Three Indicators Suggest What’s Next For Inflation

One way to predict the future is to accurately compute the direction of future inflation. This is because the direction of inflation is a big driver of financial asset prices. Following the exhaustion of the ‘Trump trade’ in the first quarter of this year, headline inflation has been falling in rate-of-change terms. During this time, the US dollar has substantially weakened while long-dated US government bonds have traded sideways. In the past few months headline inflation appears to have turned a corner, while the dollar has also been strengthening. Looking at reliable front-runners of inflation such as the copper/gold ratio, crude oil prices and 5y5y breakeven rates suggest that inflation is set to continue strengthening.

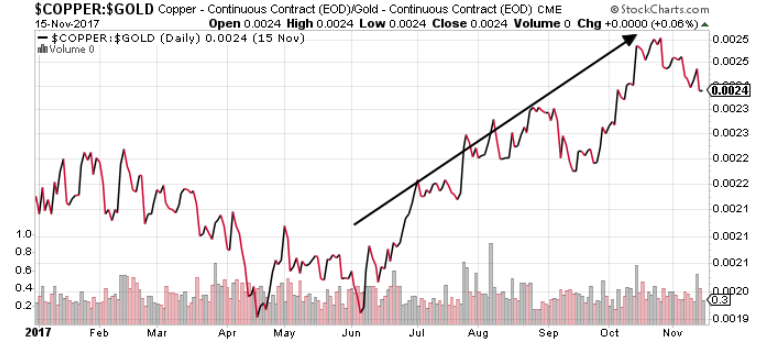

Copper to gold ratio suggests inflation set to accelerate

Favored by bond investor Jeff Gundlach, the copper to gold ratio is widely seen as a reliable indicator of future inflation. Copper is an industrial metal, and has many applications including power transmission, automobile manufacturing, and telecommunications. Thanks to accelerating GDP growth in China, Japan, the US and the European Union this year, copper prices have strengthened. On the other hand, gold tends to trade sideways or weaken when economic growth is strong. Unlike copper, gold has few industrial applications and is primarily used as a store of value. During an economic boom, investors sell gold in favor of assets such as stocks and corporate credit. As such, the trending direction of the copper/gold ratio is a good front-runner for inflation and is shown below for reference:

Up and up: Copper/gold ratio suggests a positive outlook for inflation

As can be seen from the chart above, the falling copper/gold ratio after March accurately predicted the demise of the ‘Trump trade’. Since June the ratio has been trending higher, suggesting that higher inflation is in store.

Strengthening crude oil another reason to get long inflation

Crude oil is another good front-runner for inflation. Given the importance of commodity inputs for the overall economy, rising crude prices eventually filter into prices of everyday goods and services. As prices rise, this is reflected as accelerating inflation. Since early 2016, demand growth for crude oil has been running ahead of supply. In a longer commentary on the fundamental dynamics of the crude oil market, we have argued that slow growth in supply means that the bull market remains intact for now. An overview of recent crude oil futures prices are shown below:

Crude strengthens as bull market continues

Similar to the copper/gold ratio, crude oil prices peaked in the first quarter and bottomed in the summer. Following lower crude oil prices, inflation began decelerating in rate-of-change terms. Since the summer, crude oil prices have strengthened sharply. Given crude’s ongoing strength, accelerating inflation looks set to follow.

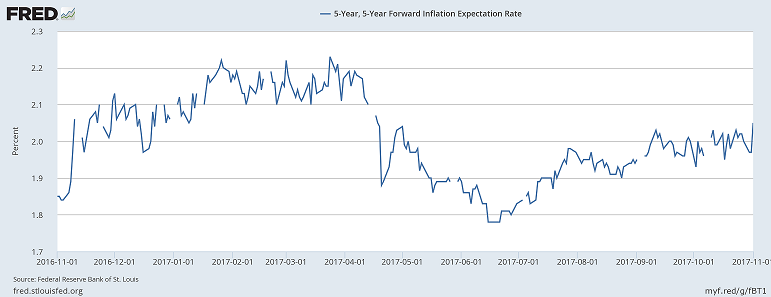

5y5y breakeven rates trending higher, but relatively subdued

The last inflation indicator is the 5-year, 5-year breakeven rate. The gauge is computed from prevailing inflation swap rates, and is the market’s expectation of inflation over 5 years, 5 years from now. Unlike commodity-based indicators, 5y5y breakeven rates are not true inflation front-runners. Instead, they indicate to what extent inflation expectations are already ‘priced in’ today. Looking at the rate is therefore instructive, and is shown below:

Positive trend, with potentially more to come

Similar to the copper/gold ratio and crude oil prices, inflation expectations peaked in the first quarter of the year and then headed down. By June, inflation expectations had bottomed and proceeded to rise. Looking at the previous two indicators, inflation expectations are likely to continue rising in the near future.

A good backdrop for the US dollar

All in all, inflation looks set to keep accelerating today. Recent CPI and core CPI numbers confirm our view, with headline inflation running at 2% and core inflation at 1.8% (versus expectations of 1.7%). The last time both growth and inflation were accelerating in tandem was in the fourth quarter of 2016. During that time, the US dollar soared while gold and long-dated bonds suffered significant losses. While the outcome of accelerating inflation may not be as dramatic today, the US dollar has many reasons to keep strengthening for the rest of 2017.

Any opinions, news, research, analyses, prices or other information is provided as general market commentary and does not constitute investment advice. MarketsNow will not accept liability for any ...

more