Is The Treasury Market Still Expecting Moderate US Growth?

The roller-coaster ride in global markets in recent weeks has raised new doubts about economic growth in general and the case for a Fed rate hike this month in particular. But the resilience of key Treasury yields in recent days suggests that the bond market may be rethinking the case for the worst-case scenario that seemed inevitable over a few days last week. It could all reverse course in a heartbeat–especially if tomorrow’s employment report for August falls short of expectations for solid growth. Meantime, the rebound in US yields this week suggests that reports of optimism’s death may have been exaggerated.

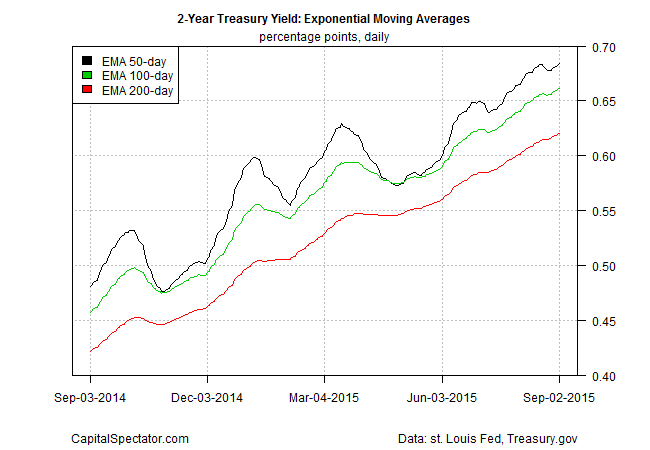

Or maybe it’s just another instance of the dead-cat bounce? We’ll know more in a few days. For now, the 2-year yield—arguably the most sensitive spot on the yield curve for rate expectations—has again moved close to a four-year high after a sharp drop in late-August. The 2-year yield ticked up to 0.72% yesterday (Sep. 2), based on Treasury.gov’s daily data–up from 0.59% on Aug. 24.

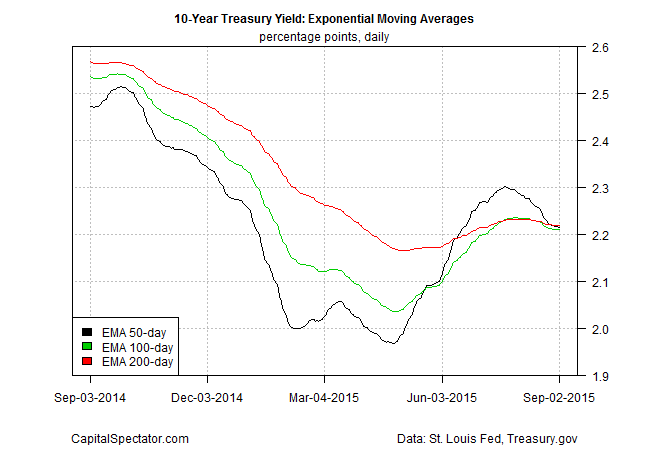

The benchmark 10-year yield is firmer this week as well, inching up to 2.20% yesterday. Although that’s still well below the roughly 2.50% mark seen earlier this year, the mild rise in recent days for the 10-year yield has reversed the previous slide that pushed the rate close to 2.0% at one point in late-August.

Looking at yields through a momentum filter—exponential moving averages (EMAs)—shows that the upside bias for the 2-year rate remains intact through yesterday.

The 10-year yield’s momentum, by contrast, is neutral to slightly negative at the moment, although it’s not yet clear if the recent reversal is temporary or the start of a new leg down.

In any case, the evidence for expecting trouble in the US economy remains a speculative forecast, based largely on weak markets of late. The economic numbers, on the other hand, still point to moderate growth, as yesterday’s ADP Employment report implied.

Nonetheless, recent market turmoil has convinced many analysts to assume that the Fed won’t begin hiking interest rates this month. But what if the central bank surprises the crowd by tightening monetary policy at its Sep. 16-17 meeting? Torsten Slok, Deutsche Bank’s chief U.S. economist, yesterday outlined an interesting spin on the possibilities, according to Bloomberg:

“If anything, the narrative in markets at the moment is such that if the Fed does hike in September, then long rates and the dollar will decline because the market will think the Fed is hiking prematurely,” Slok says in a research note. “Ironically, September may be the ideal time for the Fed to hike rates because given the way we currently talk about the economy in markets a Fed hike in September will likely be associated with an easing of financial conditions and not a tightening.”

Perhaps, although it’s clear that the pressure to start raising rates NOW has diminished lately. Indeed, white-knuckle tumbles in global markets have a habit of tempering hawkish tendencies. But it’s not clear that the latest wave of volatility has knocked the US economy off of its moderate-growth trajectory. Upcoming economic numbers could tell us otherwise, but for the moment it’s still hard to see chaos in the broad macro trend based on published data to date. For what it’s worth, the Treasury market is inclined to agree… again.

Disclosure: None.