Market Data Hints At Higher Rate-Hike Odds

The Federal Reserve isn’t expected to raise interest rates at next week’s policy meeting, but the Nov. 1-2 gathering will be closely watched for signs that the central bank is preparing to make a move when it reconvenes in December.

The futures market is currently predicting a 78% probability that the Fed will squeeze policy on Dec. 14, based on Fed funds pricing via CME as of Oct. 25. By contrast, the probability of a rate hike for next week’s meeting is priced at just 8%.

The market may be confident about the December FOMC meeting, but New York Fed President Bill Dudley prefers to err on the side of ambiguity… for now. “There isn’t this tremendous urgency to act on monetary policy right now,” he told The Wall Street Journal last week. “It’s not like if we wait a meeting or don’t wait a meeting that it has huge consequences for the trajectory of the economy.”

But the crowd isn’t taking any chances, at least in some corners. ETFTrends.com reports that investors seem to be anticipating higher rates by moving into senior bank loan ETFs. Last week the site advised that PowerShares Senior Loan Portfolio (BKLN), a senior-loan ETF with more than $6 billion in assets, has attracted nearly $225 million in net inflows over the previous week and nearly $1.5 billion in inflows over the previous 90 days, based on data from Invesco PowerShares. “A rising interest rate would negatively affect bond funds as newer debt securities would come with a higher rate, making older bonds with lower yields less attractive,” reminds columnist Tom Lyndon. “Consequently, bond investors may turn to senior loans as a way to mitigate the rate risks but still be able to generate attractive yields.”

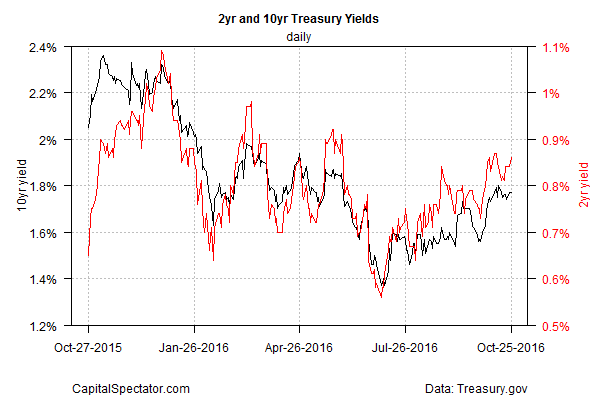

The Treasury market appears to be preparing for a rate hike too, but only marginally so. The policy sensitive 2-year yield has been winding higher over the last few months, closed yesterday at 0.86%, which is close to the highest level since June.

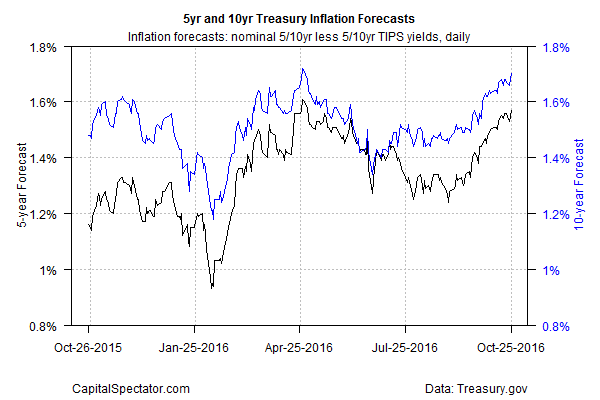

In addition, the Treasury market’s inflation expectations have been trending higher, providing the Fed with a degree of cover for hiking rates by way of rationalizing that pricing pressures are starting to run a bit hotter.

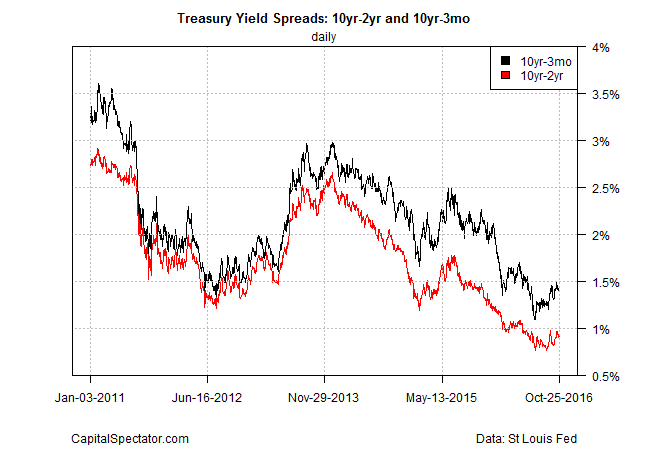

Meanwhile, two key Treasury yield spreads have been widening lately, albeit only slightly. The 10-year/3-month spread in particular has been trending higher in recent weeks. It could be noise, but there’s a possibility that the past three years of narrowing is reversing. If this spread continues to climb in the weeks ahead, the advance will be read as another clue for anticipating that the Fed will raise rates in December.

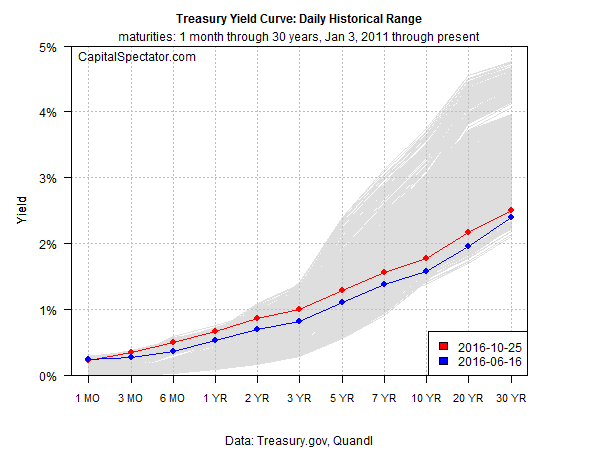

Reviewing the entire Treasury yield curve’s history also reflects a modest bias toward tighter policy. Although the curve is still low by the standards of the last several years, rates have moved higher through yesterday (Oct. 25) vs. 90 trading days earlier, as shown by the red line moving above the blue line in the chart below.

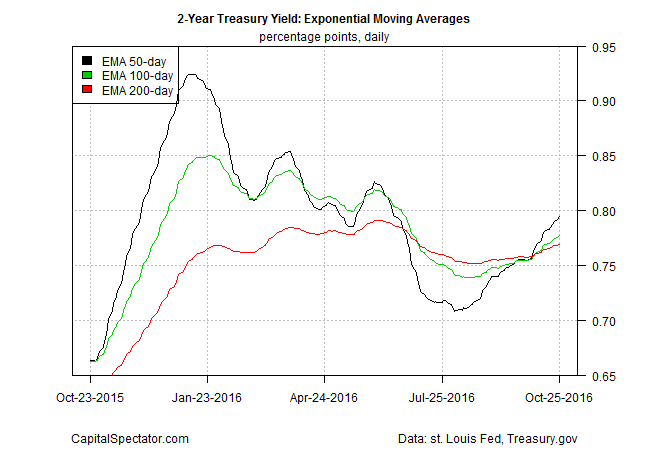

From a momentum perspective, the 2-year yield’s upward momentum is looking stronger these days, based on a set of exponential moving averages (EMAs). The 2-year’s 50-day EMA has recently moved decisively above its 100-day EMA, which has turned above the 200-day EMA in early October for the first time since July.

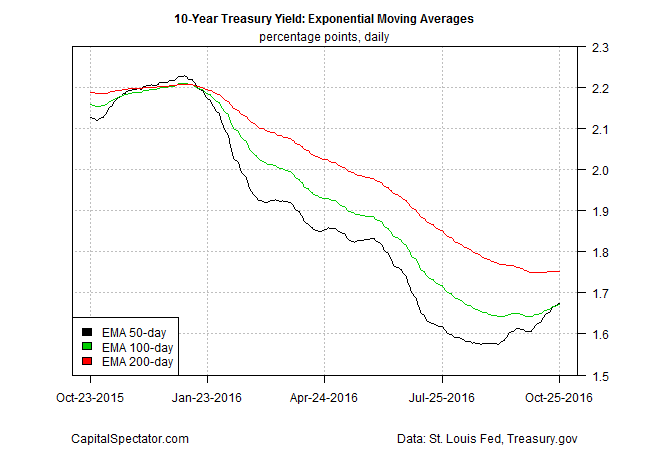

The benchmark 10-year yield’s upward momentum still looks mixed, but the trend looks set to change in the wake of the 50-day EMA’s rebound in recent weeks that may be set to rise above the 100-day EMA.

The Fed may still decide to punt by delaying the next rate. It wouldn’t be the first time that the market has been hornswoggled by an indecisive central bank. Meantime, the incoming economic data will play an outsized role on influencing policy makers. But at the moment, the crowd is again considering the possibility that a change in the monetary weather may be near.

Disclosure: None.