TIPping Points?

The Federal Reserve’s complete change last year wasn’t something that happened all at once. There were several hints that a lot was going on behind the scenes that may never become public, including five years (now four) down the road when the full policy transcripts are released to the public. There was more interest in R* and secular stagnation, for one, as well as changing thoughts on inflation expectations.

The latter has been an important topic for policymakers all along, but more so going back to early 2012. After all, by last March the PCE Deflator hadn’t registered 2% in compliance with the Fed’s mandate for four years at that point despite massive additional balance sheet expansion ($1.7 trillion through QE3 and QE4). Through it all, maintaining that it wasn’t but a “transitory” concern, Janet Yellen in particular remained steadfast that long run inflation expectations (anchor) had not changed.

In a speech on March 29 last year, her position suddenly softened. The events that started 2016, grand global liquidations, could be nothing other than such a wakeup call. The Fed after all had been projecting nothing but clear sailing as far back as 2014, but here the economy and markets were pulling off the exact opposite circumstances. She admitted to the Economic Club in New York last March:

Nevertheless, the decline in some indicators has heightened the risk that this judgment could be wrong.

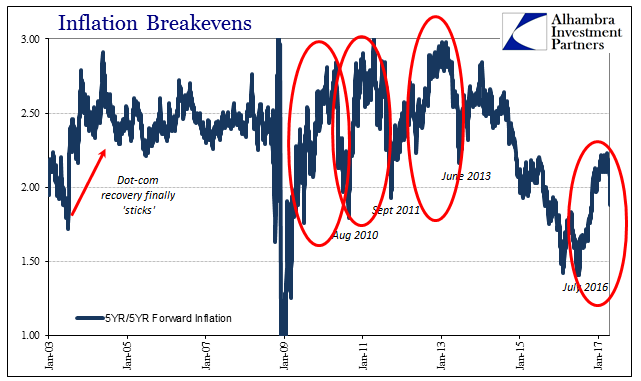

The judgment she was referring to was those long run forecasts of so-called professional forecasters that never, ever budge in their assumptions that inflation expectations remain fully anchored right at 2%. That anchor at that level would mean a high degree of faith in monetary policy to by the long run get it right or fix whatever was ailing. The Fed’s preferred market-based inflation indicator, the 5-year/5-year forward inflation rate, desperately disagreed and more so all the time. It was projecting not just a continued miss on the inflation target but some pretty dour long run implications of what it might mean that Fed could be so powerless for so long even with great effort expended on their part.

I wrote instead right on February 11 last year:

This week, however, still needs conclusion with the economic picture having been unbelievably darkened by the scale of the liquidations this week. In what might be Yellen’s greatest rebuke, 5-year/5-year inflation forwards collapsed today to the lowest level since March 3, 2009. The longer she holds to “professional forecasters” as some legitimate resource for inflation anchor estimations, the worse the Federal Reserve looks by more significant comparison.

I believe that more than anything is why the Fed was forced to change its outlook and accounting of the past (including QE). They were being made the fool and over the next several months they started to get with reality (or at least partway) rather than holding on to the “transitory” narrative that QE was going to extract an economic miracle at the last minute.

What is most interesting from that March 29 speech is what Yellen actually admitted as to what might be causing especially the utter collapse in the 5-year/5-year forward rate:

Analysis carried out at the Fed and elsewhere suggests that the decline in market-based measures of inflation compensation has largely been driven by movements in inflation risk premiums and liquidity concerns rather than by shifts in inflation expectations. [emphasis added]

It was the first time (that I can find) the Fed Chair finally confessed that QE maybe hadn’t accomplished the most basic transformation (“money printing”), correctly, for once, linking together (in reserved fashion, of course) what was going on across the whole bond market (as well as funding) with explicit failure of monetary policy so far as its primary duty – currency elasticity. By all convention, there should not have been any liquidity concerns whatsoever in early 2016, just as 2015 and all years since the first MBS was purchased under QE1, because by that time there were $2.4 trillion in bank reserves supposedly available to satiate any amount of dollar desire possible.

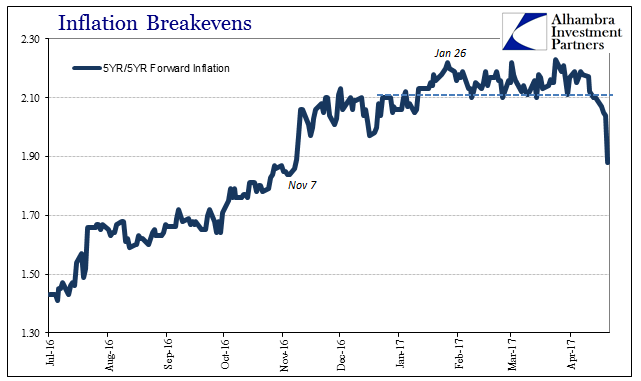

It wasn’t until early July and the Japanese birthed “reflation” that the forward rate began to once again move back upward. But it didn’t get all that far, matching at its peak in January 2017 some of the worst points during the early post-crisis period – back when markets were still confirming what monetary policy was after only suspecting as far back as 2007 what it was not.

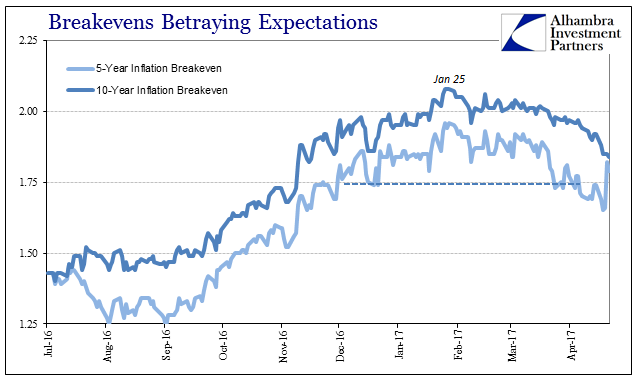

Having traded, like almost everything else, sideways for several months, 5-year/5-year forwards began to decline again in early April. Yesterday, they collapsed though the reason for it is unclear. There was a highly unusual TIPS auction where dealers either largely abstained from participation (a record low takedown) for whatever their own reasons or private investors were so desperate for 5-year inflation protection they outbid everyone. That last wasn’t likely given the behavior of oil the past few days, meaning that it was very likely liquidity concerns drove non-dealer money in the direction of whatever OTR paper could be found – 5-year TIPS being it.

If there was some technical reason for the auction to go the way it had, we might expect this irregularity to unwind and do so relatively quickly. It may yet still, but in trading today the huge, unusual spread persisted.

What do we make of all this? I have to think that Yellen’s instinct from thirteen months ago was correct, an unusual position for both of us. There are, after all, quite a few indications that liquidity once again isn’t what it was even just a few weeks ago and very far from where it “should” be. She, in my view, had a big hand in that given the behavior of a lot of these markets ever since the last “rate hike.” Things may be changing again, though it is far too earlier to be confident in making that a more determined declaration. There is, however, at the very least more that looks like last year than anyone should be comfortable with.

Disclosure: This material has been distributed fo or informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more