Seven Myths About Municipal Bonds

In the Know: Professionals at Franklin Templeton Investments offer a quick but insightful update on a pressing investment topic.

Today, Rafael Costas and Sheila Amoroso clear up some misconceptions about investing in municipal bonds and share their view on the current state of the market. (Rafael Costas and Sheila Amoroso are co-directors of the Municipal Bond Department, Franklin Templeton Fixed Income Group®.)

Myth 1: Recent volatility in municipal bonds means it’s a bad time to invest.

Reality: Over the past few years, the municipal market has seen some bouts of volatility, stemming from fears of higher interest rates as well as isolated credit events in Puerto Rico and Detroit. In many cases, we believe the realities are far less serious than reported and may not reflect the market’s underlying fundamentals. Market volatility may also provide the opportunity for potentially higher income for long-term municipal bond investors. Increased volatility causes yields to move higher, and prices lower. While many investors tend to sell when there are higher yields and volatility, we believe it is an attractive time for investors to consider investing in municipal bonds for their increased income potential, because over the past 20 years, municipal yields have generally come down from their highs.

Myth 2: When US interest rates start to rise, it’s best to be on the sidelines when it comes to muni investing.

Reality: When interest rates rise, it’s true that bond prices generally fall. However, when interest rates rise, bond investors also have the opportunity to invest in new, higher-yielding bonds. Municipal bond prices are sensitive to interest-rate movements and as history has shown, even experts can’t precisely predict when, in which direction, or by how much long-term interest rates will change. They also can’t precisely predict the market reaction, such as a municipal bond selloff. When markets sell off, there may be an opportunity for the savvy investor to increase income by investing in the higher-yielding bonds. By contrast, worried investors sitting on the sidelines may miss out on this potential income.

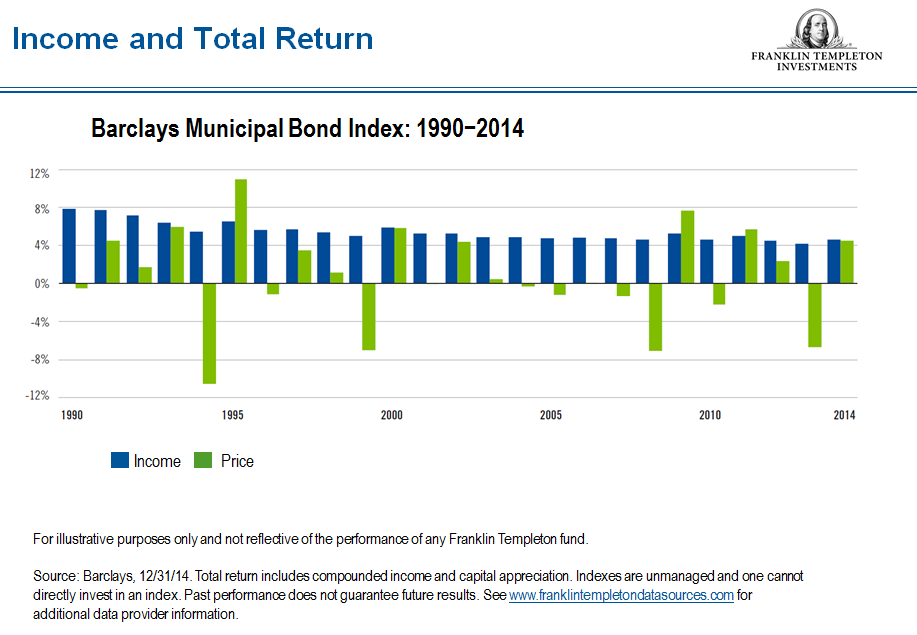

For municipal bond investors, income has its advantages and has been the primary driver of total returns. Over the long term, income historically has contributed much more to municipal bond total returns than price appreciation.1 And over the short term, income has helped to cushion overall municipal bond total returns when prices have declined. Although the prices of municipal bonds declined in 12 out of the 24 calendar years, as illustrated in the chart below, the bonds’ income helped offset the price movements. In fact, after considering income, municipal bonds experienced negative total returns in only four out of the 24 calendar years.2 Please remember, past performance does not guarantee future results.

Myth 3: Municipal bond investors have a limited number of investment choices that are all the same, so it really doesn’t matter what you invest in.

Reality: As of December 2014, the municipal bond market included over 100,000 issuers and over 950,000 outstanding issues.3 And even for the same issuer, there can be different securities with different structures. Within this vast and diverse universe, municipal bond investors must carefully evaluate individual bonds based on numerous factors, including their respective sectors, maturities, yields, risk, covenants and bondholder protections. Against this complex backdrop, it is more important now than ever for investors to know what they are holding. A knowledgeable and experienced research team identifies what it considers to be attractive investment opportunities based on a number of criteria and, more importantly, can manage potential problems.

Myth 4: Municipal bond fund managers are all the same.

Reality: The truth is, portfolio managers can take very different approaches to investing in the sector. In an effort to boost their portfolios’ yields, some managers use leverage, invest in derivatives or invest heavily in lower-quality sectors. In the municipal bond market, leverage is generally associated with greater volatility of principal. Other managers stick to a conservative, “plain vanilla” approach—which we favor at Franklin Templeton—to seek to maximize potential income. It’s wise for investors to be aware of these and other differences.

Myth 5: Municipal bonds are just for the wealthy.

Reality: Municipal bonds are used to fund the public works projects that affect all of us every day. They fund the roads and bridges we drive over daily and the water facilities that support our homes and the schools in our neighborhoods. For many everyday investors (not just the wealthy) seeking to generate income in retirement, we think municipal bonds are worth considering.

Myth 6: Bankruptcies in places like Stockton, California, and Detroit, Michigan, reflect the health of the entire asset class.

Reality: Overall, many state and local governments have received increased revenues as the economy has improved. But challenges remain ahead for some state and local governments, primarily rising costs associated with pensions and health care. While state governments have financial flexibility to close budget gaps, local governments generally have less. However, most local governments will not choose bankruptcy to solve budget problems. Although there are thousands of local governments, most are small issuers that, combined, make up a small portion of the municipal bond market. The municipal market is broadly diversified, and approximately 60% of the market consists of revenue bonds with a pledged revenue source dedicated to paying off debt, i.e., water and sewer.4

Myth 7: A passive approach is best when it comes to investing in municipal bonds.

Reality: If we look at the most popular benefits of exchange-traded funds (ETFs) that take a passive approach versus actively managed portfolios, we find that actively managed municipal bond strategies already provide those benefits, or that these perceived benefits are overstated, in our view. These benefits include tax efficiency, the ability to trade within a day and the ability to concentrate on specific sectors of a market.

Tax efficiency is usually an important consideration when it comes to capital gains distributions because such distributions are generally taxable, and we believe one of the benefits of Franklin’s active approach over the years has been the management of capital gains and losses. Ultimately, what matters most to many investors is the potential income he or she receives, and as we know, most of the total return that municipal bond securities have generated over time has been through tax-free interest. Of course, for investors subject to the alternative minimum tax, a small portion of interest may be taxable.

To us, the advantage that ETFs offer of being able to trade within a day is moot because the bulk of the muni market is not a “trading” market, but rather a “buy-and-hold” market made up mostly of retail buyers who own either funds or individual bonds.

While we are long-term, buy-and-hold investors, we can also become active to take advantage of potential opportunities provided by the markets or to make changes to our portfolios in anticipation of negative credit trends. Active management allows for diversification among sectors, maturities and credit quality.5 Muni bond investing in general has not lent itself well to “sector” investing, as we think the muni market is too small for that strategy to work efficiently.

The comments, opinions and analyses expressed herein are personal views of the investment managers and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. The information provided in this material is rendered as at publication date and may change without notice, and it is not intended as a complete analysis of every material fact regarding any country, region, market or investment.

This information is intended for US residents only.

What Are the Risks?

All investments involve risks, including possible loss of principal. Municipal bonds are sensitive to interest-rate movements. Municipal bond prices generally move in the opposite direction of interest rates. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

1. Source: Morningstar, Inc. (NASDAQ:MORN), as of 12/31/14. Barclays PLC (NYSE:BCS) (LON:BARC), 12/31/14. See www.franklintempletondatasources.com for additional data provider information. Total return is based on the Barclays Municipal Bond Index and includes compounded income and capital appreciation or depreciation. Indexes are unmanaged, and one cannot invest directly in an index.

2. Source: Barclays, 12/31/14. Total return is based on the Barclays Municipal Bond Index and includes compounded income and capital appreciation. Indexes are unmanaged, and one cannot invest directly in an index.

3. Source: Bloomberg, 12/31/2014.

4. Source: Barclays Municipal Bond Index, as of 3/31/15. Indexes are unmanaged, and one cannot directly invest in an index.

5. Diversification does not guarantee profit or protect against risk of loss.

Disclosure: None.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears ...

more