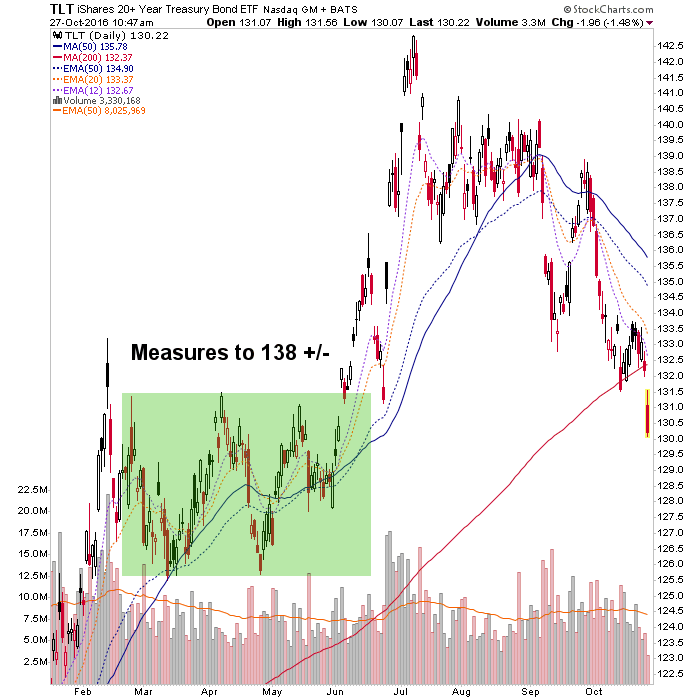

First, remember when we projected upside of 138 on TLT? Remember when they (momo freaks, people stampeding out the Brexit door and the herd rushing to risk ‘off’ when risk was about to turn ‘on’) drove TLT to and through target? Well now, despite a weakening US stock market, TLT is not providing welcoming arms to risk ‘off’ refugees.

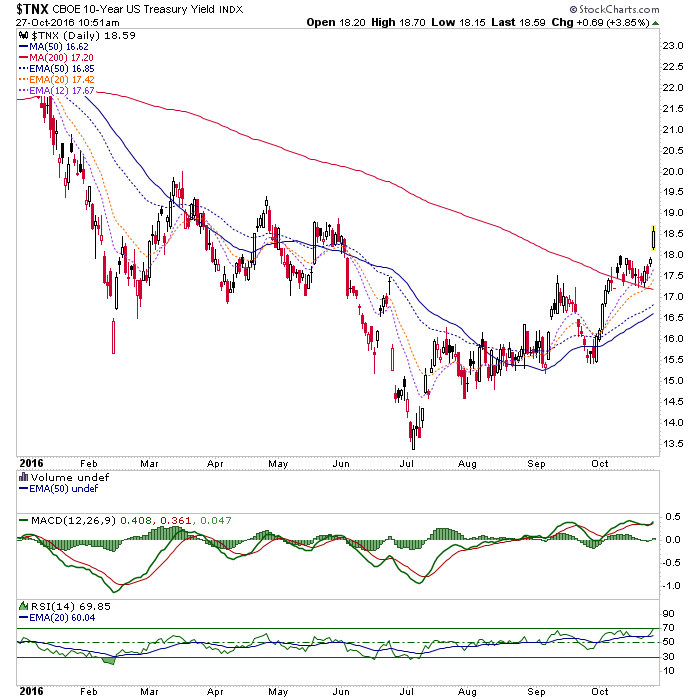

That is because interest rates are rising, obviously and as we have been noting. These are market-driven rates and they are not rising because the bond market is afraid the Fed is going to put on another puny 1/4 to the FFR. Whatever the modern Treasury bond market is nowadays, it is pushing up yields of its own devices.

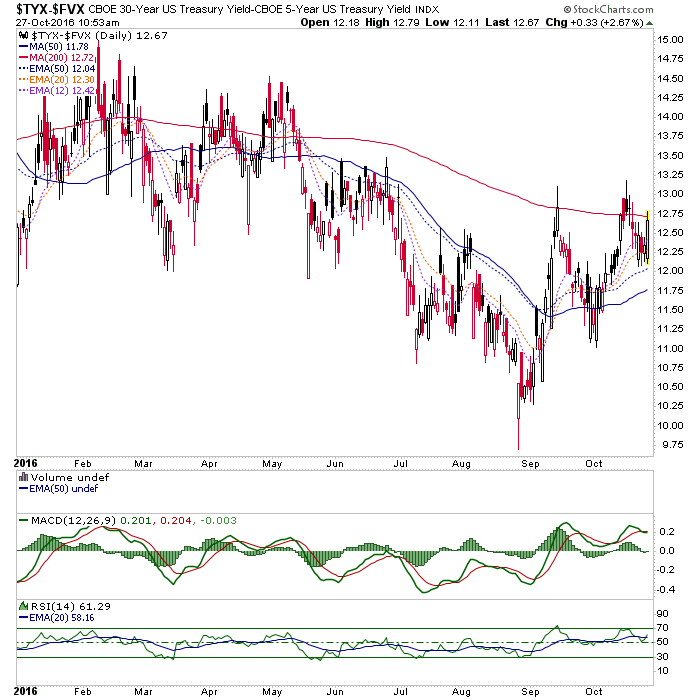

But we have also been noting that the yield curve has been constructive to bottom. Here’s the latest view of the 30yr-5yr yields. Still constructive. When the curve turns up, assuming it does so for more than a bounce, it is in rebellion mode toward policy makers who, as evidenced by 2011’s brilliant Operation Twist manipulation, want it going the other way over the long-term.

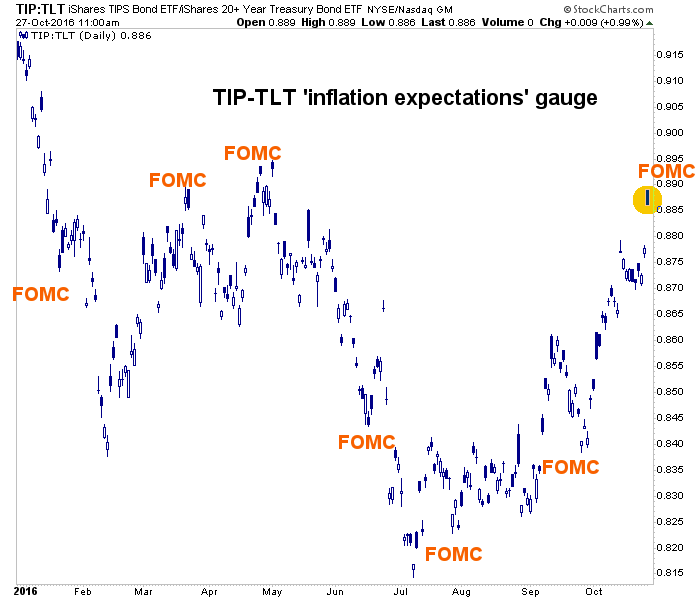

And that leads us to inflation expectations and a meeting of our friendly centralized policy monetarists on November 1st and 2nd. Here is one item among many they’ll be looking at as they consider how to baffle us with bullshit this time.

Disclosure: Subscribe to more