Short XLF For Risk Management

We have been noting that the US stock market is bullish and that it is also at high and increasing risk. I kept positions because of the bullish technical trend and because of the Santa seasonal, which sure looks like a non-starter this year. It could morph into a January effect as the post-election euphoria gets one more burst after a low volume consolidation. BUT…

Think about it; this year tax winners have more reason to delay profitable sales until 2017. Not only is there the usual reason of getting to hold on to your money for another year before the government takes it, but in delaying another year there is also now the likelihood of tax rates being lower when gains are finally realized.

Anyway, it’s low volume silly season and maybe I am thinking too much. But thus far I have been hedging with a high level of cash and currently out of favor (i.e. risk ‘off’) items like long-term Treasury bonds (TLT & IEF) and even a couple of high quality gold stocks (one royalty and one miner, and getting tempted to sell them, mind you).

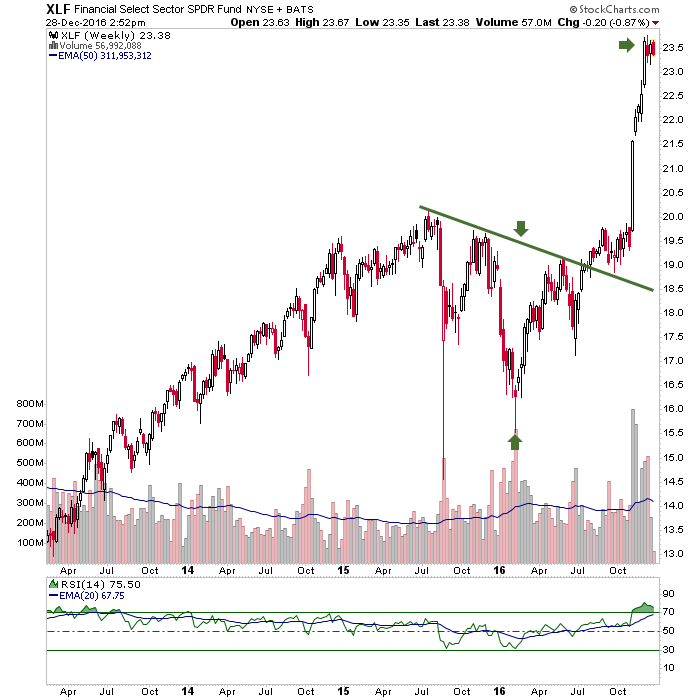

But I have also now taken my first outright short position, against the prime beneficiary of the Trump-induced market euphoria, the Financial sector. It’s just a straight, non-leveraged short against XLF. This is a lot like being long T bonds because if they rise the Banks and Financials are going to drop. So it’s similar to those risk ‘off’ positions in that way. XLF is by the way, at an implied target of 23.50. If it doesn’t work it’ll likely mean the risk ‘on’ stuff is working and getting what I think could be the final Trump hump bump (I can’t wait til the day I am able publicly coin the phrase “Trumpty Dumpty” ©, which you heard here first!).

If this were not silly season I’d probably be taking out the jokes and making this an NFTRH+ update, but I just don’t trust the market’s signals until we iron things out in January and get back to a normal mode of operation.

Disclosure: Subscribe to more