The Big German Zombie

It’s kind of a cheap shot to go back and rehash corporate statements from way back in the past. Still, when the topic is banking and why the monetary system refuses more than intermittent and minor progress, it’s worth the revisit. What’s different now than before 2008, really August 2007, is far more than regulation. It’s the attitude that’s changed.

On August 1, 2007, Dr. Josef Ackermann, Chairman of the Board for Deutsche Bank, reported strong results for the firm. This was eight days before all hell broke loose.

After an excellent first quarter, we delivered another outstanding quarterly result, with significant earnings growth over the same period last year. All our business divisions contributed to this growth. As a result, we delivered a very strong first half year, clearly demonstrating the power and resilience of our platform.

Obliged to put down just a few words to reassure shareholders about all the wild stuff they were hearing in the media about toxic waste and what not, Ackermann ably dismissed any concerns with hard words.

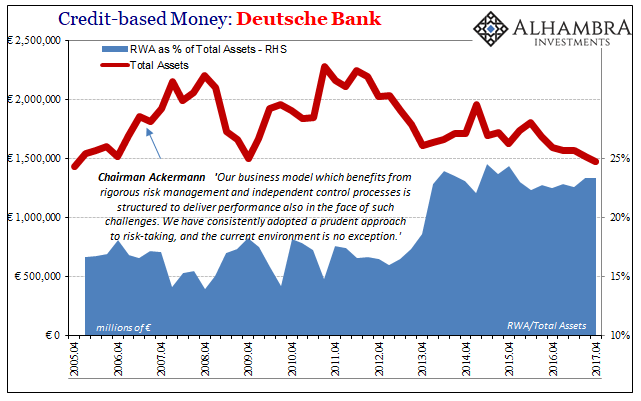

Some areas of the credit markets may continue to experience turbulent conditions, and investors may adopt a more conservative stance toward leveraged finance. Our business model which benefits from rigorous risk management and independent control processes is structured to deliver performance also in the face of such challenges. We have consistently adopted a prudent approach to risk-taking, and the current environment is no exception.

Some might read that decade-old passage and see little more than the usual bland boilerplate. It’s easy to look at that and conclude the bank chief was almost lying, claiming the bank was safe when it wasn’t.

What he was really saying, however, was that unlike some others Deutsche Bank, in his view, took risks but they were the right ones, the bets on positions (from vanilla to exotic) that would pay off no matter what. He wasn’t denying that there were risks on his sheets, Ackermann was admitting to them. That was the hubris that defined the pre-crisis era, particularly from the Asian flu up to then. Everyone knew things could get dicey like for LTCM in 1998, but that was for somebody else to worry about. Our risks were the good risks that would always pay off because we know what we are doing.

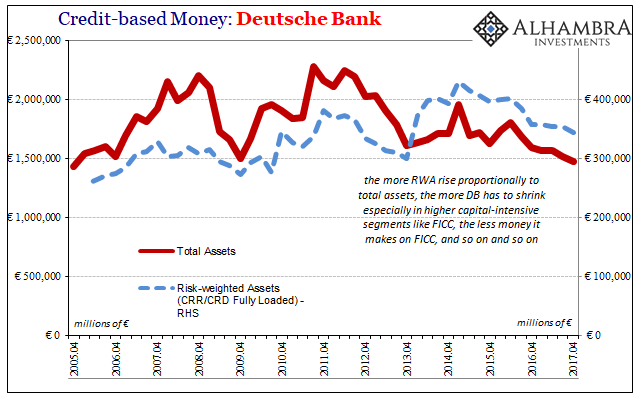

Accompanying the Chairman’s statement was the usual quarterly figures and reports. Deutsche Bank as a result of its “prudent approach to risk-taking” had increased its balance sheet to €1.86 trillion in assets. A huge part of those assets, those left mostly off-balance sheet, was its massive derivatives book that so much of the rest of the world depended upon for systemic risk absorption (in eurodollar terms, the ability to manipulate balance sheets in a predictable and capital efficient manner is modern money).

Ten and a half years later, Deutsche Bank just reported that it has shrunk yet again. Total assets, along with its derivatives portfolios, have been falling almost regularly for the past six quarters since all that “global turmoil” at the end of 2015 and the beginning of 2016. The bank blames, among other things, that hefty fine it was forced to pay for housing bubble era wrongdoing (so much for risk protocols). The bank’s problems are much deeper than that (no surprise).

It is an astonishing 35% smaller now (Q4 2017) than it was at its peak in Q3 2011 (why always 2011?), and 20% reduced from those last days of the risk-everything-eurodollar in the middle of 2007.

The problem isn’t fines or regulations, but balance sheet management. They cannot manipulate their constraints and risks like they could before the last months of 2007. There seemed a possible restoration to it between 2009 and 2011, but that later secondary crisis closed the door forever. It has become harder over time as other banks besides DB cut back on “bond trading” or FICC (or FIC, in Deutsche’s categorization), the essence of this kind of monetary flexibility.

Derivatives were absolutely essentially to the massive prior growth, mostly because, as Dr. Ackermann will be remembered for, they fooled everyone into thinking they could cheat (in a sense) on the balance sheet and there would be no cost in doing so.

Recognizing that, yes, there are huge risks involved in all these money dealing activities, there is simply no incentive to do them anyway. Many people blame regulation for that imbalance, but it always reduces to simple profit analysis. If there was money to be made here, they would do it regardless of still any lingering risks.

Instead, Deutsche’s FIC segment just posted €554 million in revenue for the latest quarter, down 29% compared to Q4 2016 even though for most of it “reflation” was the widespread trend. For the year as a whole, which wasn’t all “reflation”, FIC revenues were €4.38 billion, 14% less than in 2016. It isn’t that there is no money in money, but there isn’t nearly enough to be made to make it worth the time, effort, and now very limited balance sheet resources.

The bank is just another zombie, the formerly living, breathing monetary basis for worldwide credit-based money. Fed Chairman Bernanke was asked about zombies all the way back in February 2009.

No, assured Bernanke. “I think zombie was not an appropriate description for any of the banks,” including, clearly, Citi. They all had, in the Chair’s esteemed estimation, “substantial franchise value, they’re all lending, they’re all active, they have substantial international franchises.”

It’s another major point he got very wrong. For the economic history of the last ten years, falling back on “substantial franchise value” was his biggest mistake. It haunted him into four QE’s, and us as those ridiculous experiments failed to spark recovery. What’s even more galling, Bernanke knew this was the key to everything. He told Congress even before the crisis was over that:

If there is one message that I’d like to leave you with, if we’re going to have a strong recovery, it has got to be on the back of a stabilization of the financial system.

The zombies are still shrinking, destroying all the groundwork for any possible boom. Small consolation for anyone, but the former Chairman got that much right.

Disclosure: None.