Gundlach Agrees On Treasury Bonds

Stan Druckenmiller was held up far and wide by the gold community, when he was bearish on stocks and bullish on gold. Stan Druckenmiller is a media rock star whose opinions retail investors get all worked up over because after all, he’s smarter than they are… so they think. He has gone bearish on gold, bullish on US stocks and bearish on T bonds (a little late there, Druck).

Jeff Gundlach is a media rock star as well and in my opinion either smarter or less politically biased than Druckenmiller. Gundlach is in agreement with the view we put forth in NFTRH 421, that long-term interest rates are over done to the upside and so, bonds are over done to the downside in the wake of the utterly stupid Trump hysterics last week.

Jeff Gunlach sees relief for Treasury Bonds after Trump-inspired tantrum

Jeffrey Gundlach of DoubleLine Capital, one of the few high-profile money managers to predict a Donald Trump win, on Friday suggested that the Treasury sell off that has hammered yields is about 80% done.

“We have really critical resistance on yields,” he told CNBC in an interview. “So I do think this rate rise is about 80% of the way through—at least this leg of it.” Yields rise as debt prices fall.

Gundlach’s prognosis follows a selloff in the bond market by investors anticipating an accelerated rise in debt as President-elect Trump goes on a fiscal stimulus spree.

and…

The savvy investor, often referred to as the “bond king,” added that the collapse in Treasury prices is not surprising given the narrative that has emerged since Trump’s election.

Ha, now Gundlach is the Bond King? I guess that’s because Bill Gross clowned himself one too many times. Anyway, I’ve always found Gundlach to be worth listening to, unlike maybe 70% of the financial media stars out there.

From NFTRH 421...

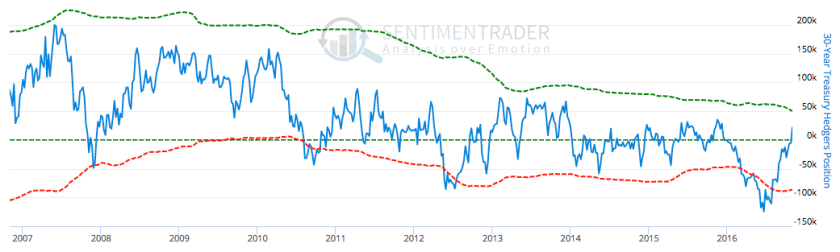

Look at the commercial hedgers’ positions in the long bond as of November 1. Folks, I think that the rising interest rates play – to which we were early – is played out from a sentiment standpoint if not yet from a price standpoint. This data is from 2 weeks ago, well before lower-still bond prices and the election Trumped the financial markets.

Graphic from Sentimentrader.com…

People who chase momentum think that they have found the next big play in the stock market as TRUMP builds out America, making it great again. What I think is that I hate hype and want to buy items that these momentum oriented speed freaks hate. Therefore, I am thinking about buying some debt of the good ole’ US of A; long-term T bonds.

Disclosure: Subscribe to more

Hey Gary, he is the second bond guru in a week to say there is a cap on yields on long bonds. Thanks for posting the information: www.talkmarkets.com/.../blackrock-cap-on-yields-because-of-monumental-bond-demand

Thanks for the link Gary.