Stocks Overreact To Potential Steel & Aluminum Tariff

After the market had declined for a couple days over fears of a hawkish Fed, many wondered if stocks would rally on Thursday after investors heard Powell give a neutral testimony. Stocks were up in the morning, but then they cratered hard after news of President Trump announcing steel and aluminum tariffs. The S&P 500 fell 1.33% and the VIX increased 13.2% to 22.47. The prognosticators have been worrying about Trump going through with a trade war ever since he campaigned on protectionism. After he made deals with China which opened up their markets, it looked like Trump wasn’t going to hurt the consumer with high tariffs. I’ve been a proponent of ignoring the campaign rhetoric as I don’t expect a trade war.

The tariffs on aluminum and steel caused the market to fall even though this is probably a small change which could cause a scuffle rather than an outright trade war. It’s like if someone considered investing 1% of their money in Apple stock. Then the investor gets emotional about a decline in stocks even though there was only a consideration of a small investment. To use a colloquial term, the market went from 0 to 100 really quick. The market looked at a potential small tariff and immediately feared the worst: a trade war. It’s not as if this potential 25% tariff on steel and 10% tariff on aluminum are the only policies in place that a country has to protect itself. America’s weak dollar policy is a far bigger deal to the global trade battle than tariffs on steel and aluminum.

Aluminum & Steel Stocks Rally While End Users Fall

I think the positive reaction in aluminum and steel stocks and the negative reaction in the end users of those commodities are appropriate, but the overall market decline is an overreaction. U.S. Steel stock was up 5.75%. AK Steel was up 9.5%. Caterpillar stock was down 2.84% and GM stock was down 3.99%. The price of these end materials will increase and the companies who produce them will be investing in their production which will create jobs in areas like Kentucky. If this plan goes through, it’s a small negative for the consumer and a positive for workers in the aluminum and steel industries.

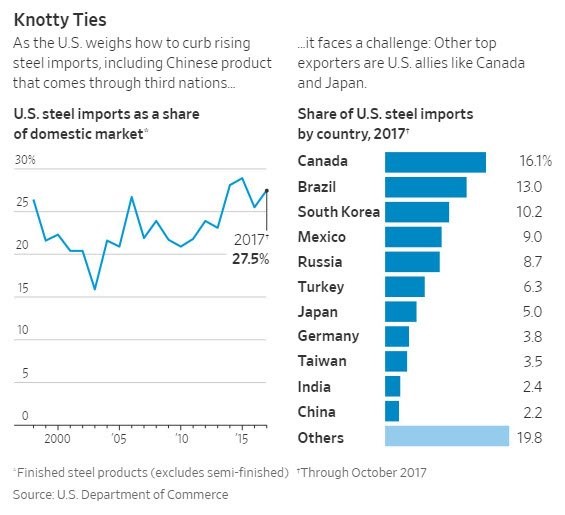

The chart on the left shows the U.S. steel imports as a percentage of the domestic market is 27.5%. It doesn’t seem like there has been an increase in dumping recently. The chart on the right shows the percentage of U.S. steel imports by country. As you can see, allies like South Korea, Japan, Germany, and Canada all export steel to America.

The Effect Will Be Small

This will only matter to most stocks if there’s an overall change in how the Trump administration operates. Considering how conservatives are already opposing these tariffs, it’s a far stretch to expect tariffs on more items. Comparing these tariffs to Smoot-Hawley is ridiculous. The Smoot-Hawley Act in 1930 raised tariffs on over 20,000 imported goods. As you can see from the chart below, steel and aluminum imports account for about 2% of total goods imports.

Congressional Conservatives & Economic Advisor Gary Cohn Hate This Plan

It’s a very contentious decision to go ahead with these tariffs which is why it’s far from certain that they will be enacted. Most Republicans in Congress are against the tariffs and even Trump’s chief economic adviser Gary Cohn is against them. GOP Senators Ben Sasse, Orin Hatch, John Thune, and Roy Blunt came out against them along with conservative Representative Mark Meadows. Gary Cohn is battling trade adviser Peter Navarro, who supports the tariffs, within the Trump administration. Trump stated the tariffs will be implemented next week. It will be interesting to see if the stock market selloff causes a policy shift. The plan is a blanket tariff on all countries without any quotas. That’s different from the Commerce Department’s recommendation two weeks ago which called for a 24% global tariff on steel with a 53% tariff on specific countries and a 7.7% tax on aluminum with a 23.5% tax on specific nations.

Retaliation From Foreign Trade Partners

While it’s unlikely for the Trump administration to go ahead with more tariffs, the worry is about retaliation from the E.U. and China. The E.U. is considering a tariff on Harley Davidson motorcycles and China is considering a tariff on sorghum which is a cereal grain used to feed livestock. Furthermore, the German Steel Association says the U.S. tariffs violate WTO rules. Therefore, the tariffs need to get passed the WTO rules, Trump advisor Gary Cohn, the threat of a falling stock market, and the threat of a counter punch from the E.U. and China. These are the reasons why I think the stock market’s reaction was too harsh.

The worst case scenario is if China decides to retaliate by selling some of its U.S treasuries. That could disrupt the market. The economy will see increased inflation from the price increases the tariffs cause. This is along with the already inflationary tax cuts and spending increases. The inflation would cause rising rates, so China selling their treasuries would cause even more selling. This is a low probability event.

In the flight to safety trade on Thursday, the treasuries actually rallied. The 10 year bond yield fell 5 basis points to 2.81%. That’s makes the total decline in the 10 year bond yield, from the high on February 21st, 14 basis points. With this decline in yields, I’m much more neutral on the 10 year bond. 70% of the decline I called for has occurred.

Conclusion

It feels like the market used the potential tariff as an excuse to sell off as it decides on whether it wants to re-test the February lows or the all-time high. With this 3 day decline, the market is down 6.79% from the peak. It needs to decline 3.6% from here to re-test the February 8 closing low.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more