Inflation Is Below Expectations, Flummoxing The Fed

The all-important CPI was released this week. It showed more of the same disinflationary trend we have been seeing in the past six months. I have been looking for an uptick in inflation heading into the back half of the year because of the base effect comparisons oil has since oil fell at this time last year and because of the wage inflation which could push overall inflation up. According to the July report, the CPI increased 0.1% month over month. This was below the 0.2% increase expected. On a year over year basis, inflation was up 1.7% which was a one tenth increase from June, but was below the expectation for 1.8% growth.

Looking at core CPI, it was up 0.1% for the fourth straight month and was up 1.7% year over year for the third straight month. Gas prices were flat and food prices were up 0.2%. Rental housing was up 0.2%. The owners’ equivalent to rent was up 0.3%. The cost of new motor vehicles was down 0.5% for the sixth straight decline. I have been expecting weakness in the auto sector this year. The bears were correct to point out the weakness in this sector, but they were wrong in claiming it would cause a recession as there’s very little chance of a recession starting this year. None of the major economic indicators signal we are in a recession. There are some bears who can manipulate stats to show the economy is heading off a cliff, but those prognosticators have been wrong for years.

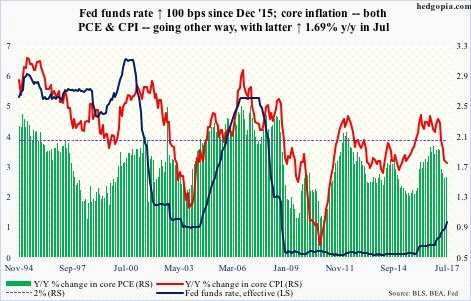

The chart below does a great job of breaking down the situation we find ourselves in. On the one hand, you have a Federal Reserve which is being cautious with rate hikes even though the recovery has been going for eight years. Rates have been the lowest for the longest time ever. On the other hand, for the first time ever we have the Fed raising rates as inflation is falling. Usually the Fed hikes rates too high because it accelerates above inflation. In this case, only a few more rate hikes would push the Fed to a tight policy because of the drop in inflation. In theory, two more rate hikes could cause the policy to be tight if inflation falls slightly. That would lead to the Fed potentially causing a recession because of poor forecasts. From the Fed’s perspective, it thinks inflation could rise rapidly as there is a tight labor market. It thinks if it doesn’t raise rates now, inflation could get out of hand.

The Fed is in a bind much like where it was in 2015 and 2016 when it comes to meeting its guidance. The Fed initially anticipated more than one rate hike those years, but that’s all it could muster. Many investors and economists though this year would be different, but it’s turning out to be more of the same. The latest economic readings are better than 2016, but inflation falling has put the third rate hike in jeopardy. As a result of this weak CPI report, the chances of at least one rate hike by December have fallen from 43.7% to 35.9%. That’s a large decline, putting the Fed’s credibility on the line. There’s virtually no chance of a hike in September or November.

I think a small increase in inflation will occur in August and September, but the deciding factor will be the success of the start of the unwind. The Fed buying $10 billion less in bonds shouldn’t have a major effect on asset prices, but it could enforce the narrative that the Fed no longer has the stock market’s back. That could be an issue if any weak economic reports come out or earnings growth decelerates. It’s too early to discuss if the Fed would hike rates if there only was a 35.9% chance implied because that can easily change in a few weeks as we saw in the March hike.

The odds of hikes are dependent on economic reports and Fed rhetoric. In theory, the Fed is supposed to be reliant on the economy, but as we’re seeing this year, it can choose to focus on what it’s models are predicting instead of the recent reports. If the Fed was to use rhetoric to push the odds of a rate hike up, then that would freeze credit markets. I’m not saying it would cause a recession, but it would slow lending activity.

The craziest part of this situation is the Atlanta Fed’s own wage tracker is showing 3.3% growth which is below the November 2016 peak of 3.9% growth. Why would inflation increase this year because of wages, if the Fed’s own metric doesn’t show accelerated wage inflation? My answer to that question is the acceleration in hourly and weekly earnings we saw in the BLS report.

The most interesting part of the CME’s website, which shows where the market is pricing in the chances of hikes/cuts at each meeting, is when you start to look at 2018. The chart below is the furthest the website goes. As you can see, the market is still only expecting rates to be a quarter point higher in August 2018 than they are now. One hike next year would be a slowed pace from the two hikes this year. The question is what inning the Fed is in its hike cycle. If there’s only one more hike next year, then we must be close to the end because the chances of a recession happening by 2019 are quite high considering all the debt that consumers are piling up.

Conclusion

Inflation came in below expectations, pushing rate hikes off further. The Fed waited a long time to raise rates and now it’s doing so at a gingerly rate. There was hope in the beginning of the year that the Fed would be able to take a big step forward this year, but those hopes are fading. The major big picture question is what the unintended consequences of keeping rates low are if there is low inflation. Low rates encourage debt expansion as money is virtually free. That could make raising rates a viable option even with low inflation. That’s not an idea the Fed will consider, but it’s something investors should consider.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more