Federal Reserve Independence

When it comes to Federal Reserve policy, we need to focus our worries on the correct thing. Hint: It’s not inflation. Also, it’s not recession. Also, It’s not the rate of interest rate hikes.

It’s the Fed’s independence. Even President Trump agrees with me. Although admittedly, for reasons diametrically opposed to my reasons.

In recent weeks, President Trump has ramped up his attacks on the Federal Reserve. Trump told Fox News that “my biggest threat is the Fed.” Also, that the Fed is “loco,” and he’s unhappy “because the Fed is raising rates too fast, and it’s too independent.”

After three interest rate hikes earlier in 2018, the Federal Reserve will raise short-term interest rates one more time this year. The Fed will likely rise another 1 percent over the next two years, according to their future guidance, and barring unexpected developments like war or recession.

The fact that Trump is unhappy is not particularly surprising. In fact, White House grumbling about the Federal Reserve is a common enough theme over the last eighty years. Not using Trump’s uniquely colorful language, mind you, but it’s still not wholly new.

History of Presidential Jawboning

Political leaders in power always want pro-growth policies. Low unemployment and high asset prices tend to make leaders look good. Presidents generally don’t want the Federal Reserve to – in Fed Chairman’s William McChesney Martin’s famous phrase “take away the punch bowl just as the party is getting started.” President Nixon reportedly blamed his 1960 loss to Kennedy as a result of Fed Chairman Martin’s tight monetary policy of high interest rates.

President Johnson complained as well, saying “Martin, my boys are dying in Vietnam, and you won’t print the money I need.”

President Nixon reportedly both put pressure on Martin’s successor at the Federal Reserve Arthur Burns to keep interest rates low and money flowing during his 1972 re-election, which he handily won. Paul Volcker, Fed Chairman during the 1980's, published a book in late October 2018 in which he claims President Reagan’s Chief of Staff James Baker told him in 1984: “The president is ordering you not to raise interest rates before the election.” Volcker adds to the story that the Federal Reserve at the time had no plan to raise interest rates.

George HW Bush was upset in the fall of 1992 that the Fed was raising interest rates, before he went on to lose his re-election to Bill Clinton.

President Clinton’s budget chief Leon Panetta and later Chief of Staff twice tried to preempt the Federal Reserve, saying at his 1993 confirmation hearing “we ought to have cooperation from the Federal Reserve,” meaning lower interest rates, and then in a 1995 interview “it would be nice to get whatever kind of cooperation we can get to get this economy going,”referring again to Federal Reserve policy. Despite the instincts of leaders in power, Federal Reserve observers think we have made a lot of progress since the bullying of President’s Johnson and Nixon.

Presidents George W. Bush and Barack Obama avoided appearing to try to influence interest rate policy. Inevitably, political leaders oppose higher interest rates because they reduce business borrowing, risk increasing unemployment, and knock down asset prices of real estate and stock markets. Political leaders want lower interest rates – it’s stimulative to the economy, and therefore helpful for their political prospects.

Volcker’s legacy

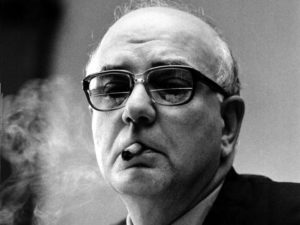

Since Paul Volcker famously raised interest rates early enough in the Reagan presidency to tame inflation in the early 1980's, the Fed has built a rock-solid reputation as independent from political influence. It is believed to manage the money supply without favor or political influence, giving investors worldwide confidence in the dollar.

OldSchoolCool: Paul Volcker

The key question then is whether Trump’s attacks on the Federal Reserve will have an effect. We need to hope they do not. Just as the greatest risk to Trump’s presidency is not the independence of the Fed, neither is the greatest risk to the US economy inflation or the rise in unemployment, the two typical concerns of the Federal Reserve.

Rather, the greatest risk to the US economy is that people the world over would come to believe that the US Federal Reserve is not acting independently of political pressure. A primary reason the dollar still remains the global reserve currency of choice is that global allocators of capital believe the Federal Reserve is not captive to the US political system.

In a clever take that emphasizes a silver lining in the storm clouds, the Wall Street Journal’s Spencer Jakab recently argued that Trump’s recent Fed bashing is actually a good thing, since it proves that the Fed is willing to do an unpopular thing for the right reasons. Since it continues to defy Trump’s wishes, we should be happy that the Federal Reserve is under attack. I mean, I guess? Like a Category Five hurricane slamming against the retaining wall protecting the coastal city is a good thing, because it didn’t break the wall this time, and that shows us how strong the retaining wall is right now. So, yay, hurricanes? I’m sorry, that logic is bass-ackwards.

The real risk

We can survive a recession. We would have a harder time surviving the loss of confidence that would follow if Trump could jawbone the Fed into keeping rates low, for political purposes.

We can survive a little inflation. A little inflation does not make us much closer to Venezuela. Rather, a political leader who can get what he or she wants with monetary policy does make us a lot more like Venezuela.

Thanks for visiting Bankers Anonymous. Be sure to sign-up for Michael's newsletter so you ...

more